PNC Bank 2011 Annual Report Download - page 120

Download and view the complete annual report

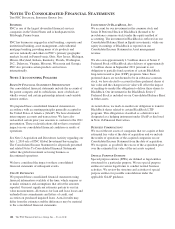

Please find page 120 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.method or the cost method of accounting. We use the

equity method for general and limited partner

ownership interests and limited liability companies in

which we are considered to have significant influence

over the operations of the investee and when the net

asset value of our investment reflects our economic

interest in the underlying investment. Under the

equity method, we record our equity ownership share

of net income or loss of the investee in noninterest

income. We use the cost method for all other

investments. Under the cost method, there is no

change to the cost basis unless there is an other-than-

temporary decline in value or dividends are received.

If the decline is determined to be other-than-

temporary, we write down the cost basis of the

investment to a new cost basis that represents

realizable value. The amount of the write-down is

accounted for as a loss included in Other noninterest

income. Distributions received from the income of an

investee on cost method investments are included in

noninterest income. Investments described above are

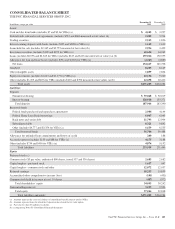

included in the caption Equity investments on the

Consolidated Balance Sheet.

Private Equity Investments

We report private equity investments, which include direct

investments in companies, affiliated partnership interests and

indirect investments in private equity funds, at estimated fair

value. These estimates are based on available information and

may not necessarily represent amounts that we will ultimately

realize through distribution, sale or liquidation of the

investments. Fair value of publicly traded direct investments are

determined using quoted market prices and are subject to

various discount factors for legal or contractual sales

restrictions, when appropriate. The valuation procedures applied

to direct investments in private companies include techniques

such as multiples of adjusted earnings of the entity, independent

appraisals, anticipated financing and sale transactions with third

parties, or the pricing used to value the entity in a recent

financing transaction. We value affiliated partnership interests

based on the underlying investments of the partnership using

procedures consistent with those applied to direct investments.

On October 1, 2009, we adopted ASU 2009-12 – Fair Value

Measurements and Disclosures (Topic 820) – Investments in

Certain Entities That Calculate Net Asset Value per Share (or

Its Equivalent). Based on the guidance, we value indirect

investments in private equity funds based on net asset value as

provided in the financial statements that we receive from their

managers. Due to the time lag in our receipt of the financial

information and based on a review of investments and valuation

techniques applied, adjustments to the manager-provided values

are made when available recent portfolio company information

or market information indicates significant changes in value

from that provided by the manager of the fund. We include all

private equity investments on the Consolidated Balance Sheet in

the caption Equity investments. Changes in the fair value of

private equity investments are recognized in noninterest

income.

We consolidate affiliated partnerships when we are the

general partner and have determined that we have control of

the partnership or are the primary beneficiary of the VIE. The

portion we do not own is reflected in the caption

Noncontrolling interests on the Consolidated Balance Sheet.

L

OANS

Loans are classified as held for investment when management

has both the intent and ability to hold the loan for the

foreseeable future, or until maturity or payoff. Management’s

intent and view of the foreseeable future may change based on

changes in business strategies, the economic environment,

market conditions and the availability of government

programs.

Measurement of delinquency status is based on the contractual

terms of each loan. Loans that are 30 days or more past due in

terms of payment are considered delinquent.

Except as described below, loans held for investment are

stated at the principal amounts outstanding, net of unearned

income, unamortized deferred fees and costs on originated

loans, and premiums or discounts on purchased loans. Interest

on performing loans originated (excluding purchased impaired

loans, which are further discussed below) are accrued based

on the principal amount outstanding and recorded in interest

income as earned using the constant effective yield method.

Loan origination fees, direct loan origination costs, and loan

premiums and discounts are deferred and accreted or

amortized into net interest income, over periods not exceeding

the contractual life of the loan.

When loans are redesignated from held for investment to held

for sale, specific reserves and allocated pooled reserves

included in the allowance for loan and lease losses (ALLL) are

charged-off to reduce the basis of the loans to the lower of

cost or estimated fair value less cost to sell.

In addition to originating loans, we also acquire loans through

portfolio purchases or acquisitions of other financial services

companies. For certain acquired loans that have experienced a

deterioration of credit quality, we follow the guidance

contained in ASC 310-30 – Loans and Debt Securities

Acquired with Deteriorated Credit Quality. Under this

guidance, acquired purchased impaired loans are to be

recorded at fair value without the carryover of any existing

valuation allowances. Evidence of credit quality deterioration

may include information and statistics regarding bankruptcy

events, updated borrower credit scores, such as Fair Isaac

Corporation scores (FICO), past due status, and updated

loan-to-value (LTV) ratios. We review the loans acquired for

evidence of credit quality deterioration and determine if it is

probable that we will be unable to collect all contractual

amounts due, including both principal and interest. When both

conditions exist, we estimate the amount and timing of

undiscounted expected cash flows at acquisition for each loan

either individually or on a pool basis. We estimate the cash

The PNC Financial Services Group, Inc. – Form 10-K 111