Capital One 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 47

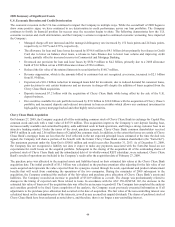

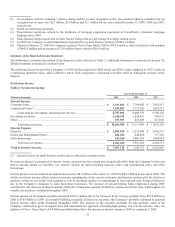

Secondary Equity Offering

On September 30, 2008, the Company raised $760.8 million through the issuance of 15,527,000 shares of common stock at $49.00 per

share.

Goodwill Impairment

During the fourth quarter of 2008, the Company recorded an impairment to goodwill of $810.9 million. The impairment was recorded

in the Auto Finance business. The deficit was primarily a result of a reduced estimate of the fair value of the Auto Finance business

due to the decision to scale that business back beginning in 2008.

Sale of MasterCard Shares

During the second quarter of 2008, the Company recognized a gain of $44.9 million in other non-interest income from the sale of

154,991 shares of MasterCard class B common stock.

Visa IPO

During the first quarter of 2008, Visa completed an initial public offering (“IPO”) of its stock. With IPO proceeds Visa established an

escrow account for the benefit of member banks to fund certain litigation settlements and claims. As a result, in the first quarter of

2008, the Company reduced its Visa-related indemnification liabilities of $90.9 million recorded in other liabilities with a

corresponding reduction of other non-interest expense. In addition, the Company recognized a gain of $109.0 million in non-interest

income for the redemption of 2.5 million shares related to the Visa IPO. Both items were included in the Other category.

Debt Refinancing

During the first quarter of 2008, the Company repurchased approximately $1.0 billion of certain senior unsecured debt, recognizing a

gain of $52.0 million in non-interest income. The Company initiated the repurchases to take advantage of the current market

environment and replaced the repurchased debt with lower-rate unsecured funding.

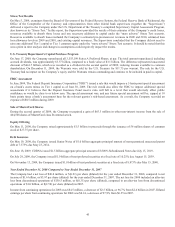

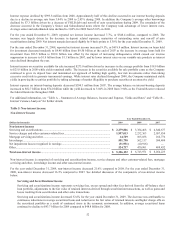

2007 Summary of Significant Events

Shut Down of Mortgage Origination Operations of Wholesale Mortgage Banking Unit

See “Note 4 – Discontinued Operations” for further details.

Restructuring Charges Associated with Cost Initiative

During the second quarter of 2007, we announced a broad-based initiative to reduce expenses and improve our competitive cost

position. We recognized $138.2 million in restructuring charges in 2007.

Share Repurchase

During 2007, we executed a $3.0 billion stock repurchase program, resulting in a net share retirement of 43,717,110 shares.

Litigation Settlements and Reserves

During the fourth quarter of 2007, we recognized a pre-tax charge of $79.8 million for liabilities in connection with the antitrust

lawsuit settlement with American Express. Additionally, we recorded a legal reserve of $59.1 million for estimated possible damages

in connection with other pending Visa litigation, reflecting our share of such potential damages as a Visa member.

Sale of Interest in Spain

During 2007, the Company completed the sale of its interest in a relationship agreement to develop and market consumer credit

products in Spain and recorded a net gain related to this sale of $31.3 million consisting of a $41.6 million increase in non-interest

income partially offset by a $10.3 million increase in non-interest expense.