PNC Bank 2011 Annual Report Download - page 63

Download and view the complete annual report

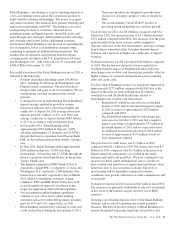

Please find page 63 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.markets for growth, and focus on the retention and growth of

balances for relationship customers.

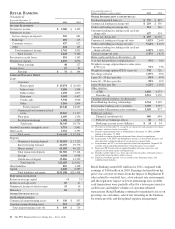

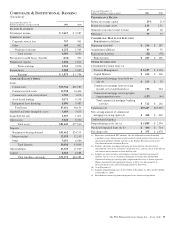

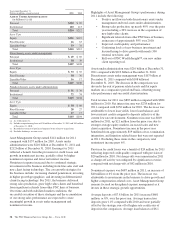

In 2011, average total deposits of $122.5 billion decreased

$3.1 billion, or 2%, compared with 2010.

• Average demand deposits increased $3.4 billion, or

9%, over 2010. The increase was primarily driven by

customer growth and customer preferences for

liquidity.

• Average money market deposits increased $877

million, or 2%, from 2010. The increase was

primarily due to core money market growth as

customers generally preferred more liquid deposits in

a low rate environment.

• Average savings deposits increased $1.2 billion, or

17%, over 2010. The increase was attributable to net

customer growth and new product offerings.

• Average consumer certificates of deposit decreased

$8.5 billion or 21% from 2010. The decline is

expected to continue through 2012 due to the

continued run-off of higher rate certificates of

deposit.

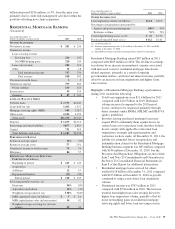

Currently, our primary focus is on a relationship-based

lending strategy that targets specific customer sectors

including mass and mass affluent consumers, small businesses

and auto dealerships. In 2011, average total loans were $58.3

billion, a decrease of $429 million, or 1%, over 2010.

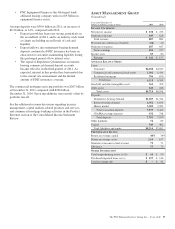

• Average indirect auto loans increased $991 million,

or 47%, over 2010. The increase was due to the

expansion of our indirect sales force and product

introduction to acquired markets, as well as overall

increases in auto sales.

• Average education loans grew $606 million, or 7%,

compared with 2010, primarily due to portfolio

purchases in December 2010, July 2011, and

November 2011 of approximately $450 million, $445

million, and $560 million, respectively.

• Average auto dealer floor plan loans grew $114

million, or 9%, compared with 2010, primarily

resulting from additional dealer relationships and

higher line utilization.

• Average credit card balances decreased $200 million,

or 5%, over 2010. The decrease was primarily the

result of fewer active accounts generating balances

coupled with increased paydowns on existing

accounts.

• Average commercial and commercial real estate

loans declined $610 million, or 5%, compared with

2010. The decline was primarily due to refinancings,

paydowns, and charge-offs outpacing loan demand.

• Average home equity loans declined $576 million, or

2%, compared with 2010. Home equity loan demand

remained soft in the current economic climate. The

decline is driven by loan demand being outpaced by

paydowns, refinancings, and charge-offs. Retail

Banking’s home equity loan portfolio is relationship

based, with 96% of the portfolio attributable to

borrowers in our primary geographic footprint. The

nonperforming assets and charge-offs that we have

experienced are within our expectations given current

market conditions.

• Average indirect other and residential mortgages are

primarily run-off portfolios and declined $397

million and $419 million, respectively, compared

with 2010. The indirect other portfolio is comprised

of marine, RV, and other indirect loan products.

54 The PNC Financial Services Group, Inc. – Form 10-K