Capital One 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

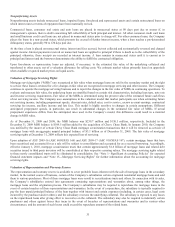

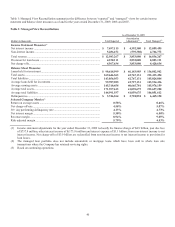

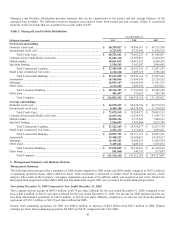

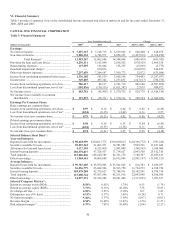

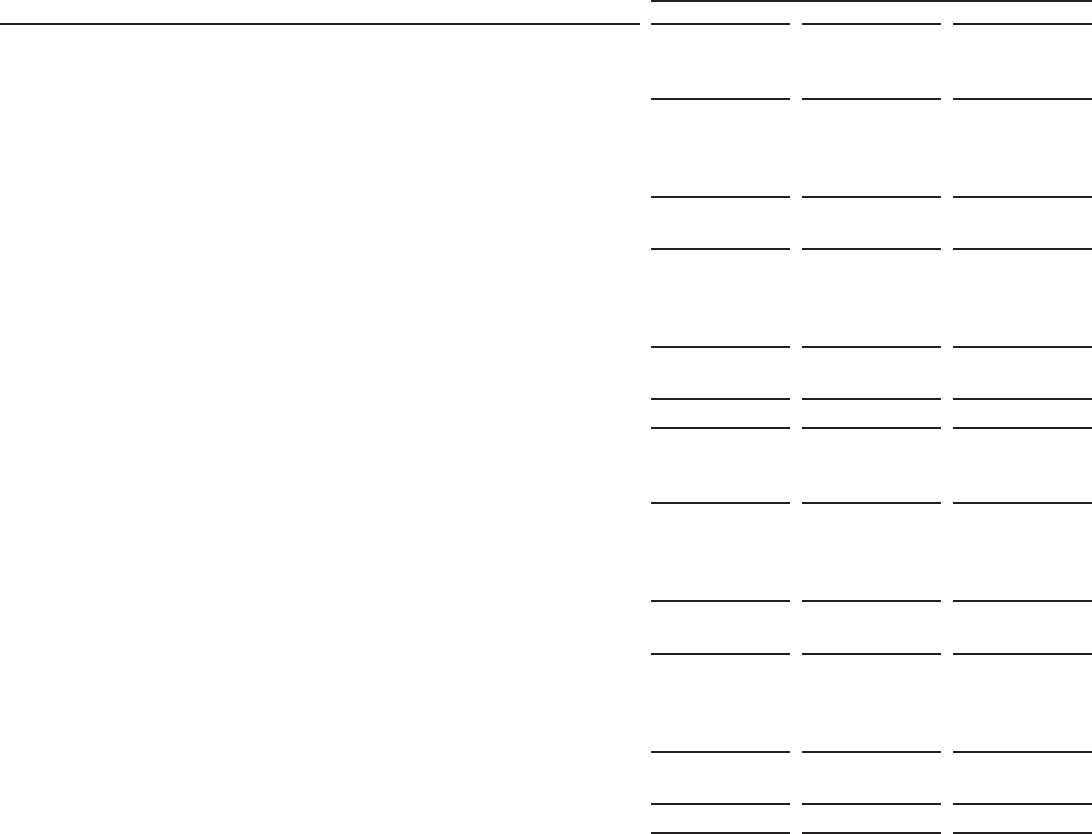

Managed Loan Portfolio Distribution provides summary data on the composition of the period end and average balances of the

managed loan portfolio. The difference between managed and reported loans, both period end and average, relates to securitized

domestic credit card loans that are accounted for as sales under GAAP.

