PNC Bank 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

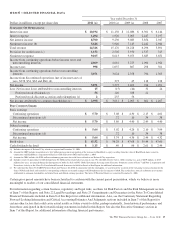

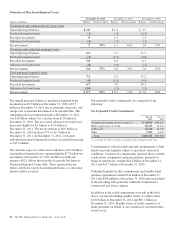

Our performance in 2011 included the following:

• Net income for 2011 of $3.1 billion was down 10%

from 2010. Results for 2011 included $324 million for

residential mortgage foreclosure-related expenses

primarily as a result of ongoing governmental matters

and a noncash charge of $198 million related to the

redemption of trust preferred securities. Results for

2010 included $71 million of residential mortgage-

related expenses, $328 million after-tax gain on our

sale of GIS, and integration expenses of $387 million,

whereas the comparable amount of integration

expenses for 2011 was $42 million. For 2010, net

income attributable to common shareholders and

diluted earnings per common share were impacted by

a noncash reduction of $250 million related to our

redemption of TARP preferred stock.

• Net interest income of $8.7 billion for 2011 was

down 6% from 2010; net interest margin was down

to 3.92% in 2011 compared with 4.14% for 2010

primarily due to the impact of lower purchase

accounting accretion, a decline in average loan

balances and the low interest rate environment.

• Noninterest income of $5.6 billion in 2011 declined

5% compared with 2010. Noninterest income for 2011

reflected higher asset management fees that were

offset by lower corporate service fees primarily due to

a reduction in the value of commercial mortgage

servicing rights and the impact of the rules set forth in

Regulation E. The fourth quarter impact of Dodd-

Frank on interchange revenue was offset by increased

customer-initiated volumes throughout 2011.

• The provision for credit losses declined to $1.2

billion in 2011 compared with $2.5 billion in 2010 as

overall credit quality continued to improve due to

slowly improving economic conditions and actions

we took to reduce exposure levels during the year.

• Noninterest expense for 2011 increased by 6%

compared with 2010, to $9.1 billion primarily due to

higher residential mortgage foreclosure-related

expenses and a charge for the unamortized discount

related to the redemption of trust preferred securities.

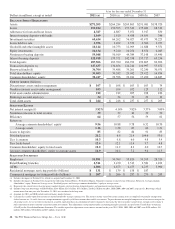

• Overall credit quality continued to improve during

2011. Nonperforming assets declined $967 million,

or 19%, to $4.2 billion as of December 31, 2011 from

December 31, 2010. Accruing loans past due

increased $12 million, or less than 1%, during 2011

to $4.5 billion at year end primarily attributable to

government insured or guaranteed loans. The

allowance for loan and lease losses (ALLL) was $4.3

billion, or 2.73% of total loans and 122% of

nonperforming loans, as of December 31, 2011.

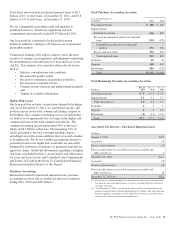

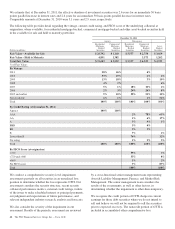

• We remain committed to responsible lending to

support economic growth. Total loan originations and

new commitments and renewals totaled

approximately $147 billion for 2011, including $4.1

billion of small business loans. Total loans were

$159.0 billion at December 31, 2011, an increase of

6% from $150.6 billion at December 31, 2010. The

growth in total loans exceeded the $2.4 billion

decrease in Non-Strategic Assets Portfolio loans

driven by customer payment activity and portfolio

management activities to reduce under-performing

assets. Consolidated growth in commercial loans of

$10.5 billion, auto loans of $2.2 billion, and

education loans of $.4 billion was partially offset by

declines of $1.7 billion in commercial real estate

loans, $1.5 billion of residential real estate loans and

$1.1 billion of home equity loans compared with

December 31, 2010. The $3.2 billion decrease in

consolidated commercial and residential real estate

loans included $1.4 billion of Non-Strategic Assets

• Portfolio loans, accounting for approximately 43% of

the consolidated decline.

• Total deposits were $188.0 billion at December 31,

2011 compared with $183.4 billion at the prior year

end. Growth in transaction deposits (interest-bearing

money market, interest-bearing demand and

noninterest-bearing) continued with an increase of

$13 billion, or 10%, for the year. Retail certificates of

deposit were reduced by $7.8 billion, or 21%, during

2011 and deposit costs were 51 basis points, which

was 19 basis points lower than in 2010.

• Our higher quality balance sheet during 2011

reflected core funding with a loans to deposits ratio

of 85% at year end and strong bank and holding

company liquidity positions to support growth.

• We grew common shareholders’ equity by $2.8

billion during 2011. The Tier 1 common capital ratio

was 10.3% at December 31, 2011, up 50 basis points

from December 31, 2010.

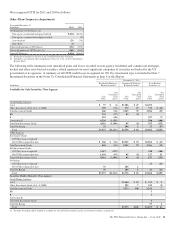

Our Consolidated Income Statement Review section of this

Item 7 describes in greater detail the various items that

impacted our results for 2011 and 2010.

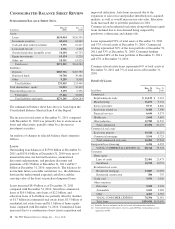

B

ALANCE

S

HEET

H

IGHLIGHTS

Total assets were $271.2 billion at December 31, 2011

compared with $264.3 billion at December 31, 2010. The

increase from year end 2010 resulted primarily from an

increase in loans and other assets somewhat offset by a

decrease in investment securities and short term investments.

Various seasonal and other factors impact our period-end

balances whereas average balances are generally more

indicative of underlying business trends apart from the impact

of acquisitions and divestitures. The Consolidated Balance

Sheet Review section of this Item 7 provides information on

changes in selected Consolidated Balance Sheet categories at

December 31, 2011 compared with December 31, 2010.

Total average assets were $265.3 billion for 2011 compared

with $264.9 billion for 2010. Average interest-earning assets

were $224.3 billion for 2011, compared with $224.7 billion in

2010. Both comparisons were primarily driven by a $1.8

The PNC Financial Services Group, Inc. – Form 10-K 33