Capital One 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 113

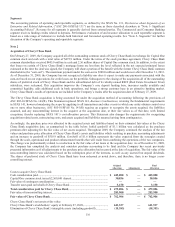

As of December 31, 2009 and 2008, the balance in the allowance for loan and lease losses was $4.1 billion and $4.5 billion,

respectively. See “Note 7- Loans Held for Investment, Allowance for Loan and Lease Losses and Unfunded Lending Commitments”

for additional detail.

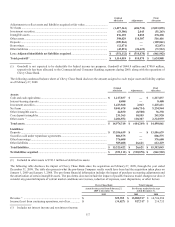

Goodwill and Other Intangible Assets

The Company performs annual impairment tests on goodwill and between annual tests if events occur or circumstances change in

accordance with SFAS No. 142, Goodwill and Other Intangible Assets, (“ASC 350-20/SFAS 142”). As of December 31, 2009 and

2008, goodwill of $13.6 billion and $12.0 billion, respectively, was included in the Consolidated Balance Sheet. See “Note 10-

Goodwill and Other Intangible Assets” for additional detail. The increase in Goodwill was a result of the Chevy Chase Bank

acquisition.

Other intangible assets that have finite useful lives are amortized either on a straight-line or on an accelerated basis over their

respective estimated useful lives and evaluated for impairment whenever events or changes in circumstances indicate the carrying

amount of the assets may not be recoverable. At December 31, 2009 and 2008, net intangible assets included in other assets of $0.9

billion, respectively, consist of core deposit intangibles, trust intangibles, lease intangibles and other intangibles.

Other Assets

Included in other assets are investments in Federal Home Loan Bank (“FHLB”) stock of $264.1 million and $267.5 million and

Federal Reserve stock of $778.1 million and $676.1 million as of December 31, 2009 and 2008, respectively. We carry FHLB stock

and Federal Reserve stock at cost and assess impairment in accordance with ASC 942-325. No impairment was recognized for 2009 or

2008.

Mortgage Servicing Rights

Mortgage Servicing Rights (“MSRs”) are recognized at fair value when mortgage loans are sold or securitized in the secondary market

and the right to service these loans are retained for a fee. Changes in fair value are recognized in mortgage servicing and other income.

The Company continues to operate the mortgage servicing business and to report the changes in the fair value of MSRs in continuing

operations. To evaluate and measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan

type, note rate and investor servicing requirements. Fair value of the MSRs is determined using the present value of the estimated

future cash flows of net servicing income. The Company uses assumptions in the valuation model that market participants use when

estimating future net servicing income, including prepayment speeds, discount rates, default rates, cost to service, escrow account

earnings, contractual servicing fee income, ancillary income and late fees. This model is highly sensitive to changes in certain

assumptions. Different anticipated prepayment speeds, in particular, can result in substantial changes in the estimated fair value of

MSRs. If actual prepayment experience differs from the anticipated rates used in the Company’s model, this difference could result in

a material change in MSR value.

The MSR balance was $239.7 million and $150.5 million which are included within other assets at December 31, 2009 and 2008,

respectively. See “Note 15- Mortgage Servicing Rights” and “Note 20- Securitizations” for additional detail. The acquisition of Chevy

Chase Bank added $109.5 million as of the acquisition date.

Upon adoption of ASU 2009-16 (ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167), certain mortgage loans that have

been securitized and accounted for as a sale will be subject to consolidation and accounted for as a secured borrowing. Accordingly,

effective January 1, 2010, mortgage securitization trusts that contain approximately $1.6 billion of mortgage loans and related debt

securities issued to third party investors are expected to be consolidated and the retained interests and mortgage servicing rights

related to these newly consolidated trusts are expected to be eliminated in consolidation. See “Note 1- Significant Accounting

Policies” for expected financial statement impact and see “Note 15- Mortgage Servicing Rights” for further information about the

accounting for mortgage servicing rights.

Representation and Warranty Reserve

The representation and warranty reserve is available to cover probable losses inherent with the sale of mortgage loans in the secondary

market. In the normal course of business, certain representations and warranties are made to investors at the time of sale, which permit

the investor to return the loan to the seller or require the seller to indemnify the investor for any losses incurred by the investor while

the loan remains outstanding.