Table 2: Managed Loan Portfolio Distribution

As of December 31,

(Dollars in thousands) 2009 2008

2007

Period end outstanding

Domestic credit card ............................................................................................. $ 60,299,827 $ 70,944,581 $ 69,723,169

International credit card ........................................................................................ 8,223,835 8,720,642 11,656,922

Total Credit Card ......................................................................................... $ 68,523,662 $ 79,665,223 $ 81,380,091

Commercial and multi-family real estate .............................................................. 13,843,158 13,303,081 12,414,263

Middle market ....................................................................................................... 10,061,819 10,081,823 8,288,476

Specialty lending ................................................................................................... 3,554,563 3,547,287 2,948,402

Total Commercial Lending .......................................................................... $ 27,459,540 $ 26,932,191 $ 23,651,141

Small ticket commercial real estate ....................................................................... 2,153,510 2,609,123 3,396,100

Total Commercial Banking ......................................................................... $ 29,613,050 $ 29,541,314 $ 27,047,241

Automobile ........................................................................................................... 18,186,064 21,494,436 25,128,352

Mortgage ............................................................................................................... 14,893,187 10,098,430 11,561,533

Other retail ............................................................................................................ 5,135,242 5,603,696 5,659,411

Total Consumer Banking ............................................................................. $ 38,214,493 $ 37,196,562 $ 42,349,296

Other loans ............................................................................................................ 451,697 533,655 585,789

Total Company ............................................................................................ $ 136,802,902 $ 146,936,754 $ 151,362,417

Average outstandings

Domestic credit card ............................................................................................. $ 64,670,269 $ 68,634,756 $ 66,774,914

International credit card ........................................................................................ 8,405,250 10,570,791 11,310,239

Total Credit Card ......................................................................................... $ 73,075,519 $ 79,208,971 $ 78,085,153

Commercial and multi-family real estate .............................................................. 13,857,522 12,829,870 11,905,715

Middle market ....................................................................................................... 10,098,454 9,172,541 7,404,313

Specialty lending ................................................................................................... 3,566,693 3,595,866 2,923,702

Total Commercial Lending .......................................................................... $ 27,522,669 $ 25,598,277 $ 22,233,730

Small ticket commercial real estate ....................................................................... 2,491,123 3,115,436 2,669,621

Total Commercial Banking ......................................................................... $ 30,013,792 $ 28,713,713 $ 24,903,351

Automobile ........................................................................................................... 19,950,123 23,490,015 24,150,217

Mortgage ............................................................................................................... 14,434,281 10,406,251 11,805,524

Other retail ............................................................................................................ 5,489,641 5,449,185 5,565,075

Total Consumer Banking ............................................................................. $ 39,874,045 $ 39,345,451 $ 41,520,816

Other loans ............................................................................................................ 551,060 544,131 217,687

Total Company ............................................................................................ $ 143,514,416 $ 147,812,266 $ 144,727,007

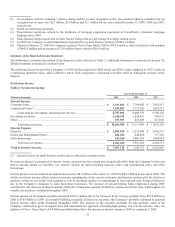

V. Management Summary and Business Outlook

Management Summary

The following discussion provides a summary of 2009 results compared to 2008 results and 2008 results compared to 2007 results on

a continuing operations basis, unless otherwise noted. Each component is discussed in further detail in subsequent sections of this

analysis. The results of the Company’s mortgage origination operations of GreenPoint, which was acquired as part of the North Fork

Bancorporation acquisition in December 2006 and discontinued in August 2007, are accounted for as discontinued operations.

Year Ended December 31, 2009 Compared to Year Ended December 31, 2008

The Company had net income of $883.8 million, or $0.74 per share (diluted) for the year ended December 31, 2009, compared to net

loss of $46.0 million, or $(0.21) per share (diluted) for the year ended December 31, 2008. Net income for 2009 included an after-tax

loss from discontinued operations of $102.8 million, or $(0.24) per share (diluted), compared to an after-tax loss from discontinued

operations of $130.5 million, or $(0.35) per share (diluted) in 2008.

Income from continuing operations for 2009 was $986.6 million, an increase of $0.9 billion from $84.5 million in 2008. Diluted

earnings per share from continuing operations for 2009 was $0.98, compared to $0.14 in 2008.