Capital One 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

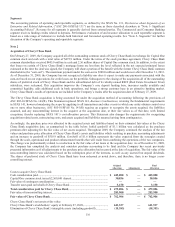

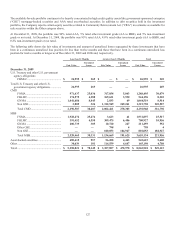

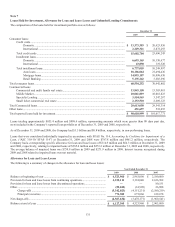

The following tables present certain information regarding our continuing operations by segment:

Year Ended December 31, 2009

Total Company

Credit

Card

Commercial

Banking

Consumer

Banking Other Total

Managed (1) Securitization

Adjustment(1)

Total

Reported

N

et interest income ........ $ 7,542,462 $ 1,144,388 $ 3,230,597 $ 172,048 $12,089,495 $(4,392,380) $ 7,697,115

N

on-interest income ....... 3,746,789 171,548 755,188 73,247 4,746,772 539,380 5,286,152

Provision for loan and

lease losses ................ 6,051,492 983,389 875,649 172,581 8,083,111 (3,853,000 ) 4,230,111

Restructuring

expenses .................... — — — 119,395 119,395 — 119,395

Other non-interest

expenses .................... 3,738,230 660,777 2,734,450 164,202 7,297,659 — 7,297,659

Income tax provision

(benefit) ..................... 521,909 (114,881 ) 131,490 (189,033 ) 349,485 — 349,485

N

et income (loss) from

continuing operations

net of tax ................... $ 977,620 $ (213,349 ) $ 244,196 $ (21,850 ) $ 986,617 $ — $ 986,617

Loans held for

investment ................. $68,523,662 $29,613,050 $38,214,493 $ 451,697 $136,802,902 $(46,183,903) $90,618,999

Total deposits ................. $ — $20,480,297 $74,144,805 $21,183,994 $115,809,096 $ — $115,809,096

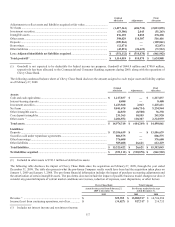

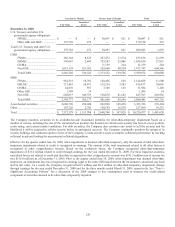

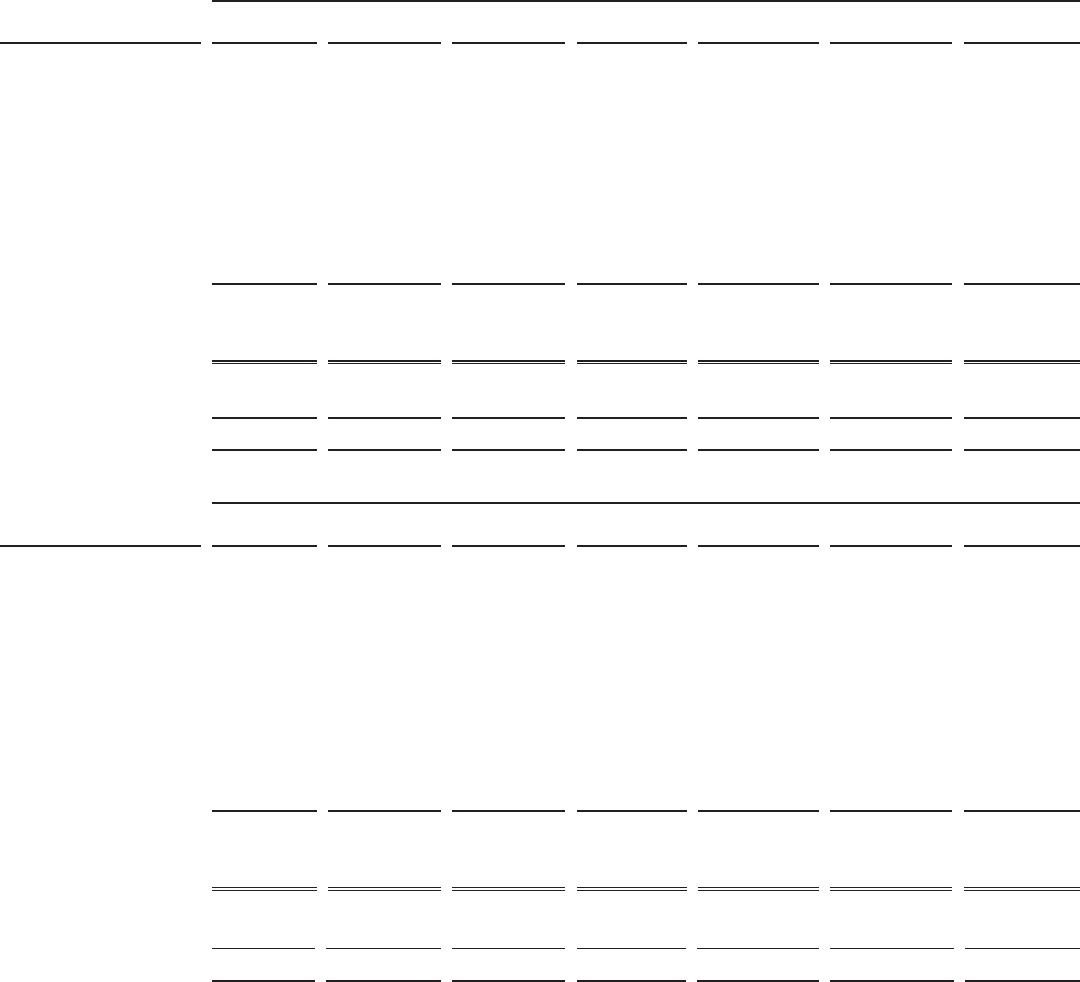

Year Ended December 31, 2008

Total Company

Credit

Card

Commercial

Banking

Consumer

Banking Other Total

Managed (1) Securitization

Adjustment(1)

Total

Reported

N

et interest income ........ $ 7,463,480 $ 961,372 $ 2,987,962 $ 9,241 $11,422,055 $(4,273,340) $ 7,148,715

N

on-interest income ....... 4,678,377 144,227 728,705 (133,911 ) 5,417,398 1,326,573 6,743,971

Provision for loan and

lease losses ................ 6,107,961 233,877 1,534,281 171,688 8,047,807 (2,946,767 ) 5,101,040

Restructuring

expenses .................... — — — 134,464 134,464 — 134,464

Goodwill impairment ..... — — 810,876 — 810,876 — 810,876

Other non-interest

expenses .................... 4,392,968 480,983 2,452,637 (61,901 ) 7,264,687 — 7,264,687

Income tax provision

(benefit) ..................... 573,908 136,759 (101,146 ) (112,419 ) 497,102 — 497,102

N

et income (loss) from

continuing operations

net of tax ................... $ 1,067,020 $ 253,980 $ (979,981 ) $ (256,502 ) $ 84,517 $ — $ 84,517

Loans held for

investment .............. $79,665,223 $ 29,541,314 $ 37,196,562 $ 533,655 $ 146,936,754 $(45,918,983) $101,017,771

Total deposits .............. $ — $ 16,483,361 $ 61,763,503 $ 30,373,925 $ 108,620,789 $ — $108,620,789