Capital One 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

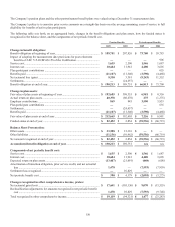

145

The Company also issues cash equity units which are recorded as liabilities as the expense is recognized. Cash equity units are not

issued out of the Company’s stock-based compensation plans because they are settled with a cash payment for each unit vested equal

to the fair market value of the Company’s stock on the vesting date. Cash equity units vest 25 percent on the first and second

anniversaries of the grant date and 50 percent on the third anniversary date or three years from the date of grant.

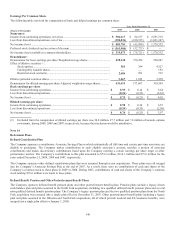

The Company recognizes compensation expense on a straight line basis over the entire award’s vesting period for any awards with

graded vesting. Total compensation expense recognized for share based compensation during the years 2009, 2008 and 2007 was

$146.3 million, $112.2 million and $230.0 million, respectively. The total income tax benefit recognized in the consolidated statement

of income for share based compensation arrangements during the years 2009, 2008 and 2007 was $51.2 million, $39.3 million and

$80.5 million, respectively.

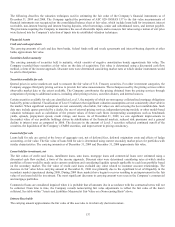

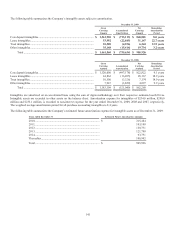

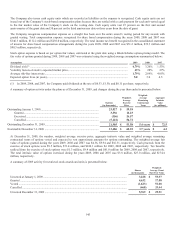

Stock option expense is based on per option fair values, estimated at the grant date using a Black-Scholes option-pricing model. The

fair value of options granted during 2009, 2008 and 2007 was estimated using the weighted average assumptions summarized below:

Assumptions

2009

2008 2007

Dividend yield (1) ....................................................................................................................................... 4.79% 3.20% 1.53%

Volatility factors of stock’s expected market price ................................................................................... 43% 28% 27%

Average risk-free interest rate ................................................................................................................... 1.79% 2.89% 4.05%

Expected option lives (in years) ................................................................................................................ 5.0 5.0 4.5

(1) In 2009, 2008, and 2007, the Company paid dividends at the rate of $0.53, $1.50, and $0.11 per share, respectively.

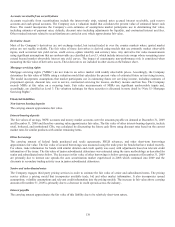

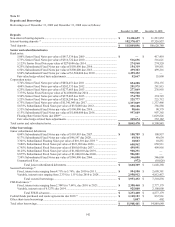

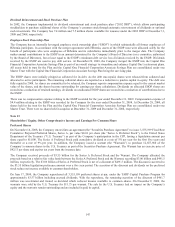

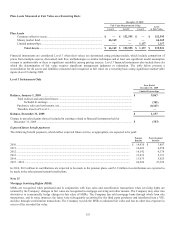

A summary of option activity under the plans as of December 31, 2009, and changes during the year then ended is presented below:

Options

(in thousands)

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(in millions)

Outstanding January 1, 2009 ................................................................................

.

23,827 $ 59.18

Granted .......................................................................................................

.

3,556 18.23

Exercised ....................................................................................................

.

(356) 26.57

Cancelled ....................................................................................................

.

(5,122) 56.72

Outstanding December 31, 2009 ..........................................................................

.

21,905 $ 53.58 5.4 years $ 72.5

Exercisable December 31, 2009 ..........................................................................

.

13,486 $ 60.25 3.7 years $ 4.2

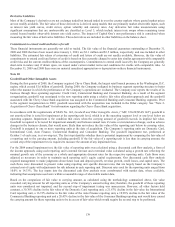

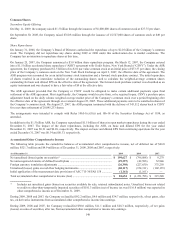

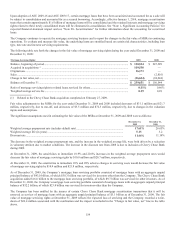

At December 31, 2009, the number, weighted average exercise price, aggregate intrinsic value and weighted average remaining

contractual terms of options vested and expected to vest approximate amounts for options outstanding. The weighted-average fair

value of options granted during the years 2009, 2008 and 2007 was $4.56, $9.94 and $16.31, respectively. Cash proceeds from the

exercise of stock options were $9.5 million, $71.4 million, and $224.1 million for 2009, 2008 and 2007, respectively. Tax benefits

realized from the exercise of stock options were $1.3 million, $9.4 million and $61.0 million for 2009, 2008 and 2007, respectively.

The total intrinsic value of options exercised during the years 2009, 2008 and 2007 was $3.8 million, $27.0 million, and $174.4

million, respectively.

A summary of 2009 activity for restricted stock awards and units is presented below:

Shares

(in thousands)

Weighted-

Average Grant

Date Fair Value

Unvested at January 1, 2009 .................................................................................................................... 3,228 $ 59.37

Granted .................................................................................................................................................... 4,632 17.58

Vested ...................................................................................................................................................... (1,623) 51.88

Cancelled ................................................................................................................................................. (468) 33.44

Unvested December 31, 2009 .................................................................................................................. 5,769 $ 29.91