Capital One 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

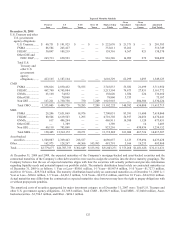

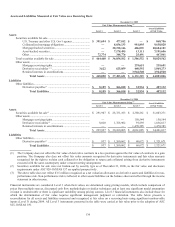

The available-for-sale portfolio continues to be heavily concentrated in high credit quality assets like government-sponsored enterprise

(“GSE”) mortgage-backed securities and AAA rated asset-backed securities. In addition to debt securities held in the investment

portfolio, the Company reports certain equity securities related to Community Reinvestment Act (“CRA”) investments as available for

sale securities within the Other category above.

At December 31, 2009, the portfolio was 90% rated AAA, 5% rated other investment grade (AA to BBB), and 5% non-investment

grade or not rated. At December 31, 2008, the portfolio was 95% rated AAA, 4.8% rated other investment grade (AA to BBB), and

0.2% non-investment grade or not rated.

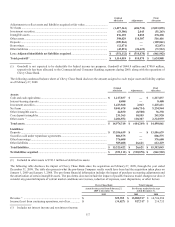

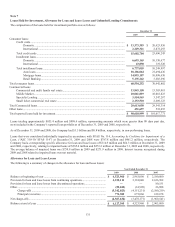

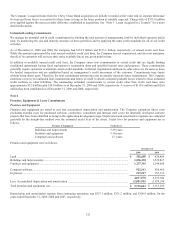

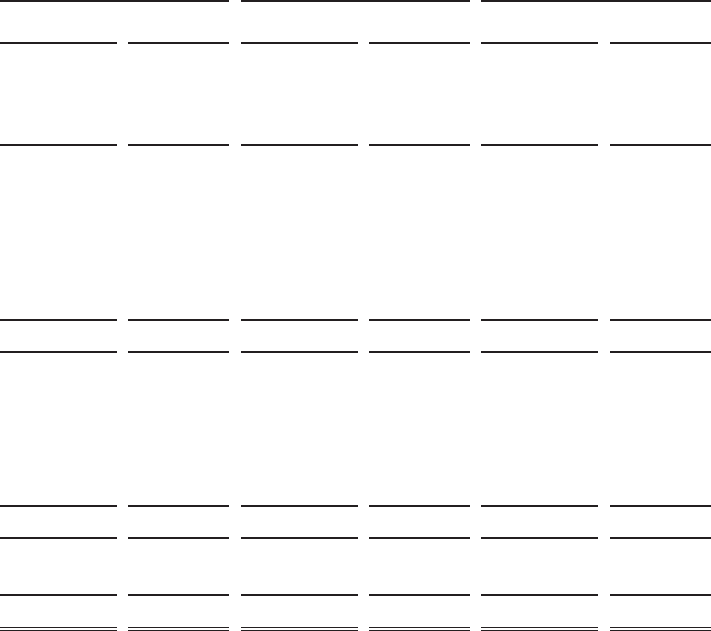

The following table shows the fair value of investments and amount of unrealized losses segregated by those investments that have

been in a continuous unrealized loss position for less than twelve months and those that have been in a continuous unrealized loss

position for twelve months or longer as of December 31, 2009 and 2008 and, respectively.

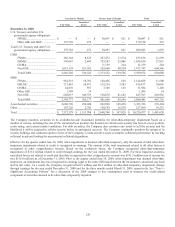

Less than 12 Months Greater than 12 Months Total

Fair Value Unrealized

Losses Fair Value Unrealized

Losses

Fair Value

Unrealized

Losses

December 31, 2009

U.S. Treasury and other U.S. government

agency obligations

FHMLC ............................................... $ 26,995 $ 269 $ — $ — $ 26,995 $ 269

Total U.S. Treasury and other U.S.

government agency obligations ............... 26,995 269 — — 26,995 269

CMO

FNMA ................................................. 971,437 25,036 317,058 5,043 1,288,495 30,079

FHLMC ............................................... 174,575 4,280 369,621 3,930 544,196 8,210

GNMA ................................................ 1,041,686 8,845 2,833 69 1,044,519 8,914

Non GSE ............................................. 2,809 326 1,312,949 269,261 1,315,758 269,587

Total CMO .......................................... 2,190,507 38,487 2,002,461 278,303 4,192,968 316,790

MBS

FNMA ................................................. 1,928,274 25,476 3,623 41 1,931,897 25,517

FHLMC ............................................... 391,452 4,550 309,475 6,406 700,927 10,956

GNMA ................................................ 200,739 305 10,720 247 211,459 552

Other GSE ........................................... — — 798 4 798 4

Non GSE ............................................. — — 810,053 184,927 810,053 184,927

Total MBS ........................................... 2,520,465 30,331 1,134,669 191,625 3,655,134 221,956

Asset-backed securities ................................. 489,415 957 56,208 4,443 545,623 5,400

Other ............................................................. 30,639 101 114,559 4,607 145,198 4,708

Total .............................................................. $ 5,258,021 $ 70,145 $ 3,307,897 $ 478,978 $ 8,565,918 $ 549,123