Capital One 2009 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

177

Note 24

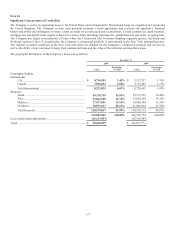

Significant Concentration of Credit Risk

The Company is active in originating loans in the United States and internationally. International loans are originated in Canada and

the United Kingdom. The Company reviews each potential customer’s credit application and evaluates the applicant’s financial

history and ability and willingness to repay. Loans are made on an unsecured and secured basis. Certain commercial, small business,

mortgage and automobile loans require collateral in various forms including cash deposits, automobiles and real estate, as appropriate.

The Company has higher concentrations of loans where the Commercial and Consumer Banking segments operate, the South and

Northeast regions of the U.S. In particular, the Company’s commercial portfolio is concentrated in the New York metropolitan area.

The regional economic conditions in the New York area affect the demand for the Company’s commercial products and services as

well as the ability of our customers to repay their commercial loans and the value of the collateral securing these loans.

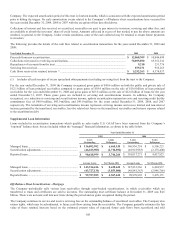

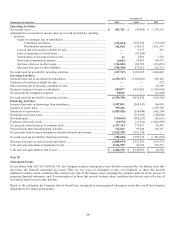

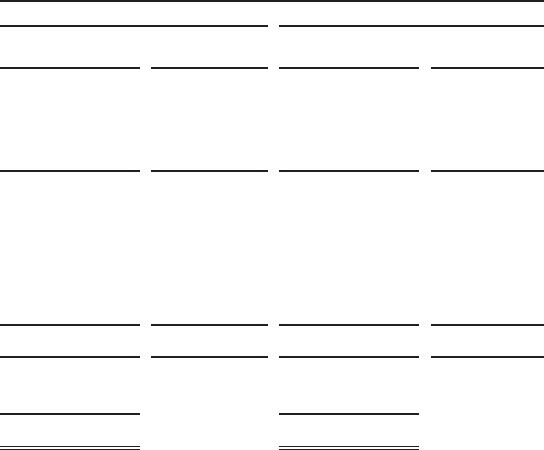

The geographic distribution of the Company’s loans was as follows:

December 31

2009 2008

Loans Percentage

of Total Loans

Percentage

of Total

Geographic Region:

International

U.K. ...................................................................................... $ 4,716,981 3.45% $ 5,527,237 3.76%

Canada ................................................................................. 3,506,854 2.56% 3,193,405 2.17%

Total International ................................................................ 8,223,835 6.01% 8,720,642 5.93%

Domestic

South .................................................................................... 49,170,769 35.94% 53,572,725 36.46%

West ..................................................................................... 22,842,140 16.70% 23,662,269 16.10%

Midwest ............................................................................... 17,973,051 13.14% 19,900,704 13.55%

Northeast .............................................................................. 38,593,107 28.21% 41,080,414 27.96%

Total Domestic ..................................................................... 128,579,067 93.99% 138,216,112 94.07%

136,802,902 100.00% 146,936,754 100.00%

Less securitization adjustments ..................................................... (46,183,903) (45,918,983)

Total............................................................................................... $ 90,618,999 $ 101,017,771