Capital One 2009 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

175

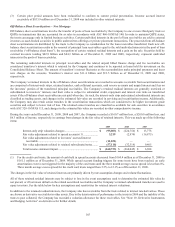

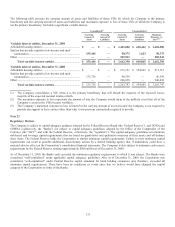

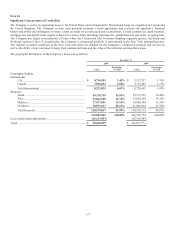

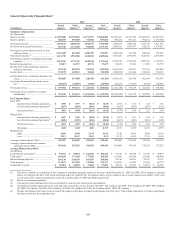

The following table presents the carrying amount of assets and liabilities of those VIEs for which the Company is the primary

beneficiary and the carrying amount of assets and liabilities and maximum exposure to loss of those VIEs of which the Company is

not the primary beneficiary, but holds a significant variable interest.

Consolidated(1) Unconsolidated

Carrying

Amount of

Assets

Carrying

Amount of

Liabilities

Carrying

Amount of

Assets

Carrying

Amount of

Liabilities

Maximum

Exposure to

Loss(2)(3)

Variable interest entities, December 31, 2009

Affordable housing entities ..................................................... $ — $ — $ 1,401,080 $ 638,442 $ 1,401,080

Entities that provide capital to low-income and rural

communities ....................................................................... 155,444 — 58,375 1,623 58,375

Other ....................................................................................... — — 202,943 — 202,943

Total variable interest entities .................................... $ 155,444 $ — $ 1,662,398 $ 640,065 $ 1,662,398

Variable interest entities, December 31, 2008

Affordable housing entities ..................................................... $ — $ — $ 971,151 $ 554,605 $ 971,151

Entities that provide capital to low-income and rural

communities ....................................................................... 135,736 — 46,558 — 46,558

Other ....................................................................................... — — 246,038 — 246,038

Total variable interest entities .................................... $ 135,736 $ — $ 1,263,747 $ 554,605 $ 1,263,747

(1) The Company consolidates a VIE when it is the primary beneficiary that will absorb the majority of the expected losses,

majority of the expected residual returns or both.

(2) The maximum exposure to loss represents the amount of loss the Company would incur in the unlikely event that all of the

Company’s assets in the VIEs became worthless.

(3) The Company’s maximum exposure to loss is limited to the carrying amount of assets because the Company is not required to

provide any support to these entities other than what it was previous contractually required to provide.

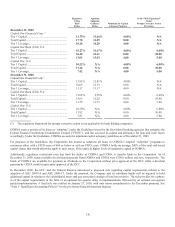

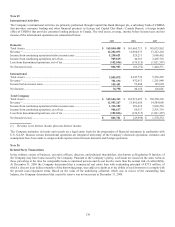

Note 23

Regulatory Matters

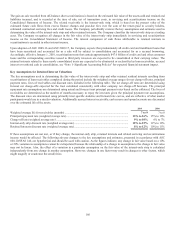

The Company is subject to capital adequacy guidance adopted by the Federal Reserve Board (the “Federal Reserve”), and CONA and

COBNA (collectively, the “Banks”) are subject to capital adequacy guidelines adopted by the Office of the Comptroller of the

Currency (the “OCC”, and with the Federal Reserve, collectively, the “regulators”). The capital adequacy guidelines set minimum

risk-based and leverage capital requirements that are based on quantitative and qualitative measures of their assets and off-balance

sheet items. The Federal Reserve holds the Corporation to similar minimum capital requirements. Failure to meet minimum capital

requirements can result in possible additional, discretionary actions by a federal banking agency that, if undertaken, could have a

material adverse effect on the Corporation’s consolidated financial statements. The Company is also subject to minimum cash reserve

requirements by the Federal Reserve totaling approximately $900 million as of December 31, 2009.

As of December 31, 2009, the Banks each exceeded the minimum regulatory requirements to which it was subject. The Banks were

considered “well-capitalized” under applicable capital adequacy guidelines. Also as of December 31, 2009, the Corporation was

considered “well-capitalized” under Federal Reserve capital standards for bank holding companies and, therefore, exceeded all

minimum capital requirements. There have been no conditions or events since that we believe would have changed the capital

category of the Corporation or either of the Banks.