PNC Bank 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

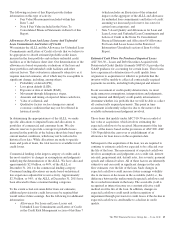

C

ORPORATE

&I

NSTITUTIONAL

B

ANKING

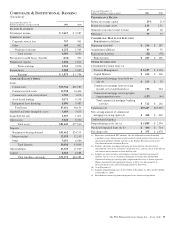

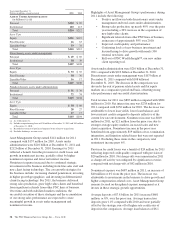

(Unaudited)

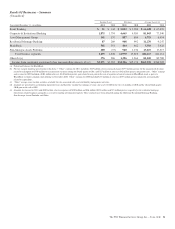

Year ended December 31

Dollars in millions, except as noted 2011 2010

I

NCOME

S

TATEMENT

Net interest income $ 3,417 $ 3,587

Noninterest income

Corporate service fees 767 961

Other 485 402

Noninterest income 1,252 1,363

Total revenue 4,669 4,950

Provision for credit losses (benefit) (124) 303

Noninterest expense 1,830 1,821

Pretax earnings 2,963 2,826

Income taxes 1,088 1,032

Earnings $ 1,875 $ 1,794

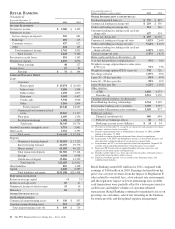

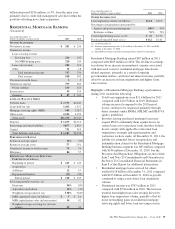

A

VERAGE

B

ALANCE

S

HEET

Loans

Commercial $35,764 $32,787

Commercial real estate 13,938 16,466

Commercial – real estate related 3,782 3,076

Asset-based lending 8,171 6,318

Equipment lease financing 5,506 5,487

Total loans 67,161 64,134

Goodwill and other intangible assets 3,405 3,613

Loans held for sale 1,257 1,473

Other assets 9,220 8,320

Total assets $81,043 $77,540

Deposits

Noninterest-bearing demand $31,462 $24,713

Money market 12,925 12,153

Other 5,651 6,980

Total deposits 50,038 43,846

Other liabilities 13,323 11,949

Capital 8,010 8,588

Total liabilities and equity $71,371 $64,383

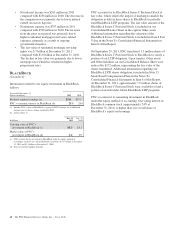

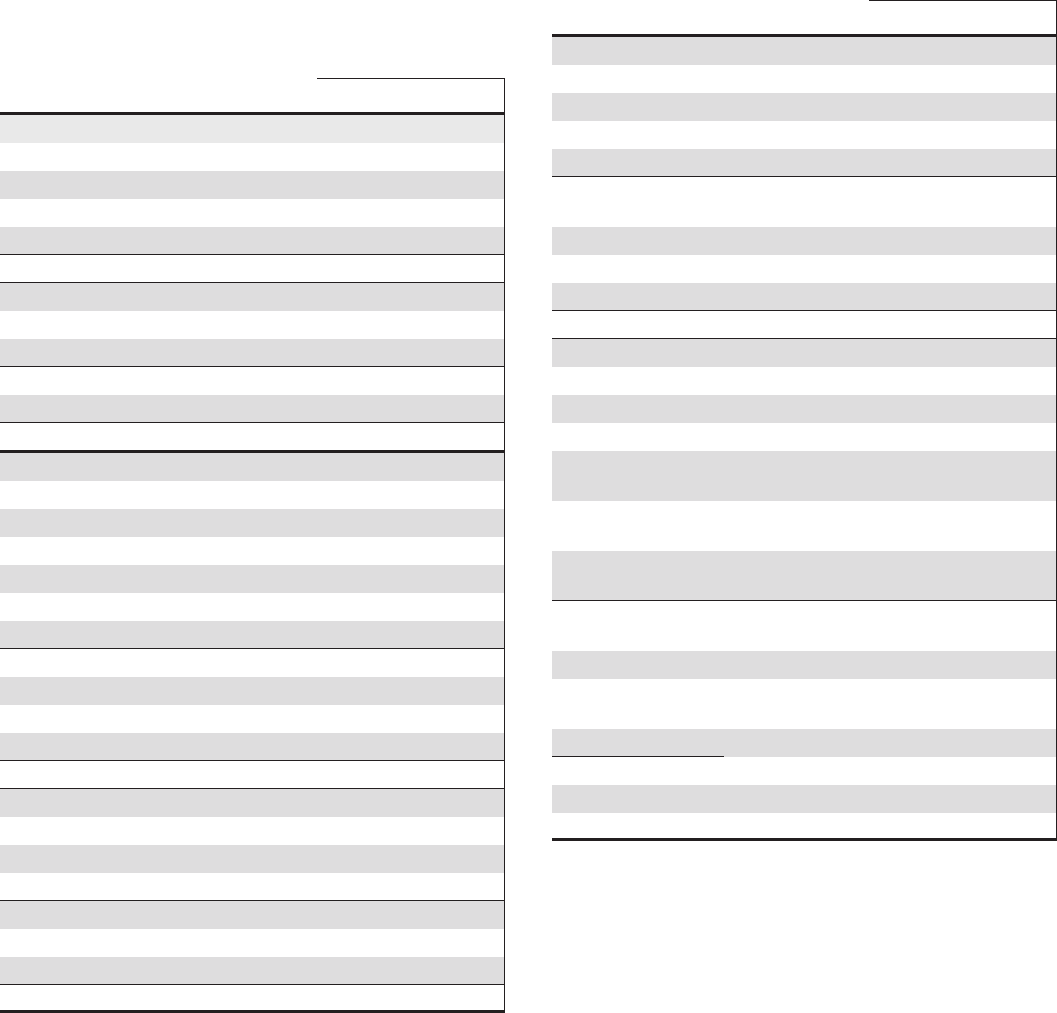

Year ended December 31

Dollars in millions, except as noted 2011 2010

P

ERFORMANCE

R

ATIOS

Return on average capital 23% 21%

Return on average assets 2.31 2.31

Noninterest income to total revenue 27 28

Efficiency 39 37

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

(in billions)

Beginning of period $ 266 $ 287

Acquisitions/additions 43 35

Repayments/transfers (42) (56)

