Capital One 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 147

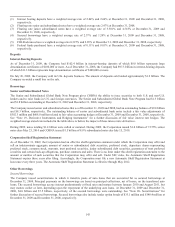

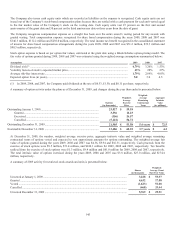

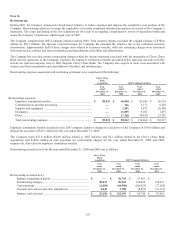

Dividend Reinvestment and Stock Purchase Plan

In 2002, the Company implemented its dividend reinvestment and stock purchase plan (“2002 DRP”), which allows participating

stockholders to purchase additional shares of the Company’s common stock through automatic reinvestment of dividends or optional

cash investments. The Company has 7.4 million and 7.5 million shares available for issuance under the 2002 DRP at December 31,

2009 and 2008, respectively.

Employee Stock Ownership Plan

The Company has an internally leveraged employee stock ownership plan (“ESOP”) in which substantially all former employees of

Hibernia participate. In accordance with the merger agreement with Hibernia, assets of the ESOP trust were allocated solely for the

benefit of participants who were employees of Hibernia and its subsidiaries immediately prior to the merger date. The Company

makes annual contributions to the ESOP in an amount determined by the Company’s Board of Directors (or a committee authorized

by the Board of Directors), but at least equal to the ESOP’s minimum debt service less dividends received by the ESOP. Dividends

received by the ESOP are used to pay debt service. At December 29, 2009, the Company merged the ESOP into the Capital One

Financial Corporation Associate Savings Plan as part of an overall strategy to streamline and enhance Capital One’s retirement plans.

All assets held in trust for the Plan and the Capital One Financial Corporation Associate Savings Plan are consolidated under one

Master Trust with the Capital One Financial Corporation Associate Savings Plan being the surviving plan.

The ESOP shares were initially pledged as collateral for its debt. As the debt was repaid, shares were released from collateral and

allocated to active participants. The remaining collateral shares are reported as a reduction to paid-in capital in equity. The debt was

fully repaid in 2008. As shares are committed to be released, the Company reports compensation expense equal to the current market

value of the shares, and the shares become outstanding for earnings per share calculations. Dividends on allocated ESOP shares are

recorded as a reduction of retained earnings; dividends on unallocated ESOP shares are recorded as a reduction of contributions due to

the ESOP.

There was no compensation expense relating to the ESOP recorded for the year ended December 31, 2009. Compensation expense of

$4.4 million relating to the ESOP was recorded by the Company for the year ended December 31, 2008. At December 29, 2009, all

shares held in the trust for the Plan and the Capital One Financial Corporation Associate Savings Plan are consolidated under one

Master Trust. There were no shares held in suspense at December 31, 2009 and December 31, 2008, respectively.

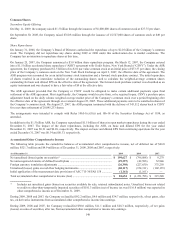

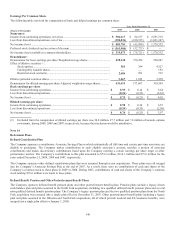

Note 13

Shareholders’ Equity, Other Comprehensive Income and Earnings Per Common Share

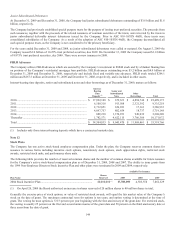

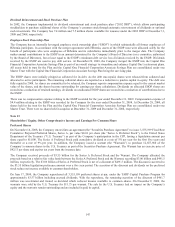

Preferred Shares

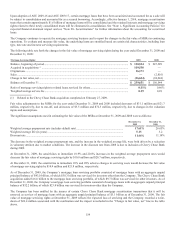

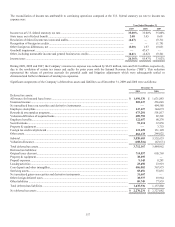

On November 14, 2008, the Company entered into an agreement (the “Securities Purchase Agreement”) to issue 3,555,199 Fixed Rate

Cumulative Perpetual Preferred Shares, Series A, par value $0.01 per share (the “Series A Preferred Stock”), to the United States

Department of the Treasury (“U.S. Treasury”) as part of the Company’s participation in the CPP, having a liquidation amount per

share equal to $1,000. The Series A Preferred Stock paid cumulative dividend at a rate of 5% per year for the first five years and

thereafter at a rate of 9% per year. In addition, the Company issued a warrant (the “Warrants”) to purchase 12,657,960 of the

Company’s common shares to the U.S. Treasury as part of the Securities Purchase Agreement. The Warrant has an exercise price of

$42.13 per share and expires ten years from the issuance date.

The Company received proceeds of $3.55 billion for the Series A Preferred Stock and the Warrant. The Company allocated the

proceeds based on a relative fair value basis between the Series A Preferred Stock and the Warrant, recording $3.06 billion and $491.5

million, respectively. The $3.06 billion of Series A Preferred Stock is net of a discount of $491.5 million. The discount is accreted to

the $3.55 billion liquidation preference amount over a five year period. The accretion of the discount and dividends on the preferred

stock reduce net income available to common shareholders.

On June 17, 2009, the Company repurchased all 3,555,199 preferred shares at par, under the TARP Capital Purchase Program for

approximately $3.57 billion including accrued dividends. With the repurchase, the remaining accretion of the discount of $461.7

million was accelerated and treated as dividend which reduced income available to common shares. On December 9, 2009, the

warrants were sold by the U.S. Treasury for $11.75 per warrant. The sale by the U.S. Treasury had no impact on the Company’s

equity and the warrants remain outstanding and are included in paid in capital.