PNC Bank 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

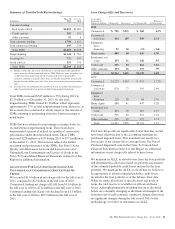

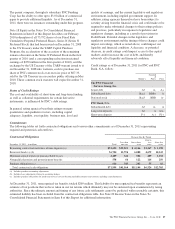

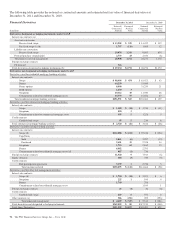

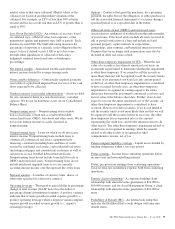

Total trading revenue was as follows:

Trading Revenue

Year ended December 31

In millions 2011 2010 2009

Net interest income $43 $55 $61

Noninterest income 225 183 170

Total trading revenue $268 $238 $231

Securities underwriting and trading (a) $81 $94 $75

Foreign exchange 88 76 73

Financial derivatives and other 99 68 83

Total trading revenue $268 $238 $231

(a) Includes changes in fair value for certain loans accounted for at fair value.

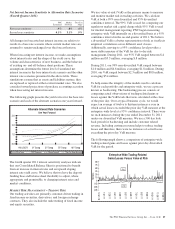

The trading revenue disclosed above includes results from

providing investing and risk management services to our

customers as well as results from hedges of customer activity.

Trading revenue excludes the impact of economic hedging

activities which we transact to manage risk primarily related

to residential mortgage servicing rights, residential and

commercial mortgage loans held-for-sale, and certain

residential mortgage-backed agency securities with embedded

derivatives. Derivatives used for economic hedges are not

designated as accounting hedges because the contracts they

are hedging are typically also carried at fair value on the

balance sheet, resulting in symmetrical accounting treatment

for both the hedging instrument and the hedged item.

Economic hedge results are reported in noninterest income

along with the associated hedge items.

Trading revenue for 2011 increased $30 million compared

with 2010 primarily due to higher derivatives and foreign

exchange client sales revenues, improved client related trading

results, and the reduced impact of counterparty credit risk on

valuations of derivative positions. These increases were

partially offset by lower underwriting activity.

Trading revenue increased $7 million in 2010 compared with

2009 primarily due to higher underwriting and derivatives

client sales revenue, partially offset by reduced proprietary

and customer related trading results. Proprietary trading

positions were essentially eliminated by the end of the second

quarter of 2010.

M

ARKET

R

ISK

M

ANAGEMENT

–E

QUITY

A

ND

O

THER

I

NVESTMENT

R

ISK

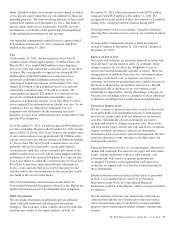

Equity investment risk is the risk of potential losses associated

with investing in both private and public equity markets. PNC

invests primarily in private equity markets. In addition to

extending credit, taking deposits, and underwriting and trading

financial instruments, we make and manage direct investments

in a variety of transactions, including management buyouts,

recapitalizations, and growth financings in a variety of

industries. We also have investments in affiliated and

non-affiliated funds that make similar investments in private

equity and in debt and equity-oriented hedge funds. The

economic and/or book value of these investments and other

assets such as loan servicing rights are directly affected by

changes in market factors.

The primary risk measurement for equity and other

investments is economic capital. Economic capital is a

common measure of risk for credit, market and operational

risk. It is an estimate of the potential value depreciation over a

one year horizon commensurate with solvency expectations of

an institution rated single-A by the credit rating agencies.

Given the illiquid nature of many of these types of

investments, it can be a challenge to determine their fair

values. See Note 8 Fair Value in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information.

Various PNC business units manage our equity and other

investment activities. Our businesses are responsible for

making investment decisions within the approved policy limits

and associated guidelines.

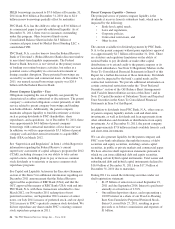

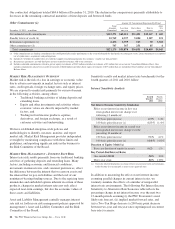

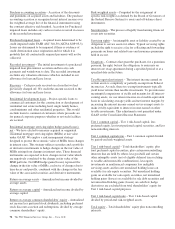

A summary of our equity investments follows:

In millions

Dec. 31

2011

Dec. 31

2010

BlackRock $ 5,291 $5,017

Tax credit investments 2,646 2,054

Private equity 1,491 1,375

Visa 456 456

Other 250 318

Total $10,134 $ 9,220

BlackRock

PNC owned approximately 36 million common stock

equivalent shares of BlackRock equity at December 31, 2011,

accounted for under the equity method. The primary risk

measurement, similar to other equity investments, is economic

capital. The Business Segments Review section of this Item 7

includes additional information about BlackRock.

Tax Credit Investments

Included in our equity investments are tax credit investments

which are accounted for under the equity method. These

investments, as well as equity investments held by

consolidated partnerships, totaled $2.6 billion at December 31,

2011 and $2.1 billion at December 31, 2010.

Private Equity

The private equity portfolio is an illiquid portfolio comprised

of mezzanine and equity investments that vary by industry,

stage and type of investment.

Private equity investments carried at estimated fair value

totaled $1.5 billion at December 31, 2011 and $1.4 billion at

December 31, 2010. As of December 31, 2011, $856 million

was invested directly in a variety of companies and $635

million was invested indirectly through various private equity

90 The PNC Financial Services Group, Inc. – Form 10-K