Capital One 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

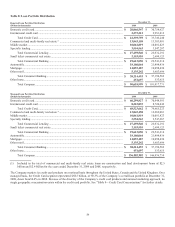

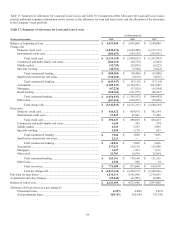

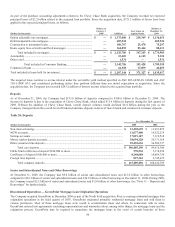

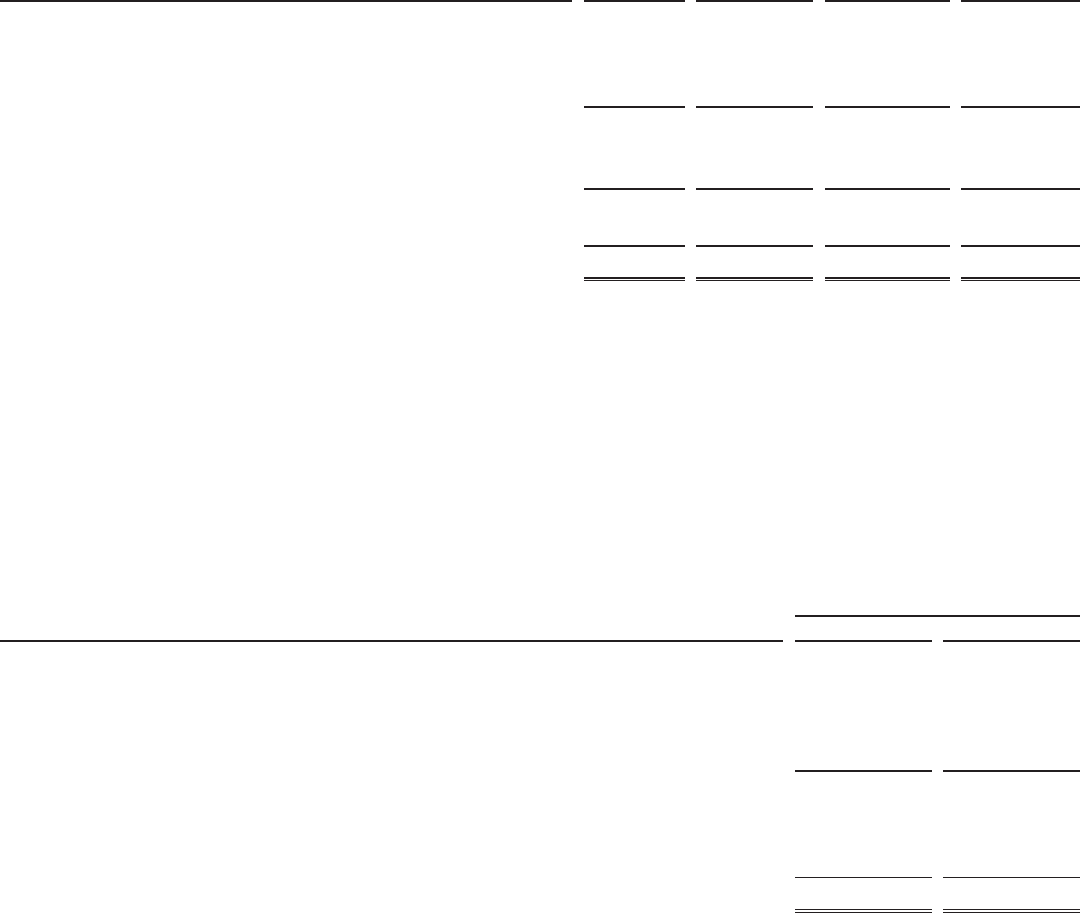

As part of the purchase accounting adjustments related to the Chevy Chase Bank acquisition, the Company recorded net expected

principal losses of $2.2 billion related to the acquired loan portfolio. Since the acquisition date, $371.3 million of losses have been

applied to the expected principal losses, as follows:

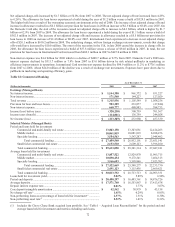

(Dollars in thousands)

Balance at

January 1,

2009 Additions Less: losses on

acquired loans

Balance at

December 31,

2009

Option adjustable rate mortgages ............................................................. $ — $ 1,375,000 $ 238,349 $ 1,136,651

