Capital One 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 29

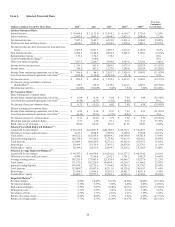

II. Critical Accounting Estimates

The Notes to the Consolidated Financial Statements contain a summary of the Company’s significant accounting policies, including a

discussion of recently issued accounting pronouncements. Several of these policies are considered to be more critical to the portrayal

of the Company’s financial condition and results of operations, since they require management to make difficult, complex or

subjective judgments, some of which may relate to matters that are inherently uncertain. Areas with significant judgment and/or

estimates or that are materially dependent on management judgment include: fair value measurements including assessments of other-

than-temporary impairments of securities available for sale; determination of the level of allowance for loan and lease losses;

valuation of goodwill and other intangibles; finance charge, interest and fee revenue recognition; valuation of mortgage servicing

rights; valuation of representation and warranty reserves; valuation of retained interests from securitization transactions; recognition of

customer reward liability; treatment of derivative instruments and hedging activities; and accounting for income taxes.

Additional information about accounting policies can be found in Item 8 “Financial Statements and Supplementary Data—Notes to

the Consolidated Financial Statements—“Note 1—Significant Accounting Policies”.”

During the second quarter of 2009, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting

Standards SFAS No. 168, The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting

Principles—a replacement of FASB Statement No. 162 (“ASC 105-10-65/SFAS 168”). This standard establishes the Accounting

Standards Codification for the FASB (“Codification” or “ASC”) as the single source of authoritative U.S. GAAP. The Codification

does not change GAAP, but rather how the guidance is organized and presented to users. Effective July 1, 2009, changes to the source

of authoritative U.S. GAAP are communicated through an Accounting Standards Update (“ASU”). ASUs will be published for all

authoritative U.S. GAAP promulgated by the FASB, regardless of the form in which such guidance may have been issued prior to

release of the FASB Codification (e.g., FASB Statements, EITF Abstracts, FASB Staff Positions, etc.). ASUs also will be issued for

amendments to the SEC content in the FASB Codification as well as for editorial changes. Subsequently, the Codification will require

companies to change how they reference GAAP throughout the financial statements. The Company adopted the Codification for the

year ended December 31, 2009 and has provided the pre-Codification references along with the related ASC references to allow

readers an opportunity to see the impact of the Codification on our financial statements and disclosures.

Fair Value Measurements

Certain financial instruments are reported under generally accepted accounting principles, or GAAP, at fair value. The estimated fair

value of other financial instruments not recorded at fair value must be disclosed. Securities available for sale, derivatives, mortgage

servicing rights and retained interest in securitizations are financial instruments recorded at fair value on a recurring basis.

Additionally, from time to time, we may be required to record at fair value other financial instruments on a nonrecurring basis, such as

loans held for investment and mortgage loans held for sale. We include in “Note 9—Fair Value of Assets and Liabilities” information

about the extent to which fair value is used to measure assets and liabilities, the valuation methodologies used and impact to earnings.

Additionally, for financial instruments not recorded at fair value we disclose the estimate of their fair value.

Effective January 1, 2008, the Company adopted “SFAS” No. 157, Fair Value Measurements (“ASC 820-10/SFAS 157”) for all

financial assets and liabilities and for nonfinancial assets and liabilities measured at fair value on a recurring basis. ASC 820-10/SFAS

157 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the

principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the

measurement date. ASC 820-10/SFAS 157 also establishes a fair value hierarchy which prioritizes the valuation inputs into three

broad levels. Based on the underlying inputs, each fair value measurement in its entirety is reported in one of the three levels. These

levels are:

• Level 1 – Valuation is based upon quoted prices for identical instruments traded in active markets. Level 1 assets and

liabilities include debt and equity securities traded in an active exchange market, as well as U.S. Treasury securities.

• Level 2 – Valuation is based upon quoted prices for similar instruments in active markets, quoted prices for identical or

similar instruments in markets that are not active, and model based valuation techniques for which all significant

assumptions are observable in the market or can be corroborated by observable market data for substantially the full term

of the assets or liabilities.

• Level 3 – Valuation is determined using model-based techniques with significant assumptions not observable in the

market. These unobservable assumptions reflect the Company’s own estimates of assumptions that market participants

would use in pricing the asset or liability. Valuation techniques include the use of third party pricing services, option

pricing models, discounted cash flow models and similar techniques.