Capital One 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Note 7

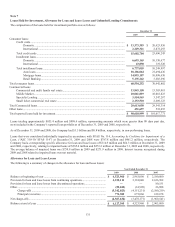

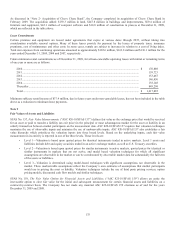

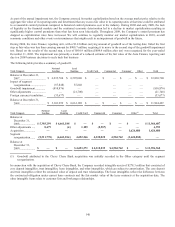

Loans Held for Investment, Allowance for Loan and Lease Losses and Unfunded Lending Commitments

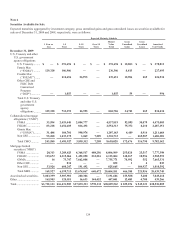

The composition of the loans held for investment portfolio was as follows:

December 31

2009

2008

Consumer loans:

Credit cards ...................................................................................................................................

Domestic ............................................................................................................................. $ 13,373,383 $ 20,623,950

International ........................................................................................................................ 2,229,321 2,872,293

Total credit cards .......................................................................................................................... 15,602,704 23,496,243

Installment loans ...........................................................................................................................

Domestic ............................................................................................................................. 6,693,165 10,130,677

International ........................................................................................................................ 43,890 119,320

Total installment loans .................................................................................................................. 6,737,055 10,249,997

Auto loans ........................................................................................................................... 18,186,064 21,494,436

Mortgage loans .................................................................................................................... 14,893,187 10,098,430

Retail Banking..................................................................................................................... 5,135,242 5,603,696

Total consumer loans ............................................................................................................................. 60,554,252 70,942,802

Commercial loans

Commercial and multi family real estate ...................................................................................... 13,843,158 13,303,081

Middle Market .............................................................................................................................. 10,061,819 10,081,823

Specialty Lending ......................................................................................................................... 3,554,563 3,547,287

Small ticket commercial real estate .............................................................................................. 2,153,510 2,609,123

Total Commercial loans ......................................................................................................................... 29,613,050 29,541,314

Other loans ............................................................................................................................................. 451,697 533,655

Total reported loans held for investment ................................................................................................ $ 90,618,999 $ 101,017,771

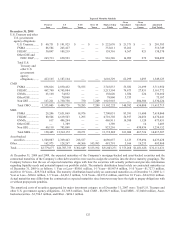

Loans totaling approximately $853.4 million and $998.6 million, representing amounts which were greater than 90 days past due,

were included in the Company’s reported loan portfolio as of December 31, 2009 and 2008, respectively.

As of December 31, 2009 and 2008, the Company had $1.3 billion and $0.8 billion, respectively, in non-performing loans.

Loans that were considered individually impaired in accordance with SFAS No. 114, Accounting by Creditors for Impairment of a

Loan, (“ASC 310-10/ SFAS 114”) at December 31, 2009 and 2008 were $787.8 million and $461.2 million, respectively. The

Company had a corresponding specific allowance for loan and lease losses of $114.9 million and $64.3 million at December 31, 2009

and 2008, respectively, relating to impaired loans of $385.6 million and $272.2 million at December 31, 2009 and 2008, respectively.

The average balance of impaired loans was $759.8 million in 2009 and $271.9 million in 2008. Interest income recognized during

2009 and 2008 related to impaired loans was not material.

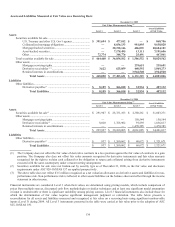

Allowance for Loan and Lease Losses

The following is a summary of changes in the allowance for loan and lease losses:

Year Ended December 31

2009 2008

2007

Balance at beginning of year .....................................................................................

.

$ 4,523,960 $ 2,963,000 $ 2,180,000

Provision for loan and lease losses from continuing operations ................................

.

4,230,111 5,101,040 2,636,502

Provision for loan and lease losses from discontinued operations .............................

.

— — 80,151

Other ..........................................................................................................................

.

(59,042) (61,909) 26,888

Charge-offs ......................................................................................................

.

(5,342,023) (4,151,231) (2,580,219)

Principal recoveries ..........................................................................................

.

774,389 673,060 619,678

N

et charge-offs ..........................................................................................................

.

(4,567,634) (3,478,171) (1,960,541)

Balance at end of year ...............................................................................................

.

$ 4,127,395 $ 4,523,960 $ 2,963,000