Capital One 2009 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

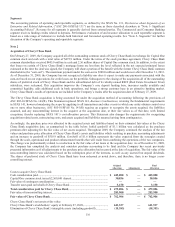

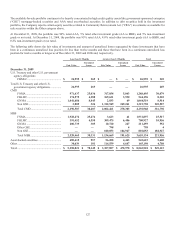

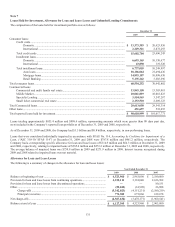

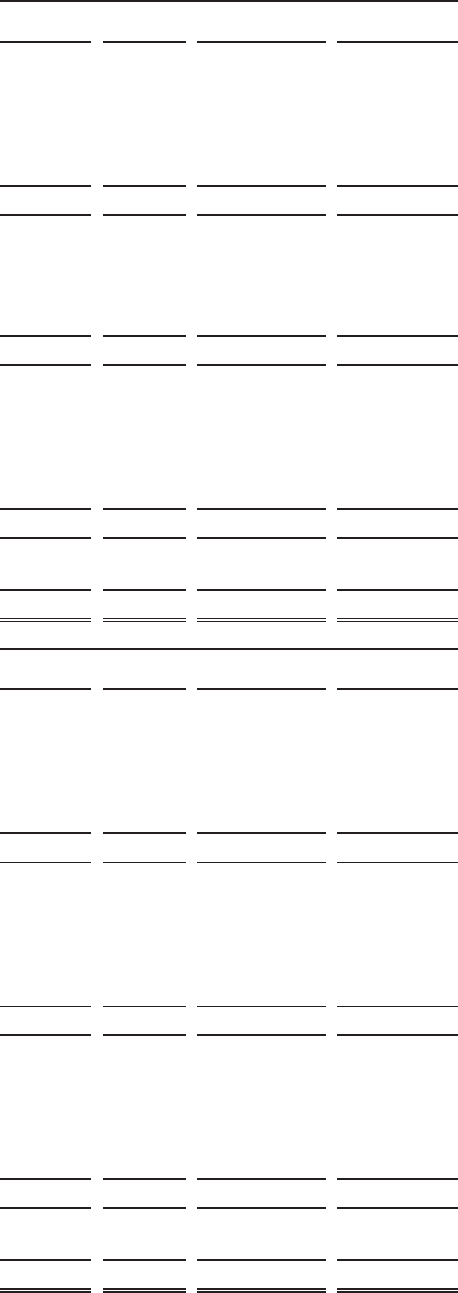

The following tables show the weighted average yield by investment category for expected maturities as of December 31, 2009 and

2008, respectively.

Weighted Average Yield Schedule

1 Year

or Less 1–5

Years 5–10

Years

Over 10

Years

December 31, 2009

U.S. Treasury and other U.S. government agency obligations

U.S. Treasury ........................................................................................ — % 2.37% — % — %

FNMA ................................................................................................... 4.34 4.51 — —

FHMLC ................................................................................................. — 4.63 3.29 —

Other GSE and FDIC DGP ................................................................... — 5.44 — —

Total U.S. Treasury and other U.S. government agency obligations .... 4.34 3.36 3.29 —

CMO

FNMA ................................................................................................... 4.99 5.13 4.73 —

FHLMC ................................................................................................. 5.16 5.25 5.35 —

GNMA .................................................................................................. 4.57 4.37 4.27 —

Non GSE ............................................................................................... 5.75 5.58 5.13 6.58

Total CMO ............................................................................................ 5.31 5.26 4.74 6.58

MBS

FNMA ................................................................................................... 5.34 4.98 4.95 5.12

FHMLC ................................................................................................. 5.55 4.32 5.26 5.23

GNMA .................................................................................................. 6.71 6.17 4.86 —

Other GSE ............................................................................................. — 3.44 — —

Non GSE ............................................................................................... 5.89 5.95 5.99 —

Total MBS ............................................................................................ 5.40 5.06 4.91 5.18

Asset-backed securities .................................................................................. 3.36 4.00 4.87 —

Other ............................................................................................................... 2.71 4.19 4.60 0.56

Total ............................................................................................................... 3.56% 4.74% 4.90% 5.04%

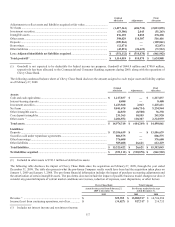

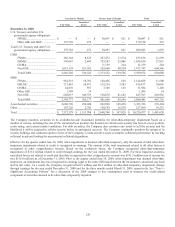

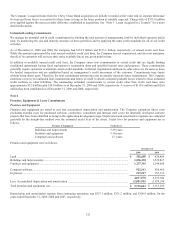

Weighted Average Yield Schedule

1 Year

or Less 1–5

Years 5–10

Years

Over 10

Years

December 31, 2008

U.S. Treasury and other U.S. government agency obligations .......................

U.S. Treasury ........................................................................................ 4.04% 4.15% — % — %

FNMA ................................................................................................... 4.68 4.41 — —

FHLMC ................................................................................................. 4.00 4.59 — —

Other GSE and FDIC DGP ................................................................... 4.81 3.13 — —

Total U.S. Treasury and other U.S. government agency obligations .... 4.65 3.67 — —

CMO

FNMA ................................................................................................... 4.98 5.53 5.50 —

FHLMC ................................................................................................. 5.23 5.22 — —

GNMA .................................................................................................. 4.61 4.89 — —

Other GSE ............................................................................................. — 5.27 — —

Non GSE ............................................................................................... 5.72 5.51 6.10 6.58

Total CMO ............................................................................................ 5.14 5.37 5.51 6.58

MBS

FNMA ................................................................................................... 4.05 5.31 5.48 —

FHLMC ................................................................................................. 6.00 4.79 5.89 —

GNMA .................................................................................................. 7.08 5.65 — —

Other GSE ............................................................................................. — 3.43 — —

Non GSE ............................................................................................... 6.30 5.96 — —

Total MBS ............................................................................................ 5.76 5.21 5.50 —

Asset-backed securities .................................................................................. 4.07 4.72 5.16 —

Other ............................................................................................................... 3.74 4.21 4.75 5.49

Total ............................................................................................................... 4.63% 5.15% 5.20% 5.53%