Capital One 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

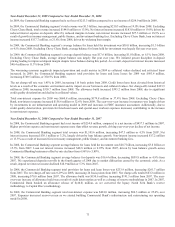

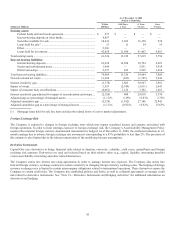

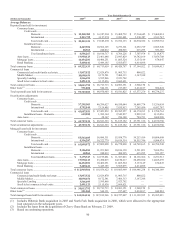

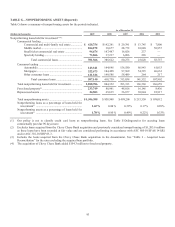

As of December 31, 2008

Subject to Repricing

(Dollars in Millions)

Within

180 Days >180 Days-

1 Year

>1 Year-

5 Years Over

5 Years

Earning assets:

Federal funds sold and resale agreement ............................................ $ 637 $ — $ — $ —

Interest-bearing deposits at other banks ............................................. 4,807 — — —

Securities available for sale ................................................................ 10,641 3,265 16,158 939

Loans held for sale(1) .......................................................................... 15 11 54 14

Other .................................................................................................. 2,366 — — —

Loans held for investment .................................................................. 42,858 11,956 41,403 4,801

Total earning assets ..................................................................................... 61,324 15,232 57,615 5,754

Interest-bearing liabilities:

Interest-bearing deposits .................................................................... 63,628 12,698 18,794 2,207

Senior and subordinated notes............................................................ 1,444 — 2,931 3,934

Other borrowings ............................................................................... 9,337 626 3,239 1,668

Total interest-bearing liabilities ................................................................... 74,409 13,324 24,964 7,809

N

on-rate related net items ............................................................................ 11,308 (103) (1,725) 3,946

Interest sensitivity gap ................................................................................. (1,778) 1,805 30,927 1,891

Impact of swaps ........................................................................................... 5,519 (2,549) (5,611) 2,641

Impact of consumer loan securitizations ...................................................... (6,061) 1,152 3,702 1,207

Interest sensitivity gap adjusted for impact of securitizations and swaps .... (2,320) 408 29,018 5,739

Adjusted gap as a percentage of managed assets ......................................... (1.11)% 0.19% 13.83% 2.73%

Adjusted cumulative gap ............................................................................. (2,320) (1,912) 27,106 32,845

Adjusted cumulative gap as a percentage of managed assets ...................... (1.11)% (0.91)% 12.92% 15.65%

(1) Mortgage loans held for sale line item excludes the related lower of cost or market adjustments.

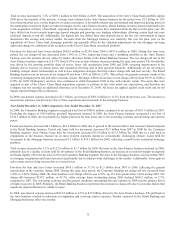

Foreign Exchange Risk

The Company is exposed to changes in foreign exchange rates which may impact translated income and expense associated with

foreign operations. In order to limit earnings exposure to foreign exchange risk, the Company’s Asset/Liability Management Policy

requires that material foreign currency denominated transactions be hedged. As of December 31, 2009, the estimated reduction in 12-

month earnings due to adverse foreign exchange rate movements corresponding to a 95% probability is less than 2%. The precision of

this estimate is also limited due to the inherent uncertainty of the underlying forecast assumptions.

Derivative Instruments

Capital One uses derivatives to hedge financial risks related to duration, convexity, volatility, yield curve, spread/basis and foreign

exchange risk exposure. Derivatives are used and selected based on their relative value (e.g., capital, liquidity, structuring benefits)

versus asset/liability structuring and other related alternatives.

The Company enters into interest rate swap agreements in order to manage interest rate exposure. The Company also enters into

forward foreign currency exchange contracts to reduce sensitivity to changing foreign currency exchange rates. The hedging of foreign

currency exchange rates is limited to certain intercompany obligations related to international operations. These derivatives expose the

Company to certain credit risks. The Company has established policies and limits, as well as collateral agreements, to manage credit

risk related to derivative instruments. See “Note 19—Derivative Instruments and Hedging Activities” for additional information on

derivatives and hedging.