Capital One 2009 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

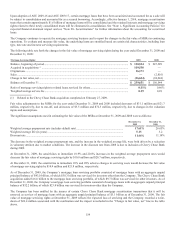

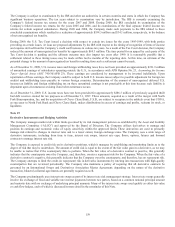

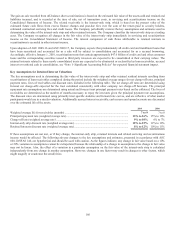

The Company uses interest rate cap agreements and reciprocal basis swap agreements in conjunction with the securitization of certain

payment option mortgage loans. The interest rate cap agreements limit the Company’s exposure to interest rate risk by providing for

payments to be made to the Company by third parties when the one-month LIBOR rate exceeds the applicable strike rate. These

agreements have individual predetermined notional schedules and stated expiration dates, and relate to both currently outstanding and

previously called securitization transactions. The reciprocal basis swap agreements are held with external counterparties and are

structured to mirror the basis swap agreements within securitization programs. The basis swaps in the securitization structures fund the

payment of uncapped floating rate interest to note holders in the trust. While payments on the basis swaps and the reciprocal basis

swaps may be similar in amounts, the Company is not a party to any of the derivative contracts between the derivative providers and

the securitization trusts. Upon consolidation of certain of the payment option mortgage loan securitization trusts due to the adoption of

ASU 2009-17 (ASC 810/SFAS 167) on January 1, 2010, applicable basis swap agreements will be included on the Company’s

consolidated balance sheet at their estimated fair values and will largely be offset by the fair values of the related reciprocal basis

swaps. See “Note 1- Significant Accounting Policies” for additional information.

The Company uses interest rate swaps in conjunction with its auto securitizations. These swaps have zero balance notional amounts

unless the pay down of auto securitizations differs from its scheduled amortization.

The Company enters into commitments to originate loans whereby the interest rate of the loan is determined prior to funding (“interest

rate lock commitment”). Interest rate lock commitments on mortgage loans that the Company intends to sell in the secondary market

as well as corresponding commitments to sell if any are considered freestanding derivatives. These derivatives are carried at fair value

with changes in fair value reported as a component of other non-interest income. Interest rate lock commitments are initially valued at

zero. Changes in fair value subsequent to inception are determined based on current secondary market prices for underlying loans with

similar coupons, maturity and credit quality, subject to the anticipated probability that the loans will fund within the terms of the

commitment. The initial value inherent in the loan commitments at origination is recognized through gain on sale of loans when the

underlying loan is sold. The interest rate lock commitments along with the related commitments to sell, if any are recorded at fair

value with changes in fair value recorded in current earnings as a component of gain on sale of loans. As of December 31, 2009, the

Company has $215.1 million in loan commitments. The Company did not have any loan commitments as of December 31, 2008.

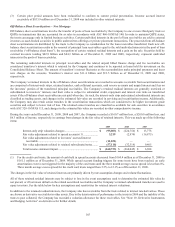

These derivatives do not qualify as accounting hedges and are recorded on the balance sheet at fair value with changes in value

included in current earnings in non-interest income.

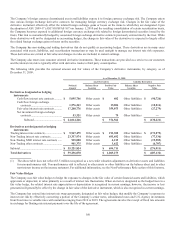

Non-Trading Other Contracts

The Company uses interest rate swaps, To Be Announced (“TBA”) forward contracts and futures contracts in conjunction with

hedging the economic risk associated with its mortgage servicing rights portfolio. These derivatives are designed to offset changes in

the fair value of mortgage servicing rights attributable to interest rate fluctuations. Changes in the fair value of mortgage servicing

rights and changes in the fair value of related derivatives are both recognized in mortgage servicing and other income.

The Company uses TBA forward contracts and whole loan commitments in conjunction with its interest rate locks and held-for-sale

fixed rate mortgages (collectively “mortgage commitments”). These derivatives are designed to provide a known future price for these

mortgage commitments.

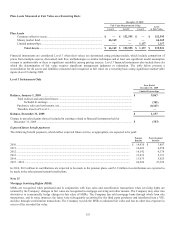

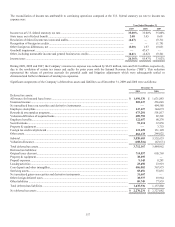

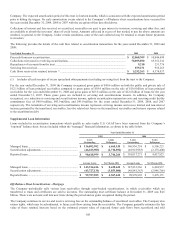

The following table shows the effect of the Company’s derivative instruments, by category, on the income statement for the year

ended December 31, 2009:

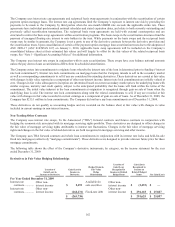

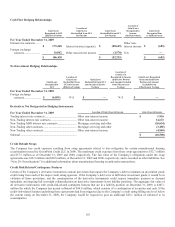

Derivatives in Fair Value Hedging Relationships

Location of

Gain/(Loss) in

Income on Derivative

Gain/(Loss) in

Income on

Derivative

Hedged Items in

Fair Value

Hedge

Relationship

Location of

Gain/(Loss)

Recognized in

Income on Related

Hedged Item

Gain/(Loss)

Recognized in

Income on

Related Hedged

Items

Net Gain/(Loss)

For Year Ended December 31, 2009

Interest rate

contracts .............

Other non-

interest income $ 2,493

Available for

sale securities

Other non-

interest income $ (2,493 ) $ —

Interest rate

contracts .............

Other non-

interest income (268,231) Fixed-rate debt

Other non-

interest income $ 294,118 $ 25,887

$ (265,738) $ 291,625 $ 25,887