End of period $ 267 $ 266

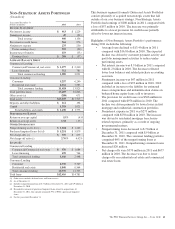

O

THER

I

NFORMATION

Consolidated revenue from: (a)

Treasury Management $ 1,187 $ 1,220

Capital Markets $ 622 $ 606

Commercial mortgage loans held for

sale (b) $ 113 $58

Commercial mortgage loan servicing

income, net of amortization (c) 156 244

Commercial mortgage servicing rights

(impairment)/recovery (157) (40)

Total commercial mortgage banking

activities $ 112 $ 262

Total loans (d) $73,417 $63,695

Net carrying amount of commercial

mortgage servicing rights (d) $ 468 $ 665

Credit-related statistics:

Nonperforming assets (d) (e) $ 1,889 $ 2,594

Purchased impaired loans (d) (f) $ 404 $ 714

Net charge-offs $ 375 $ 1,074

(a) Represents consolidated PNC amounts. See the additional revenue discussion

regarding treasury management, capital markets-related products and services, and

commercial mortgage banking activities in the Product Revenue section of the

Consolidated Income Statement Review.

(b) Includes valuations on commercial mortgage loans held for sale and related

commitments, derivatives valuations, origination fees, gains on sale of loans held for

sale and net interest income on loans held for sale.

(c) Includes net interest income and noninterest income from loan servicing and

ancillary services, net of commercial mortgage servicing rights amortization.

Commercial mortgage servicing rights (impairment)/recovery is shown separately.

Higher amortization and impairment charges in 2011 were due primarily to

decreased interest rates and related prepayments by borrowers.

(d) As of December 31.

(e) Includes nonperforming loans of $1.7 billion at December 31, 2011 and $2.4 billion

at December 31, 2010.

(f) Recorded investment of purchased impaired loans related to acquisitions.

The PNC Financial Services Group, Inc. – Form 10-K 55