Capital One 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 17

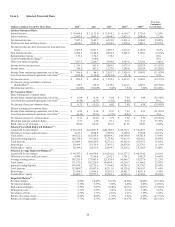

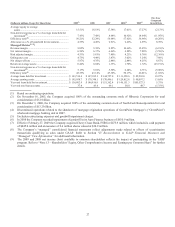

Statistical Information

The statistical information required by Item 1 can be found in Item 6 “Selected Financial Data”, Item 7 “Management Discussion and

Analysis of Financial Condition and Results of Operations” and in Item 8, “Financial Statements and Supplementary Data”.

Item 1A. Risk Factors

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. We also may make written or oral forward-looking statements in our periodic reports to the Securities and

Exchange Commission on Forms 10-Q and 8-K, in our annual report to shareholders, in our proxy statements, in our offering circulars

and prospectuses, in press releases and other written materials and in statements made by our officers, directors or employees to third

parties.

Statements that are not about historical facts, including statements about our beliefs and expectations, are forward-looking statements.

Forward looking statements include, but are not limited to, information relating to our future earnings per share, growth in managed

loans outstanding, product mix, segment growth, tangible common equity, managed revenue margin, funding costs, operations costs,

employment growth, marketing expense, delinquencies and charge-offs. Forward looking statements also include statements using

words such as “expect,” “anticipate,” “hope,” “intend,” “plan,” “believe,” “estimate” or similar expressions as well as conditional

verbs such as “will,” “should,” “would” and “could.” We have based these forward-looking statements on our current plans, estimates

and projections, and you should not unduly rely on them.

Forward-looking statements are not guarantees of future results or performance. They involve risks, uncertainties and assumptions,

including the risks discussed below. Our future performance and actual results may differ materially from those expressed in forward-

looking statements. Many of the factors that will determine these results and values are beyond our ability to control or predict.

Forward-looking statements speak only as of the date that they are made, and we undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise.

This section highlights specific risks that could affect our business. Although we have tried to discuss all material risks, please be

aware that other risks may prove to be important in the future. In addition to the factors discussed elsewhere in this report, among the

other factors that could cause actual results to differ materially from our forward looking statements are the following:

The Current Business Environment, Including a Prolonged Economic Recovery, May Adversely Affect Our Industry,

Business, Results Of Operations And Capital Levels

The recent global recession has resulted in a general tightening in the credit markets, lower levels of liquidity, reduced asset values

(including residential and commercial properties), reduced business profits, increased rates of business and consumer delinquency, and

increased rates of unemployment and consumer bankruptcy, some of which have had a negative impact on our results of operation.

The absence of recovery, or a recovery that is only shallow and very gradual, including continued elevated unemployment rates and

reduced home prices, may have a material adverse effect on our financial condition and results of operations as customers default on

their loans or maintain lower deposit levels, or in the case of credit card accounts, carry lower balances and reduce credit card

purchase activity.

In particular, we may face the following risks in connection with these events:

• Market developments may affect consumer confidence levels and may cause declines in credit card usage and adverse

changes in payment patterns, causing increases in delinquencies and default rates, which could have a negative impact on

our results of operations. In addition, changes in consumer behavior, including decreased consumer spending and a shift in

consumer payment strategies towards avoiding late fees, over-limit fees, finance charges and other fees, could have an

adverse impact on our revenues.

• Continued increases in consumer bankruptcies could cause increases in our charge-off rates, which could have a negative

impact on our revenues.

• Our ability to recover debt that we have previously charged-off may be limited, which could have a negative impact on

our revenues.

• The processes we use to estimate inherent losses may no longer be reliable because they rely on complex judgments,

including forecasts of economic conditions, which may no longer be capable of accurate estimation, which could have a

negative impact on our business.

• Our ability to assess the creditworthiness of our customers may be impaired if the criteria and/or models we use to

underwrite and manage our customers become less predictive of future losses, which could cause our losses to rise and

have a negative impact on our results of operations.