Capital One 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

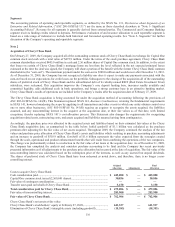

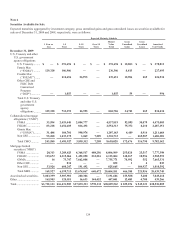

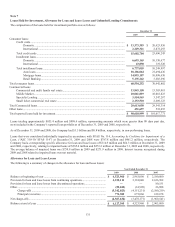

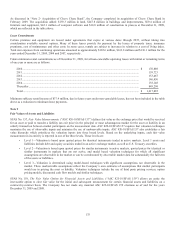

Note 6

Securities Available for Sale

Expected maturities aggregated by investment category, gross unrealized gains and gross unrealized losses on securities available-for

sale as of December 31, 2009 and 2008, respectively, were as follows:

Expected Maturity Schedule

1 Year or

Less

1–5

Years

5–10

Years Over 10

Years

Market

Value

Totals

Gross

Unrealized

Gains

Gross

Unrealized

Losses Amortized

Cost Totals

December 31, 2009

U.S. Treasury and other

U.S. government

agency obligations

U.S. Treasury .......... $ — $ 391,694 $ — $ — $ 391,694 $ 12,883 $ — $ 378,811

Fannie Mae

(“FNMA”) ......... 129,320 106,986 — — 236,306 8,813 — 227,493

Freddie Mac

(“FHLMC”) ....... — 212,656 26,995 — 239,651 12,986 269 226,934

Other GSE and

FDIC Debt

Guaranteed

Program

(“DGP”) ............. — 1,055 — — 1,055 59 — 996

Total U.S. Treasury

and other U.S.

government

agency

obligations ......... 129,320 712,391 26,995 — 868,706 34,741 269 834,234

Collateralized mortgage

obligations (“CMO”)

FNMA .................... 33,594 2,419,448 2,084,777 — 4,537,819 92,895 30,079 4,475,003

FHLMC .................. 83,218 1,654,603 816,492 — 2,554,313 75,372

8,210 2,487,151

Ginnie Mae

(“GNMA”) ......... 31,488 184,701 990,974 — 1,207,163 4,409

8,914 1,211,668

Non GSE ................ 95,280 1,233,175 3,069 7,209 1,338,733 —

269,587 1,608,320

Total CMO ........... 243,580 5,491,927 3,895,312 7,209 9,638,028 172,676 316,790 9,782,142

Mortgage backed

securities (“MBS”)

FNMA .................. 20,313 3,209,823 4,368,517 408,256 8,006,909 255,028 25,517 7,777,398

FHLMC ................ 115,672 2,315,066 1,452,050 232,216 4,115,004 140,367 10,956 3,985,593

GNMA .................. 16 73,747 7,662,008 — 7,735,771 70,992 552 7,665,331

Other GSE ............ — 832 — — 832 1 4 835

Non GSE .............. 33,926 600,247 191,492 — 825,665 — 184,927 1,010,592

Total MBS ............ 169,927 6,199,715 13,674,067 640,472 20,684,181 466,388 221,956 20,439,749

Asset-backed securities .. 3,003,399 3,907,901 280,306 — 7,191,606 153,588 5,400 7,043,418

Other .............................. 165,905 120,051 16,633 144,452 447,041 12,483 4,708 439,266

Total ............................... $ 3,712,131 $16,431,985 $ 17,893,313 $792,133 $38,829,562 $ 839,876 $ 549,123 $38,538,809