Capital One 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

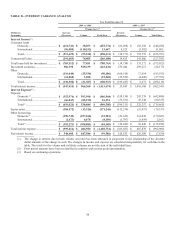

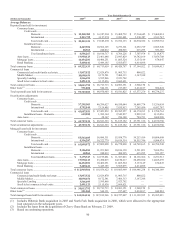

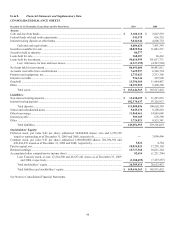

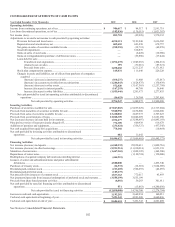

TABLE G—NONPERFORMING ASSETS (Reported)

Table G shows a summary of nonperforming assets for the periods indicated.

As of December 31

(Dollars in thousands)

2009 2008 2007

2006 2005

N

onperforming loans held for investmen

t

(1) (2):

Commercial lending .........................................................

Commercial and multi-family real estate ................ $ 428,754 $ 142,261 $ 29,391 $ 13,745 $ 7,800

Middle market ......................................................... 104,272 38,677 28,772 10,820 50,957

Small ticket commercial real estate ........................ 94,674 167,467 16,026 237 —

Specialty lending..................................................... 73,866 37,217 6,086 226 —

Total commercial loans ................................. 701,566 385,622 80,275 25,028 58,757

Consumer lending ............................................................

Automobile ............................................................. 143,341 164,646 156,580 86,943 61,053

Mortgages ............................................................... 322,473 104,498 97,969 54,325 46,632

Other consumer loans ............................................. 121,326 149,586 58,489 264 217

Total consumer loans .................................... 587,140 418,730 313,038 141,532 107,902

Total nonperforming loans held for investment ............... 1,288,706 804,352 393,313 166,560 166,659

Foreclosed property(4) ....................................................... 233,749 88,961 48,016 16,146 8,436

Repossessed assets ........................................................... 24,503 65,635 56,877 30,844 22,917

Total nonperforming assets .............................................

.

$ 1,546,958 $ 958,948 $ 498,206 $ 213,550 $ 198,012

N

onperforming loans as a percentage of loans held fo

r

investment(3) ...............................................................

.

1.42 % 0.80 % 0.39 % 0.17% 0.28 %

N

onperforming assets as a percentage of loans held fo

r

investment(3) ...............................................................

.

1.70 % 0.95 % 0.49 % 0.22% 0.33 %

(1) Our policy is not to classify credit card loans as nonperforming loans. See Table E-Delinquencies for accruing loans

contractually past due 90 days more.

(2) Excludes loans acquired from the Chevy Chase Bank acquisition and previously considered nonperforming of $1,205.6 million

as these loans have been recorded at fair value and are considered performing in accordance with ASC 805-10/SFAS 141(R)

and/or ASC 310-10/SOP 03-3.

(3) Includes the loans acquired from the Chevy Chase Bank acquisition in the denominator. See “Table I – Acquired Loan

Reconciliation” for the rates excluding the acquired loan portfolio.

(4) The acquisition of Chevy Chase Bank added $154.3 million to foreclosed property.