Capital One 2009 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 159

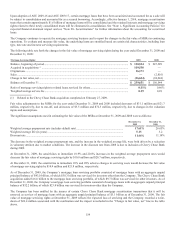

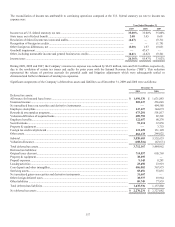

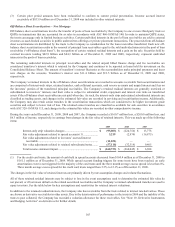

The Company is subject to examination by the IRS and other tax authorities in certain countries and states in which the Company has

significant business operations. The tax years subject to examination vary by jurisdiction. The IRS is currently examining the

Company’s federal income tax returns for the years 2007 and 2008. During 2009, the IRS concluded its examination of the

Company’s federal income tax returns for the years 2005 and 2006, and its examinations of the final separate federal income tax

returns for certain acquired subsidiaries. During 2009 and 2008, the Company made cash payments to the IRS related to these

concluded examinations which resulted in a reduction of approximately $194.5 million and $34.1 million, respectively, to the balance

of net unrecognized tax benefits.

During 2009, the U.S. Tax Court issued a decision with respect to certain tax issues for the years 1995-1999, with both parties

prevailing on certain issues. At issue are proposed adjustments by the IRS with respect to the timing of recognition of items of income

and expense derived from the Company’s credit card business in various tax years. As a result of the Tax Court decision, the Company

reduced the amount of unrecognized tax benefits by approximately $69.3 million. The time period for an appeal by each party of the

Tax Court decision is pending and the ultimate outcome may also impact tax years after 1999. It is reasonably possible that a

settlement related to these timing issues may be made within twelve months of the reporting date. At this time, an estimate of the

potential change to the amount of unrecognized tax benefits resulting from such a settlement cannot be made.

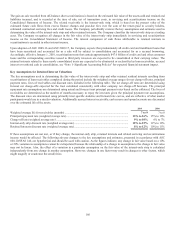

As of December 31, 2009, U.S. income taxes and foreign withholding taxes have not been provided on approximately $231.9 million

of unremitted earnings of subsidiaries operating outside the U.S., in accordance with APB Opinion No. 23, Accounting for Income

Taxes—Special Areas (ASC 740-30/APB 23). These earnings are considered by management to be invested indefinitely. Upon

repatriation of these earnings, the Company could be subject to both U.S. income taxes (subject to possible adjustment for foreign tax

credits) and withholding taxes payable to various foreign countries. Determination of the amount of unrecognized deferred U.S.

income tax liability and foreign withholding tax on these unremitted earnings is not practicable at this time because such liability is

dependent upon circumstances existing if and when remittance occurs.

As of December 31, 2009, U.S. income taxes have not been provided for approximately $286.5 million of previously acquired thrift

bad debt reserves created for tax purposes as of December 31, 1987. These amounts, acquired as a result of the merger with North

Fork Bancorporation, Inc. and the acquisition of Chevy Chase Bank, F.S.B., are subject to recapture in the unlikely event that CONA,

as successor to North Fork Bank and Chevy Chase Bank, makes distributions in excess of earnings and profits, redeems its stock, or

liquidates.

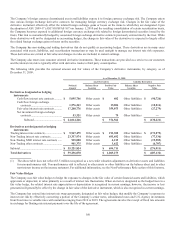

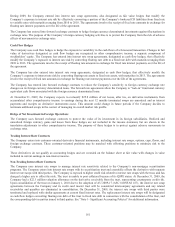

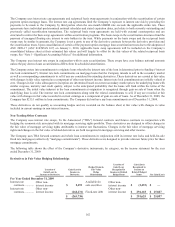

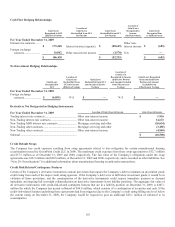

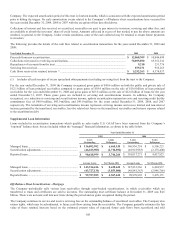

Note 19

Derivative Instruments and Hedging Activities

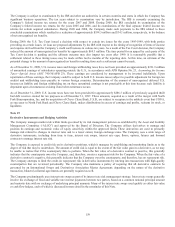

The Company manages market risk within limits governed by its risk management policies as established by the Asset and Liability

Management Committee (“ALCO”) and approved by the Board of Directors. The Company utilizes derivatives to manage and

position its earnings and economic value of equity sensitivity within the approved limits. These derivatives are used to primarily

manage risk related to changes in interest rates and to a lesser extent, foreign exchange rates. The Company uses a wide range of

derivative instruments, including from time to time, interest rate swaps, interest rate caps, floors, options, futures and forward

contracts to manage interest rate risk.

The Company is exposed to credit risk on its derivative positions, which it manages by establishing and monitoring limits as to the

degree of risk that may be undertaken. The amount of credit risk is equal to the extent of the fair value gain in a derivative, as we may

be unable to realize that if the counterparty fails to perform. When the fair value of a derivative contract is positive, this generally

indicates that the counterparty owes the Company, and, therefore, creates a repayment risk for the Company. When the fair value of a

derivative contract is negative, this generally indicates that the Company owes the counterparty, and therefore, has no repayment risk.

The Company attempts to limit the credit (or repayment) risk in derivative instruments by entering into transactions with high-quality

counterparties that are reviewed periodically. The Company also maintains a policy of requiring that all derivative contracts be

governed by an International Swaps and Derivatives Association Master Agreement; depending on the nature of the derivative

transaction, bilateral collateral agreements are generally required as well.

The Company predominantly uses interest rate swaps as part of its interest rate risk management strategy. Interest rate swaps generally

involve the exchange of fixed and variable rate interest payments between two parties, based on a common notional principal amount

and maturity date with no exchange of underlying principal amounts. Many of the interest rate swaps used qualify as either fair value

or cash flow hedges, each of which is discussed in more detail in the remainder of this Note.