Capital One 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 63

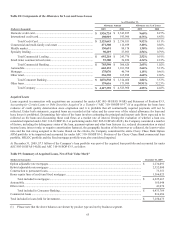

Allowance for Loan and Lease Losses

The allowance for loan and lease losses is maintained at an amount estimated to be sufficient to absorb losses, net of principal

recoveries (including recovery of collateral), inherent in the existing reported loan portfolios. The provision for loan and lease losses is

the periodic cost of maintaining an adequate allowance.

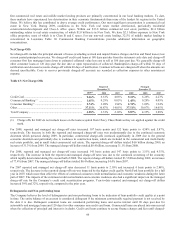

The amount of allowance necessary is based on distinct allowance methodologies depending on the type of loan. Allowance

methodologies for consumer loans such as credit card, automobile loans and mortgages are primarily based upon delinquency

migration analysis, forecasted forward loss curves and historical loss trends. The methodology for credit cards includes estimated

recoveries, while methodologies for automobile loans and mortgages consider estimated collateral values. Allowance methodologies

for commercial loans are largely based upon specifically identified criticized loans, trends in criticized loans, estimated collateral

values, and recent historical loss trends.

In evaluating the sufficiency of the allowance for loan and lease losses, management takes into consideration many factors including,

but not limited to, recent trends in delinquencies and charge-offs including bankrupt, deceased and recovered amounts, economic

conditions, the value of collateral securing the loans, legal and regulatory guidance, credit evaluation and underwriting policies,

seasonality, the degree of assumed risk inherent in the portfolio, and uncertainties in the Company’s forecasting and modeling. In

particular, unemployment rates, housing prices and the valuation of commercial properties, consumer real estate, and automobiles are

factors which significantly impact the allowance for loan and lease losses. Management examines a variety of externally available data

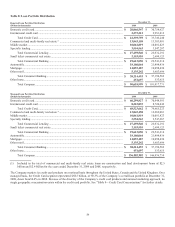

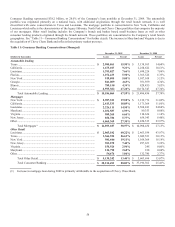

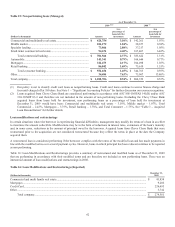

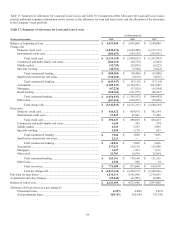

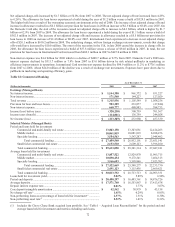

as well as the Company’s recent experience in the consideration of these factors. Table 17: Summary of Allowance for Loan and

Lease Losses provides additional detail on activity in the allowance.

The evaluation process for determining the adequacy of the allowance for loan and lease losses and the periodic provisioning for

estimated losses is undertaken on a quarterly basis, unless conditions arise that would require more frequent evaluation. Conditions

giving rise to such action could be business combinations or other acquisitions or dispositions of large quantities of loans, dispositions

of non-performing and marginally performing loans by bulk sale or any development which may indicate a significant trend not

currently contemplated in the allowance methodology.

At December 31, 2009, the allowance for loan and lease losses was $4.1 billion, or 4.55% of the overall loan portfolio, compared to

$4.5 billion, or 4.48% of the overall loan portfolio at December 31, 2008. Net charge-offs in 2009 were $4.6 billion compared to $3.5

billion in 2008 and $2.0 billion in 2007. The increase in net charge-offs reflects the economic downturn experienced in the Company’s

lending markets that began in 2007 and has continued throughout 2009. During this time period, unemployment rates in the United

States have increased from 4.7% in July 2007 to 10.0% at the end of 2009. House prices decreased approximately 28% over the same

period. In addition, the consumer led recession in the United States impacted delinquency and loss rates in the Company’s consumer

lending portfolios earlier than in its commercial lending portfolios, which began to exhibit higher levels of non performing loans and

charge-offs in late 2008 continuing into 2009.

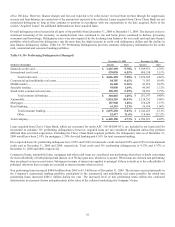

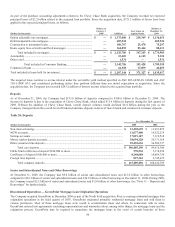

During 2009, the following are the primary factors that management considered in establishing the level of the allowance for loan and

lease losses:

• The absolute level of reported loans outstanding declined in 2009 from 2008 as certain portfolios (e.g., national closed-

end installment loans, small ticket commercial real estate loans) were in run-off mode, levels of consumer spending

declined, underwriting standards were tightened and overall loan demand remained weak. Generally, a decline in

outstandings results in a decrease in the allowance.

• Consumer loans overall: Unemployment rates increased during 2009 and we projected continued increases into 2010.

Unemployment increased faster in 2009 than our initial projections, but charge-offs were in line or lower. Based on this

experience and updated models, the Company determined that the sensitivity of its losses to changes in unemployment are

somewhat less than previously estimated. This partially offset the allowance increases caused by higher unemployment.

• Consumer card and unsecured closed end loans: Delinquency rates increased during the year. A portion of the increase is

related to the decrease in loan volumes (the “denominator effect”) and does not impact the allowance. Another portion

relates to credit degradation in the portfolio which results in an increase in the allowance. However, late stage

delinquencies in the credit card portfolio began to improve in the second half of 2009, which resulted in a decrease to the

allowance.

• Mortgage loans: Collateral values for consumer real estate deteriorated during 2009, resulting in higher charge-offs as

well as an increase to the allowance.

• Auto loans: A decline in loan volumes coupled with improvement in both unit losses and collateral values for used

automobiles during 2009 resulted in lower charge-off expectations and decreases to the allowance.

• Commercial loans: Criticized and non-performing loans increased during 2009 and collateral values for commercial real

estate loans declined. These factors drove both increased charge-offs and increased allowance. We also updated our

expected loss models to better reflect recent experience. This also contributed to an increase in the allowance.