PNC Bank 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

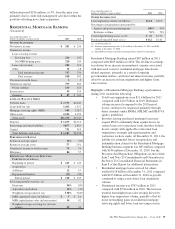

• Net interest income was $201 million in 2011

compared with $256 million in 2010. The decrease in

the comparison was primarily due to lower interest

earned on escrow deposits.

• Noninterest expense was $797 million in 2011

compared with $563 million in 2010. The increase

from the prior year period was primarily due to

higher residential mortgage foreclosure-related

expenses, primarily as a result of ongoing

governmental matters.

• The fair value of residential mortgage servicing

rights was $.7 billion at December 31, 2011

compared with $1.0 billion at December 31, 2010.

The decline in fair value was primarily due to lower

mortgage rates which has resulted in higher

prepayment rates.

B

LACK

R

OCK

(Unaudited)

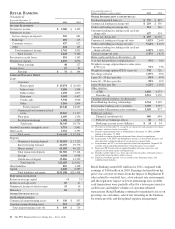

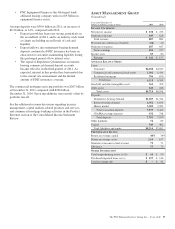

Information related to our equity investment in BlackRock

follows:

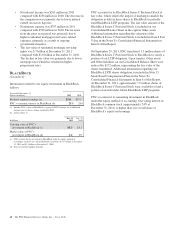

Year ended December 31

Dollars in millions 2011 2010

Business segment earnings (a) $361 $351

PNC’s economic interest in BlackRock (b) 21% 20%

(a) Includes PNC’s share of BlackRock’s reported GAAP earnings net of additional

income taxes on those earnings incurred by PNC.

(b) At December 31.

In billions

Dec. 31

2011

Dec. 31

2010

Carrying value of PNC’s

investment in BlackRock (c) $5.3 $5.1

Market value of PNC’s

investment in BlackRock (d) 6.4 6.9

(c) PNC accounts for its investment in BlackRock under the equity method of

accounting, exclusive of a related deferred tax liability of $1.7 billion at December

31, 2011 and $1.8 billion at December 31, 2010.

(d) Does not include liquidity discount.

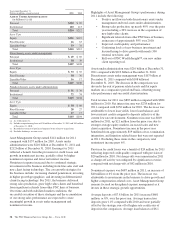

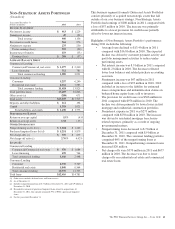

PNC accounts for its BlackRock Series C Preferred Stock at

fair value, which offsets the impact of marking-to-market the

obligation to deliver these shares to BlackRock to partially

fund BlackRock LTIP programs. The fair value amount of the

BlackRock Series C Preferred Stock is included on our

Consolidated Balance Sheet in the caption Other assets.

Additional information regarding the valuation of the

BlackRock Series C Preferred Stock is included in Note 8 Fair

Value in the Notes To Consolidated Financial Statements in

Item 8 of this Report.

On September 29, 2011, PNC transferred 1.3 million shares of

BlackRock Series C Preferred Stock to BlackRock to satisfy a

portion of our LTIP obligation. Upon transfer, Other assets

and Other liabilities on our Consolidated Balance Sheet were

reduced by $172 million, representing the fair value of the

shares transferred. Additional information regarding our

BlackRock LTIP shares obligation is included in Note 15

Stock Based Compensation Plans in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

At December 31, 2011, approximately 1.5 million shares of

BlackRock Series C Preferred Stock were available to fund a

portion of awards under future BlackRock LTIP programs.

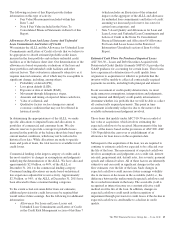

PNC accounts for its remaining investment in BlackRock

under the equity method of accounting. Our voting interest in

BlackRock common stock (approximately 24% at

December 31, 2011) is higher than our overall share of

BlackRock’s equity and earnings.

60 The PNC Financial Services Group, Inc. – Form 10-K