Capital One 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 139

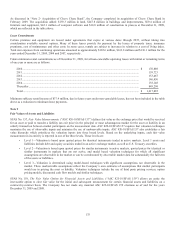

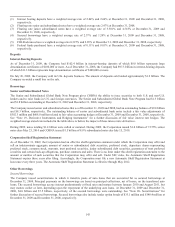

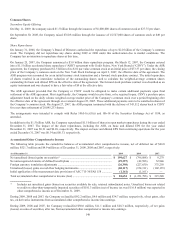

Derivative Liabilities

Most of the Company’s derivatives are not exchange traded but instead traded in over the counter markets where quoted market prices

are not readily available. The fair value of those derivatives is derived using models that use primarily market observable inputs, such

as interest rate yield curves, credit curves, option volatility and currency rates. Any derivative fair value measurements using

significant assumptions that are unobservable are classified as Level 3, which include interest rate swaps whose remaining terms

extend beyond market observable interest rate yield curves. The impact of Capital One’s non performance risk is considered when

measuring the fair value of derivative liabilities. These derivatives are included in other liabilities on the balance sheet.

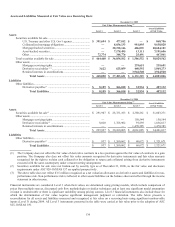

Commitments to extend credit and letters of credit

These financial instruments are generally not sold or traded. The fair value of the financial guarantees outstanding at December 31,

2009 and 2008 that have been issued since January 1, 2003, are $3.1 million and $3.5 million, respectively, and was included in other

liabilities. The estimated fair values of extensions of credit and letters of credit are not readily available. However, the fair value of

commitments to extend credit and letters of credit is based on fees currently charged to enter into similar agreements with comparable

credit risks and the current creditworthiness of the counterparties. Commitments to extend credit issued by the Company are generally

short-term in nature and, if drawn upon, are issued under current market terms and conditions for credits with comparable risks. At

December 31, 2009 and 2008 there were no material unrealized appreciation or depreciation on these financial instruments.

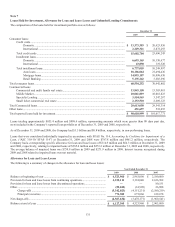

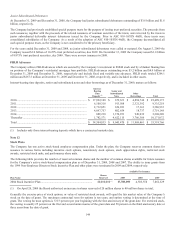

Note 10

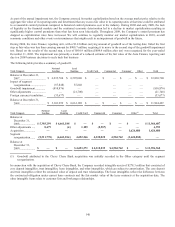

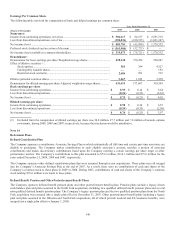

Goodwill and Other Intangible Assets

During the first quarter of 2009, the Company acquired Chevy Chase Bank, the largest retail branch presence in the Washington, D.C.

region, which created $1.6 billion of goodwill. During 2009, the Company realigned its business segment reporting structure to better

reflect the manner in which the performance of the Company’s operations are evaluated. The Company now reports the results of its

business through three operating segments: Credit Card, Commercial Banking and Consumer Banking. As a result of the segment

reorganization, goodwill was reassigned to the new reporting units using a relative fair value allocation approach and the goodwill

associated with the Chevy Chase Bank acquisition was assigned to the Commercial Banking and Consumer Banking segments. Prior

to the segment reorganization in 2009, goodwill associated with the acquisition was included in the Other category. See “Note 2-

Acquisition of Chevy Chase Bank” for information regarding the Chevy Chase Bank acquisition.

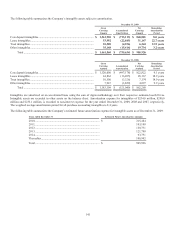

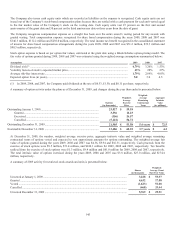

In accordance with the requirements of SFAS No. 142, Goodwill and Other Intangible Assets, (“ASC 350-20/SFAS 142”) goodwill is

not amortized but is tested for impairment at the reporting unit level, which is at the operating segment level or one level below an

operating segment. Impairment is the condition that exists when the carrying amount of goodwill exceeds its implied fair value.

Goodwill is required to be tested for impairment annually and between annual tests if events or circumstances change, such as adverse

changes in the business climate, that would more likely than not reduce the fair value of the reporting unit below its carrying value.

Goodwill is assigned to one or more reporting units at the date of acquisition. The Company’s reporting units are Domestic Card,

International Card, Auto Finance, Commercial Banking and Consumer Banking. The goodwill impairment test, performed at

October 1 of each year, is a two-step test. The first step identifies whether there is potential impairment by comparing the fair value of

a reporting unit to the carrying amount, including goodwill. If the fair value of a reporting unit is less than its carrying amount, the

second step of the impairment test is required to measure the amount of any impairment loss.

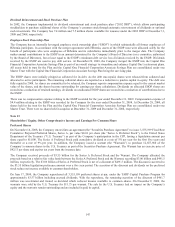

For the 2009 annual impairment test, the fair value of reporting units was calculated using a discounted cash flow analysis, a form of

the income approach, using each reporting unit’s internal forecast and a terminal value calculated using a growth rate reflecting the

nominal growth rate of the economy as a whole and appropriate discount rates for the respective reporting units. Cash flows were

adjusted as necessary in order to maintain each reporting unit’s equity capital requirements. Our discounted cash flow analysis

required management to make judgments about future loan and deposit growth, revenue growth, credit losses, and capital rates. The

cash flows were discounted to present value using reporting unit specific discount rates that are largely based on the Company’s

external cost of equity with adjustments for risk inherent in each reporting unit. Discount rates used for the reporting units ranged from

10.0% to 14.33%. The key inputs into the discounted cash flow analysis were corroborated with market data, where available,

indicating that assumptions used were within a reasonable range of observable market data.

Based on the comparison of fair value to carrying amount, as calculated using the methodology summarized above, fair value

exceeded carrying amount for all reporting units as of the Company’s annual testing date; therefore, the goodwill of those reporting

units was considered not impaired, and the second step of impairment testing was unnecessary. However, all other factors held

constant, a 30.36% decline in the fair value of the Domestic Card reporting unit, a 21.67% decline in the fair value the International

Card reporting unit, a 16.72% decline in the fair value of the Auto Finance reporting unit, a 18.98% decline in the fair value of the

Commercial Banking reporting unit and a 28.43% decline in the fair value of the Consumer Banking reporting unit would have caused

the carrying amount for those reporting units to be in excess of fair value which would require the second step to be performed.