Capital One 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

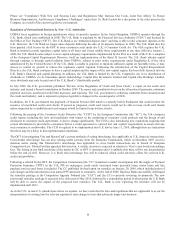

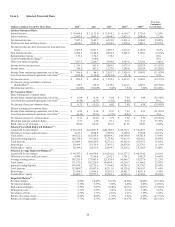

Item 6. Selected Financial Data

(Dollars in millions, Except Per Share Data)

2009(7) 2008 2007 2006(3)

2005(2)

Five Year

Compound

Growth Rate

Income Statement Data:

Interest income ................................................................ $ 10,664.6 $ 11,112.0 $ 11,078.1 $ 8,164.7 $ 5,726.9 13.24%

Interest expense ............................................................... 2,967.5 3,963.3 4,548.3 3,073.3 2,046.6 7.71%

N

et interest income ......................................................... 7,697.1 7,148.7 6,529.8 5,091.4 3,680.3 15.90%

Provision for loan and lease losses .................................. 4,230.1 5,101.0 2,636.5 1,476.4 1,491.1 23.19%

N

et interest income after provision for loan and lease

losses ......................................................................... 3,467.0 2,047.7 3,893.3 3,615.0 2,189.2 9.63%

N

on-interest income ........................................................ 5,286.2 6,744.0 8,054.2 7,001.0 6,358.1 (3.63)%

Restructuring expense ..................................................... 119.4 134.5 138.2 — — N/A

Goodwill impairment charge

(

6

)

...................................... — 810.9 — — — N/A

Other non-interest expense .............................................. 7,297.7 7,264.7 7,939.8 6,943.6 5,718.3 5.00%

Income before income taxes ............................................ 1,336.1 581.6 3,869.5 3,672.4 2,829.0 (13.93)%

Income taxes ................................................................... 349.5 497.1 1,277.8 1,246.0 1,019.9 (19.28)%

Income from continuing operations, net of tax ............... $ 986.6 $ 84.5 $ 2,591.7 $ 2,426.4 $ 1,809.1 (11.42)%

Loss from discontinued operations, net of tax

(

4

)

............ (102.8) (130.5) (1,021.4) (11.9) — N/A

N

et income (loss) ............................................................ $ 883.8 $ (46.0) $ 1,570.3 $ 2,414.5 $ 1,809.1 (13.35)%

N

et income (loss) available to common

shareholders(9) ........................................................... 319.9 (78.7) 1,570.3 2,414.5 1,809.1 (29.29)%

Dividend payout ratio...................................................... 66.80% 722.06% 2.68% 1.34% 1.52% 113.09%

Per Common Share:

Basic earnings per common share:

Income from continuing operations, net of tax ............... $ 0.99 $ 0.14 $ 6.64 $ 7.84 $ 6.98 (32.34)%

Loss from discontinued operations, net of tax

(

4

)

............ (0.24) (0.35) (2.62) (0.04) — N/A

N

et income (loss) per common share .............................. $ 0.75 $ (0.21) $ 4.02 $ 7.80 $ 6.98 (35.99)%

Diluted earnings per common share:

Income from continuing operations, net of tax ............... $ 0.98 $ 0.14 $ 6.55 $ 7.65 $ 6.73 (31.98)%

Loss from discontinued operations, net of tax

(

4

)

............ (0.24) (0.35) (2.58) (0.03) — N/A

N

et income (loss) per common share .............................. $ 0.74 $ (0.21) $ 3.97 $ 7.62 $ 6.73 (35.70)%

Dividends paid per common share .................................. 0.53 1.50 0.11 0.11 0.11 36.70%

Book value as of year-end ............................................... 59.04 68.38 65.18 61.56 46.97 4.68%

Selected Year-End Reported Balances(1) :

Loans held for investment ............................................... $ 90,619.0 $101,017.8 $101,805.0 $ 96,512.1 $ 59,847.7 8.65%

Allowance for loan and lease losses ................................ 4,127.4 4,524.0 2,963.0 2,180.0 1,790.0 18.19%

Total assets ...................................................................... 169,622.5 165,878.4 150,499.1 144,360.8 88,701.4 13.84%

Interest-bearing deposits ................................................. 102,370.4 97,326.9 71,714.6 73,913.9 43,092.1 18.89%

Total deposits .................................................................. 115,809.1 108,620.8 82,761.2 85,562.0 47,933.3 19.29%

Borrowings...................................................................... 20,994.7 23,159.9 37,491.2 29,876.8 22,278.1 (1.18)%

Stockholders’ equity ....................................................... 26,589.4 26,612.4 24,294.1 25,235.2 14,128.9 13.48%

Selected Average Reported Balances(1) :

Loans held for investment ............................................... $ 99,787.3 $ 98,970.9 $ 93,541.8 $ 63,577.3 $ 40,734.2 19.63%

Allowance for loan and lease losses ................................ 4,470.2 3,266.8 2,182.7 1,791.2 1,482.9 24.69%

Average earning assets .................................................... 145,293.0 133,083.6 121,420.4 84,086.7 55,537.0 21.21%

Total assets ...................................................................... 171,573.6 156,226.4 144,999.1 95,254.7 61,360.5 22.83%

Interest-bearing deposits ................................................. 103,078.2 82,735.6 73,764.9 45,592.4 28,370.7 29.44%

Total deposits .................................................................. 115,600.7 93,507.6 85,211.6 50,526.8 29,019.7 31.84%

Borrowings...................................................................... 23,504.9 31,096.5 30,101.5 24,451.7 18,031.9 5.44%

Stockholders’ equity ....................................................... 26,605.7 25,277.8 25,203.1 16,203.4 10,594.3 20.22%

Reported Metrics(1) :

Revenue margin .............................................................. 8.94% 10.44% 12.01% 14.38% 18.08% (13.14)%

N

et interest margin .......................................................... 5.30% 5.37% 5.38% 6.05% 6.63% (4.38)%

Risk adjusted margin ....................................................... 5.79% 7.83% 10.40% 12.71% 15.47% (17.84)%

Delinquency rate ............................................................. 4.13% 4.37% 3.66% 2.74% 3.14% 5.63%

N

et charge-off rate .......................................................... 4.58% 3.51% 2.10% 2.21% 3.55% 5.23%

Return on average assets ................................................. 0.58% 0.05% 1.79% 2.55% 2.95% (27.77)%

Return on average equity ................................................ 3.71% 0.33% 10.28% 14.97% 17.08% (26.32)%