PNC Bank 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

18 E

QUITY

C

OMMON

S

TOCK

On February 8, 2010, we raised $3.0 billion in new common

equity through the issuance of 55.6 million shares of common

stock in an underwritten offering at $54 per share. The

underwriters exercised their option to purchase an additional

8.3 million shares of common stock at the offering price of

$54 per share, totaling approximately $450 million, to cover

over-allotments. We completed this issuance on March 11,

2010.

P

REFERRED

S

TOCK

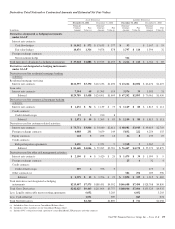

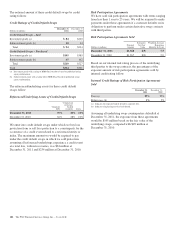

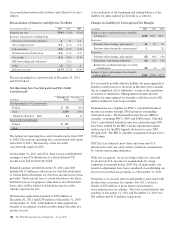

Information related to preferred stock is as follows:

Preferred Stock – Issued and Outstanding

Preferred Shares

December 31

Shares in thousands

Liquidation

value per

share 2011 2010

Authorized

$1 par value 16,588 16,588

Issued and outstanding

Series B $ 40 11

Series K 10,000 50 50

Series L 100,000 22

Series O 100,000 10

Total issued and outstanding 63 53

Our Series B preferred stock is cumulative and is not

redeemable at our option. Annual dividends on Series B

preferred stock total $1.80 per share. Holders of Series B

preferred stock are entitled to 8 votes per share, which is equal

to the number of full shares of common stock into which the

Series B Preferred Stock is convertible.

Our Series K preferred stock was issued in May 2008 in

connection with our issuance of $500 million of Depositary

Shares, each representing a fractional interest in a share of the

Fixed-to-Floating Non-Cumulative Perpetual Preferred Stock,

Series K. Dividends are payable if and when declared each

May 21 and November 21 until May 21, 2013. After that date,

dividends will be payable each 21st of August, November,

February and May. Dividends will be paid at a rate of 8.25%

prior to May 21, 2013 and at a rate of three-month LIBOR

plus 422 basis points beginning May 21, 2013. The Series K

preferred stock is redeemable at our option on or after

May 21, 2013.

Our 9.875% Fixed-to-Floating Rate Non-Cumulative

Preferred Stock, Series L was issued in connection with the

National City transaction in exchange for National City’s

Fixed-to-Floating Rate Non-Cumulative Preferred Stock,

Series F. Dividends on the Series L preferred stock are

payable if and when declared each 1st of February, May,

August and November. Dividends will be paid at a rate of

9.875% prior to February 1, 2013 and at a rate of three-month

LIBOR plus 633 basis points beginning February 1, 2013. The

Series L is redeemable at PNC’s option, subject to Federal

Reserve approval, if then applicable, on or after February 1,

2013 at a redemption price per share equal to the liquidation

preference plus any declared but unpaid dividends.

Our Series O preferred stock was issued on July 27, 2011,

when we issued one million depositary shares, each

representing a 1/100th interest in a share of our

Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred

Stock, Series O for gross proceeds before commissions and

expenses of $1 billion. Dividends are payable when, as, and if

declared by our board of directors or an authorized committee

of our board, semi-annually on February 1 and August 1 of

each year until August 1, 2021 at a rate of 6.75%. After that

date, dividends will be payable on February 1, May 1,

August 1 and November 1 of each year beginning on

November 1, 2021 at a rate of three-month LIBOR plus

3.678% per annum. The Series O preferred stock is

redeemable at our option on or after August 1, 2021 and at our

option within 90 days of a regulatory capital treatment event

as defined in the designations.

We have authorized but unissued Series H, I, J and M

preferred stock. As described in Note 13 Capital Securities of

Subsidiary Trusts and Perpetual Trust Securities, under the

terms of two of the hybrid capital vehicles we issued that

currently qualify as capital for regulatory purposes (the Trust

II Securities and the Trust III Securities), these Trust

Securities are automatically exchangeable into shares of PNC

preferred stock (Series I and Series J, respectively) in each

case under certain conditions relating to the capitalization or

the financial condition of PNC Bank, N.A. and upon the

direction of the Office of the Comptroller of the Currency.

The Series preferred stock of PNC REIT Corp. is also

automatically exchangeable under similar conditions into

shares of PNC Series H preferred stock.

As a part of the National City transaction, we established the

PNC Non-Cumulative Perpetual Preferred Stock, Series M,

which mirrors in all material respects the former National City

Non-Cumulative Perpetual Preferred Stock, Series E. PNC has

designated 5,751 preferred shares, liquidation value $100,000

per share, for this series. No shares have yet been issued;

however, National City issued stock purchase contracts for

5,001 shares of its Series E Preferred Stock (now replaced by

the PNC Series M as part of the National City transaction) to

the National City Preferred Capital Trust I in connection with

the issuance by that Trust of $500 million of 12.000%

Fixed-to-Floating Rate Normal Automatic Preferred Enhanced

Capital Securities (the Normal APEX Securities) in January

2008 by the Trust. It is expected that the Trust will purchase

5,001 of the Series M preferred shares pursuant to these stock

purchase contracts on December 10, 2012 or on an earlier date

and possibly as late as December 10, 2013. The Trust has

184 The PNC Financial Services Group, Inc. – Form 10-K