Capital One 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

Note 3

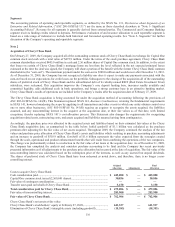

Loans Acquired in a Transfer

The Company’s acquired loans from the Chevy Chase Bank acquisition are initially recorded at fair value and no separate valuation

allowance is recorded at the date of acquisition. The Company is required to review each loan at acquisition to determine if it should

be accounted for under ASC 310-10/SOP 03-3 and if so, determines whether each loan is to be accounted for individually or whether

loans will be aggregated into pools of loans based on common risk characteristics. The Company has performed its analysis of the

loans to be accounted for as impaired under ASC 310-10/SOP 03-3 (“Impaired Loans” in the tables below). For the loans acquired

with the Chevy Chase Bank acquisition that are not within the scope of ASC 310-10/SOP 03-3 (“Non-Impaired Loans” in the tables

below), the Company followed the income recognition and disclosure guidance in ASC 310-10/SOP 03-3.

During the evaluation of whether a loan was considered impaired under ASC 310-10/SOP 03-3 or performing under ASC 805-

10/SFAS 141(R), the Company considered a number of factors, including the delinquency status of the loan, payment options and

other loan features (i.e. reduced documentation, interest only, or negative amortization features), the geographic location of the

borrower or collateral and the risk rating assigned to the loans. Based on the criteria, the Company considered the entire Chevy Chase

Bank option arm, hybrid arm and construction to permanent portfolios to be impaired and accounted for under ASC 310-10/SOP 03-3.

Portions of the Chevy Chase Bank commercial, auto, fixed mortgage, home equity, and other consumer loan portfolios were also

considered impaired.

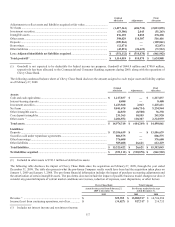

The Company makes an estimate of the total cash flows it expects to collect from the pools of loans, which includes undiscounted

expected principal and interest. The excess of that amount over the fair value of the loans is referred to as accretable yield. Accretable

yield is recognized as interest income on a level-yield basis over the life of the loans. The Company also determines the loans’

contractual principal and contractual interest payments. The excess of contractual amounts over the total cash flows expected to be

collected from the loans is referred to as nonaccretable difference, which is not accreted into income. Judgmental prepayment

assumptions are applied to both contractually required payments and cash flows expected to be collected at acquisition. The Company

continues to estimate cash flows expected to be collected over the life of the loans. Subsequent increases in total cash flows expected

to be collected are recognized as an adjustment to the accretable yield with the amount of periodic accretion adjusted over the

remaining life of the loans. Subsequent decreases in cash flows expected to be collected over the life of the loans are recognized as

impairment in the current period through allowance for loan loss.

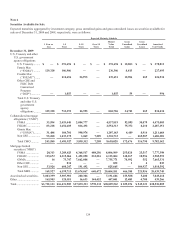

In conjunction with the Chevy Chase Bank acquisition, the acquired loan portfolio was accounted for under ASC 310-10/SOP 03-3 or

ASC 805-10/SFAS 141(R) at fair value and are as follows:

At Acquisition

(In Thousands)

Impaired

Loans Non-Impaired

Loans

Total Loans

Contractually required principal and interest at acquisition ........................................ $ 12,038,971 $ 3,348,058 $ 15,387,029

N

onaccretable difference (expected principal losses of $2,207,144 and foregone

interest of $1,820,065) (1)......................................................................................... 3,851,043 176,166 4,027,209

Cash flows expected to be collected at acquisition ..................................................... $ 8,187,928 $ 3,171,892 $ 11,359,820

Accretable yield (interest component of expected cash flows) ................................... 1,860,697 499,245 2,359,942

Fair value of loans acquired (2) .................................................................................... $ 6,327,231 $ 2,672,647 $ 8,999,878

(1) Expected principal losses and foregone interest on the impaired loans are $2,053,501 and $1,797,542, respectively. Expected

principal losses and foregone interest on the non impaired loans are $153,643 and $22,523, respectively.

(2) A portion of the acquired loans from Chevy Chase Bank acquisition were held for sale and are not included in these tabular

disclosures. These held for sale loans were assigned a fair value of $235.1 million through purchase price allocation.