PNC Bank 2011 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in October 2011. In the second amended complaint, the

plaintiffs, who allege that they are officers of a mortgage

broker, allege that several mortgage originators, including

entities affiliated with PNC Bank’s predecessor, National City

Bank, made false statements to the U.S. Department of

Veterans Affairs in order to obtain loan guarantees by the VA

under its Interest Rate Reduction Refinancing Loans (IRRRL)

program. Under that program, the VA guarantees refinancing

loans made to veterans if the loans meet program

requirements, one of which limits the type and amount of fees

that can be charged to borrowers by lenders. The plaintiffs

allege, among other things, that the defendants charged

impermissible fees to borrowers under the VA program and

then made false statements to the VA concerning such fees in

violation of the civil False Claims Act. The plaintiffs allege

that, by doing so, National City Bank and the other defendants

caused the VA to pay, among other costs, amounts in respect

of the loan guarantees to which the defendants were not

entitled. On their behalf and on behalf of the United States, the

plaintiffs seek, among other things, unspecified damages equal

to the loss the defendants allegedly caused the United States

(including treble damages under the False Claims Act),

statutory civil penalties between $5,500 and $11,000 per false

claim made by the defendants, injunctive relief against

submission of false claims to the United States and imposing

unallowable charges against veterans participating in the

IRRRL program, and attorneys’ fees. To date, the United

States has not joined in the prosecution of the plaintiffs’

lawsuit. In December 2011, PNC moved to dismiss the action.

A number of the other defendants have also filed motions to

dismiss. The court has not yet ruled on these motions.

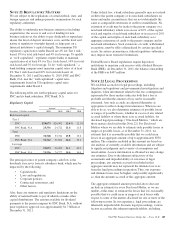

Captive Mortgage Reinsurance Litigation

In December 2011, a lawsuit (White, et al. v. The PNC

Financial Services Group, Inc., et al. (Civil Action

No. 11-7928)) was filed against PNC (as successor in interest

to National City Corporation and several of its subsidiaries)

and several mortgage insurance companies in the United

States District Court for the Eastern District of Pennsylvania.

This lawsuit, which was brought as a class action, alleges that

National City structured its program of reinsurance of private

mortgage insurance in such a way as to avoid a true transfer of

risk from the mortgage insurers to National City’s captive

reinsurer. The plaintiffs allege that the payments from the

mortgage insurers to the captive reinsurer constitute

kickbacks, referral payments, or unearned fee splits prohibited

under the Real Estate Settlement Procedures Act (RESPA), as

well as common law unjust enrichment. The plaintiffs claim,

among other things, that from the beginning of 2004 until the

end of 2010 National City’s captive reinsurer collected from

the mortgage insurance company defendants at least $219

million as its share of borrowers’ private mortgage insurance

premiums and that during the same period its share of paid

claims was approximately $12 million. The plaintiffs seek to

certify a nationwide class of all persons who obtained

residential mortgage loans originated, funded or originated

through correspondent lending by National City or any of its

subsidiaries or affiliates

between January 1, 2004 and the present and, in connection

with these mortgage loans, purchased private mortgage

insurance and whose residential mortgage loans were included

within National City’s captive mortgage reinsurance

arrangements. Plaintiffs seek, among other things, statutory

damages under RESPA (which include treble damages),

restitution of reinsurance premiums collected, disgorgement of

profits, and attorneys’ fees.

Residential Mortgage-Backed Securities Indemnification

Demands

We have received indemnification demands from several

entities sponsoring residential mortgage-backed securities and

their affiliates where purchasers of the securities have brought

litigation against the sponsors and other parties involved in the

securitization transactions. National City Mortgage had sold

whole loans to the sponsors or their affiliates that were

allegedly included in certain of these securitization

transactions. According to the indemnification demands, the

plaintiffs’ claims in these lawsuits are based on alleged

misstatements and omissions in the offering documents for

these transactions. The indemnification demands assert that

agreements governing the sale of these loans or the

securitization transactions to which National City Mortgage is

a party require us to indemnify the sponsors and their affiliates

for losses suffered in connection with these lawsuits. At

present, there has been no determination that the parties

seeking indemnification have any liability to the plaintiffs in

these lawsuits.

Other Regulatory and Governmental Inquiries

PNC is the subject of investigations, audits and other forms of

regulatory and governmental inquiry covering a broad range

of issues in our banking, securities and other financial services

businesses, in some cases as part of regulatory reviews of

specified activities at multiple industry participants. Over the

last few years, we have experienced an increase in regulatory

and governmental investigations, audits and other inquiries.

Areas of current regulatory or governmental inquiry with

respect to PNC include consumer financial protection, fair

lending, mortgage origination and servicing, mortgage-related

insurance and reinsurance, municipal finance activities, and

participation in government insurance or guarantee programs,

some of which are described below. These inquiries, including

those described below, may lead to administrative, civil or

criminal proceedings, and possibly result in remedies

including fines, penalties, restitution, alterations in our

business practices, and in additional expenses and collateral

costs.

• One area of significant regulatory and governmental

focus has been mortgage lending and servicing.

Numerous federal and state governmental, legislative

and regulatory authorities are investigating practices

in this area. PNC has received inquiries from, or is

the subject of investigations by, a broad range of

governmental, legislative and regulatory authorities

relating to our activities in this area and is

cooperating with these investigations and inquiries.

The PNC Financial Services Group, Inc. – Form 10-K 195