Capital One 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 39

The Company holds variable interests in entities (“Investor Entities”) that invest in community development entities (“CDEs”) that

provide debt financing to businesses and non-profit entities in low-income and rural communities. Investments of the consolidated

Investor Entities are also variable interests of the Company. The activities of the Investor Entities are financed with a combination of

invested equity capital and debt. The activities of the CDEs are financed solely with invested equity capital. The Company receives

federal and state tax credits for these investments. The Company consolidates the VIEs of which it absorbs the majority of the entities’

expected losses or receives a majority of the entities’ expected residual returns. The assets of the entities consolidated by the Company

at December 31, 2009 and December 31, 2008 were approximately $155.4 million and $135.7 million, respectively. The assets and

liabilities of these consolidated VIEs were recorded in cash, loans held for investment, interest receivable, other assets and other

liabilities. In addition to the amounts above, the Company had involvement with entities where we held a significant variable interest

in the VIE but were not deemed to be the primary beneficiary as the Company would not absorb the majority of expected losses or

receive a majority of the expected residual returns. Accordingly, these entities were not consolidated by the Company. The assets of

the entities that the Company held a significant variable interest in but was not required to consolidate at December 31, 2009 and

December 31, 2008 were approximately $58.4 million and $46.6 million, respectively. The Company records its interests in these

unconsolidated VIEs in loans held for investment and other assets. The Company’s maximum exposure to these entities is limited to

its variable interests in the entities. The creditors of the VIEs have no recourse to the general credit of the Company. The Company

has not provided additional financial or other support during the period that it was not previously contractually required to provide.

See “Note 22—Other Variable Interest Entities” for quantitative information regarding Other Variable Interest Entities.

Trust Preferred Securities

The Company has raised financing through the issuance of trust preferred securities. In these transactions, the Company forms a

statutory business trust and owns all of the voting equity shares of the trust. The trust issues preferred equity securities to third-party

investors and invests the gross proceeds in junior subordinated deferrable interest debentures issued by the Company. These trusts

have no assets, operations, revenues or cash flows other than those related to the issuance, administration, and repayment of the

preferred equity securities held by third-party investors. These trusts’ obligations are fully and unconditionally guaranteed by the

Company.

Because the sole asset of the trust is a receivable from the Company, the Company is not permitted to consolidate the trusts under

ASC 810-10/FIN 46R, even though the Company owns all of the voting equity shares of the trust, has fully guaranteed the trusts’

obligations, and has the right to redeem the preferred securities in certain circumstances. The Company recognizes the subordinated

debentures on its balance sheet as long-term liabilities. See “Note 11 – Deposits and Borrowings” for quantitative information

regarding Deposits and Other Borrowings.

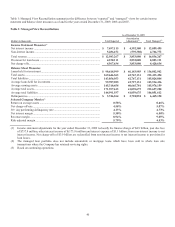

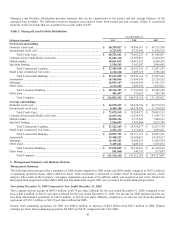

IV. Reconciliation to GAAP Financial Measures and “Managed” View Information

The Company’s consolidated financial statements prepared in accordance with accounting principles generally accepted in the United

States (“GAAP”) are referred to as its “reported” financial statements. Loans included in securitization transactions which qualify as

sales under GAAP have been removed from the Company’s “reported” balance sheet. However, servicing fees, finance charges, and

other fees, net of charge-offs, and interest paid to investors of securitizations are recognized as servicing and securitizations income on

the “reported” income statement. The Company will adopt ASU 2009-16 (ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS

167) for annual reporting periods beginning after January 1, 2010. As discussed more fully in Note 1 – Significant Accounting

Policies, loans previously securitized by the Company and accounted for as sales will be consolidated in the Company’s financial

statements. As a result, the Company does not anticipate that there will be a material difference between “reported” and “managed”

financial statements in the future.

The Company’s “managed” consolidated financial statements reflect adjustments made related to effects of securitization transactions

qualifying as sales under GAAP. The Company generates earnings from its “managed” loan portfolio which includes both the on-

balance sheet loans and off-balance sheet loans. The Company’s “managed” income statement takes the components of the servicing

and securitizations income generated from the securitized portfolio and distributes the revenue and expense to appropriate income

statement line items from which it originated. For this reason, the Company believes the “managed” consolidated financial statements

and related managed metrics to be useful to stakeholders.