Hybrid adjustable rate mortgages ............................................................ — 485,924 — 485,924

Construction to permanent loans .............................................................. — 100,767 25,470 75,297

Home equity lines of credit and fixed mortgages .................................... — 164,095 83,464 80,631

Total included in mortgages ........................................................... $ — $ 2,125,786 $ 347,283 $ 1,778,503

Automobile .............................................................................................. — 15,469 6,145 9,324

Other retail ............................................................................................... — 1,531 — 1,531

Total included in Consumer Banking ................................... — 2,142,786 353,428 1,789,358

Commercial loans .................................................................................... — 64,358 17,899 46,459

Total included in loans held for investment ............................................. $ — $ 2,207,144 $ 371,327 $ 1,835,817

The acquired loans continue to accrue interest under the accretable yield method specified in ASC 805-10/SFAS 141(R) and ASC

310-1-/SOP 03-3 and considered performing unless they perform different than our initial expectation at acquisition. Since the

acquisition date, the Company has recorded $293.2 million of interest income related to the acquired loan portfolio.

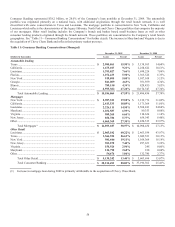

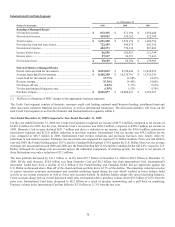

Deposits

As of December 31, 2009, the Company had $115.8 billion of deposits compared to $108.6 billion at December 31, 2008. The

increase in deposits is due to the acquisition of Chevy Chase Bank, which added $13.6 billion in deposits during the first quarter of

2009. Without the addition of Chevy Chase Bank, overall deposit volumes would declined $6.4 billion during the year as the

Company managed down the overall level of brokered and time deposits in favor of more branch and commercial customer deposits.

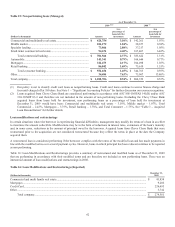

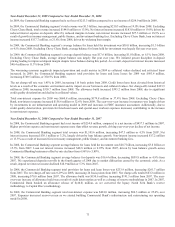

Table 20: Deposits

As of December 31,

(Dollars in thousands)

2009

2008

N

on-interest bearing..........................................................................................................................

.

$ 13,438,659 $ 11,293,852

N

OW accounts ..................................................................................................................................

.

12,077,480 10,522,219

Savings accounts ...............................................................................................................................

.

17,019,187 7,119,510

Money market deposit accounts ........................................................................................................

.

38,094,228 29,171,168

Other consumer time deposits ...........................................................................................................

.

25,455,636 36,509,357

Total core deposits...................................................................................................................

.

$ 106,085,190 $ 94,616,106

Public fund certificates of deposit $100,000 or more .......................................................................

.

578,536 1,174,294

Certificates of deposit $100,000 or more ..........................................................................................

.

8,248,008 10,084,750

Foreign time deposits ........................................................................................................................

.

897,362 2,745,639

Total company deposits ...........................................................................................................

.

$ 115,809,096 $ 108,620,789

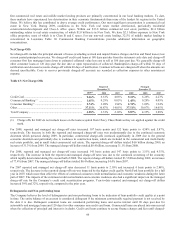

Senior and Subordinated Notes and Other Borrowings

At December 31, 2009, the Company had $9.0 billion of senior and subordinated notes and $12.0 billion in other borrowings,

compared to $8.3 billion of senior and subordinated notes and $14.9 billion of other borrowings at December 31, 2008. During 2009,

the Company issued $2.5 billion of senior and subordinated notes and $ 2.0 billion of other borrowings. See “Note 11 – Deposits and

Borrowings” for further details.

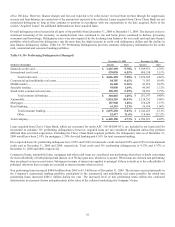

Discontinued Operations — GreenPoint Mortgage Loan Origination Operations

The Company acquired GreenPoint in December 2006 as part of the North Fork acquisition. Prior to ceasing residential mortgage loan

origination operations in the third quarter of 2007, GreenPoint originated primarily residential mortgage loans and sold them to

various purchasers. Most of these mortgage loans were resold to securitization trusts and others. In connection with its sales,

GreenPoint entered into agreements containing representations and warranties about, among other things, the mortgage loans and the

origination process. GreenPoint may be required to repurchase the mortgage loans in the event of certain breaches of these