PNC Bank 2011 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

ONQUALIFIED

S

TOCK

O

PTIONS

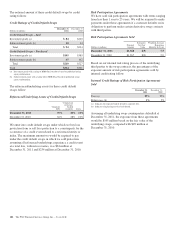

Options are granted at exercise prices not less than the market

value of common stock on the grant date. Generally, options

become exercisable in installments after the grant date. No

option may be exercisable after 10 years from its grant date.

Payment of the option exercise price may be in cash or by

surrendering shares of common stock at market value on the

exercise date. The exercise price may be paid in previously

owned shares.

Generally, options granted under the Incentive Plans vest

ratably over a three-year period as long as the grantee remains

an employee or, in certain cases, retires from PNC. In

accordance with FASB ASC 718, Stock Compensation,we

recognize compensation expense for options granted to

retirement-eligible employees during the first twelve months

subsequent to the grant, in accordance with the service period

provisions of the options.

O

PTION

P

RICING

A

SSUMPTIONS

For purposes of computing stock option expense, we

estimated the fair value of stock options primarily by using the

Black-Scholes option-pricing model. Option pricing models

require the use of numerous assumptions, many of which are

subjective.

We used the following assumptions in the option pricing

models to determine 2011, 2010 and 2009 option expense:

• The risk-free interest rate is based on the US

Treasury yield curve,

• The dividend yield typically represents average

yields over the previous three-year period, however

starting with the grants made after the first quarter of

2009, we used a yield indicative of our currently

reduced dividend rate,

• Volatility is measured using the fluctuation in

month-end closing stock prices over a period which

corresponds with the average expected option life,

but in no case less than a five-year period, and

• The expected life assumption represents the period of

time that options granted are expected to be

outstanding and is based on a weighted-average of

historical option activity.

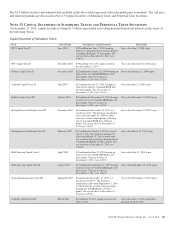

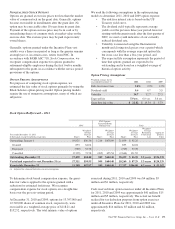

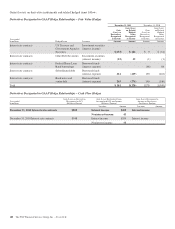

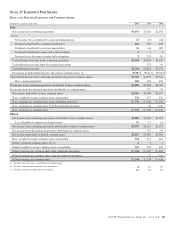

Option Pricing Assumptions

Weighted-average for the

year ended December 31 2011 2010 2009

Risk-free interest rate 2.8% 2.9% 1.9%

Dividend yield 0.6 0.7 3.5

Volatility 34.7 32.7 27.3

Expected life 5.9 yrs. 6.0 yrs. 5.6 yrs.

Grant date fair value $ 22.82 $ 19.54 $ 5.73

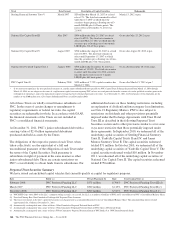

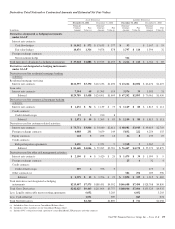

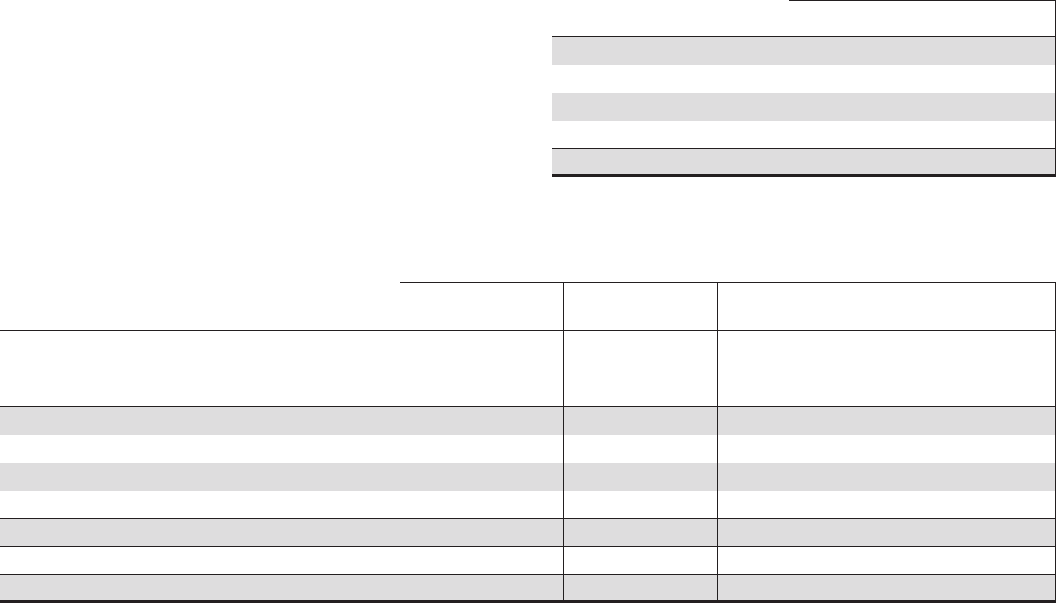

Stock Option Rollforward – 2011

PNC

PNC Options

Converted From

National City Total

Year ended December 31, 2011

In thousands, except weighted-average data Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

Outstanding, January 1 19,825 $56.36 1,214 $678.09 21,039 $ 92.25

Granted 833 64.04 833 64.04

Exercised (769) 53.78 (769) 53.78

Cancelled (2,399) 73.58 (265) 655.54 (2,664) 131.52

Outstanding, December 31 17,490 $54.48 949 $684.40 18,439 $ 86.90 5.3 years $126,535

Vested and expected to vest, December 31 (a) 17,311 $54.55 949 $684.40 18,260 $ 87.29 5.3 years $124,339

Exercisable, December 31 11,388 $57.87 949 $684.40 12,337 $106.08 4.2 years $ 53,567

(a) Adjusted for estimated forfeitures on unvested options.

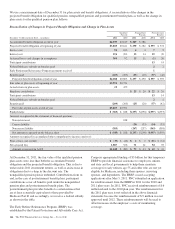

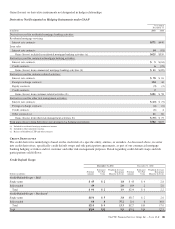

To determine stock-based compensation expense, the grant-

date fair value is applied to the options granted with a

reduction for estimated forfeitures. We recognize

compensation expense for stock options on a straight-line

basis over the pro rata vesting period.

At December 31, 2010 and 2009, options for 13,397,000 and

12,722,000 shares of common stock, respectively, were

exercisable at a weighted-average price of $118.21 and

$132.52, respectively. The total intrinsic value of options

exercised during 2011, 2010 and 2009 was $4 million, $5

million and $1 million, respectively.

Cash received from option exercises under all Incentive Plans

for 2011, 2010 and 2009 was approximately $41 million, $15

million and $5 million, respectively. The actual tax benefit

realized for tax deduction purposes from option exercises

under all Incentive Plans for 2011, 2010 and 2009 was

approximately $14 million, $5 million and $2 million,

respectively.

The PNC Financial Services Group, Inc. – Form 10-K 173