Capital One 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 49

2010 Expectations:

• The Company expects a mid-single digit percentage decline in ending managed loan balances compared to 2009, driven

by continuing runoff of loans in businesses the Company exited or repositioned earlier in the recession, including

nationally originated installment loans in its Domestic Card business, small ticket Commercial real Estate, mortgages, and

auto loans. The Company expects a high-single digit percentage decline in average loan balances compared to 2009,

driven by continuing runoff as well as lower beginning loan balances.

• The Company expects annual margins for 2010 to be similar to annual margins for 2009.

• Consistent with declining loan balances and relatively stable margins, the Company expects that annual revenues will

decline in 2010 compared to 2009.

• The Company expects non-interest expenses to increase in 2010. Media and marketing costs were unusually low in 2009.

In 2010, the Company expects these costs to increase toward more normal levels, depending upon the Company’s

assessment of market opportunities through the year. The Company expects that operating expenses in 2010 will be

similar to 2009, as ongoing efficiency improvements are offset by investments in banking and mortgage infrastructure.

• The Company expects the efficiency ratio to rise year over year, consistent with the revenue and expense trends

mentioned above.

• The Company expects that the combination of declining loan balances and a moderating charge-off outlook could create

the potential for significant allowance releases in 2010.

Credit Card Business:

The Company expects further increases in the Domestic Card charge-off rate into 2010. The Domestic Card charge-off rate for the

first quarter could cross 11%, driven by declining loan balances and elevated delinquencies in the second half of 2009 flowing through

to charge-off. The Company expects to reach the quarterly peak in Domestic Card charge-off dollars in the first quarter of 2010,

although declining loan balances may cause Domestic Card charge-off rates to remain elevated for a bit longer.

The Company expects Domestic Card loans to decline in 2010 because of the continuing runoff of about $3 billion of installment

loans. If normal seasonal patterns hold, the Company expects most or all of the decline would come in the first quarter. In subsequent

quarters the Company expects loan balances for the Domestic Card segment to be relatively flat, as originations roughly offset both

elevated charge-offs and installment loan runoff.

In 2010 the Company expects that Domestic Card marketing expenses will increase toward more normal levels depending on our

assessment of the market opportunities for profitable and resilient origination growth.

The Company expects that quarterly Domestic Card revenue margin will be in the mid-15% range in 2010, although the revenue

margin in the first quarter may be above the mid-15% range.

Longer term, the Company expects the Credit CARD Act, as well as market and competitive responses to the Credit CARD Act, will

result in the continuing redistribution of where revenue comes from within the Domestic Card business. The Company expects

declining revenues from over limit fees and increasing revenues from up front pricing. This redistribution was evident in 2009

quarterly trends in net interest income and non-interest income in the Domestic Card business. In the aggregate, the Company expects

its Domestic Card revenue margin to remain largely intact over time. Over the long-term, the Company expects that returns in the

Domestic Card business will diminish modestly from pre-recession levels, but will remain very attractive and well above hurdle rates.

The Company expects that credit trends in the International Card business will reflect continuing economic weakness in the U.K and

Canada.

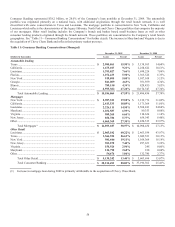

Commercial Banking:

The Company expects that the continuing recession will drive continuing declines in commercial real estate values, and that non-

performing loans and charge-offs will remain elevated across our Commercial Banking businesses in 2010. The Company expects

continuing growth in low-cost commercial deposits with disciplined pricing in 2010.

Consumer Lending:

The Company expects ending loans in the Auto Finance business to decrease approximately $1.5 billion in 2010. The Company

expects ending loans in the mortgage portfolio to decline by approximately $2.5 billion in 2010. In contrast, the Company expects

continuing growth in consumer deposits with disciplined pricing in 2010.