PNC Bank 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

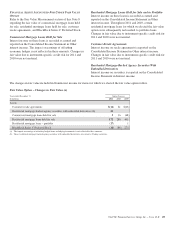

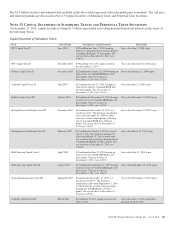

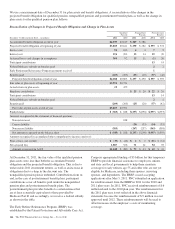

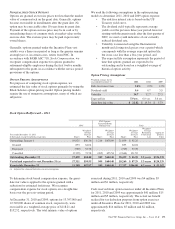

Trust Date Formed Description of Capital Securities Redeemable

Sterling Financial Statutory Trust V March 2007 $20 million due March 15, 2037 at a fixed

rate of 7%. The fixed rate remained in effect

until June 15, 2007 at which time the

securities began paying a floating rate of 3-

month LIBOR plus 165 basis points. The

rate in effect at December 31, 2011 was

2.196%.

March 15, 2012 at par.

National City Capital Trust III May 2007 $500 million due May 25, 2067 at a fixed

rate of 6.625%. The fixed rate remains in

effect until May 25, 2047 at which time the

securities pay a floating rate of one-month

LIBOR plus 212.63 basis points.

On or after May 25, 2012 at par.

National City Capital Trust IV August 2007 $518 million due August 30, 2067 at a fixed

rate of 8.00%. The fixed rate remains in

effect until September 15, 2047 at which

time the securities pay a floating rate of one-

month LIBOR plus 348.7 basis points.

On or after August 30, 2012 at par.

National City Preferred Capital Trust I January 2008 $500 million due December 10, 2043 at a

fixed rate of 12.00%. The fixed rate remains

in effect until December 10, 2012 at which

time the interest rate resets to 3-month

LIBOR plus 861 basis points.

On or after December 10, 2012 at par.

PNC Capital Trust E February 2008 $450 million of 7.75% capital securities due

March 15, 2068.

On or after March 15, 2013 at par.*

* If we redeem or repurchase the trust preferred securities of, and the junior subordinated notes payable to, PNC Capital Trust E during the period from March 15, 2038 through

March 15, 2048, we are subject to the terms of a replacement capital covenant requiring PNC to have received proceeds from the issuance of certain qualified securities prior to the

redemption or repurchase, unless the replacement capital covenant has been terminated pursuant to its terms. As of December 31, 2011, the beneficiaries of this limitation are the

holders of our $300 million of 6.125% Junior Subordinated Notes issued December 2003.

All of these Trusts are wholly owned finance subsidiaries of

PNC. In the event of certain changes or amendments to

regulatory requirements or federal tax rules, the capital

securities are redeemable in whole. In accordance with GAAP,

the financial statements of the Trusts are not included in

PNC’s consolidated financial statements.

At December 31, 2011, PNC’s junior subordinated debt with a

carrying value of $2.4 billion represented debentures

purchased and held as assets by the Trusts.

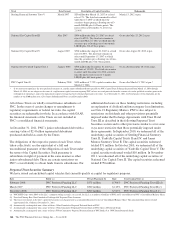

The obligations of the respective parent of each Trust, when

taken collectively, are the equivalent of a full and

unconditional guarantee of the obligations of such Trust under

the terms of the Capital Securities. Such guarantee is

subordinate in right of payment in the same manner as other

junior subordinated debt. There are certain restrictions on

PNC’s overall ability to obtain funds from its subsidiaries. For

additional disclosure on these funding restrictions, including

an explanation of dividend and intercompany loan limitations,

see Note 21 Regulatory Matters. PNC is also subject to

restrictions on dividends and other provisions potentially

imposed under the Exchange Agreements with Trust II and

Trust III as described in the following Perpetual Trust

Securities section and to other provisions similar to or in some

ways more restrictive than those potentially imposed under

those agreements. In September 2010, we redeemed all of the

underlying capital securities of Sterling Financial Statutory

Trust II, Yardville Capital Trusts II and IV, and James

Monroe Statutory Trust II. The capital securities redeemed

totaled $71 million. In October 2010, we redeemed all of the

underlying capital securities of Yardville Capital Trust V. The

capital securities redeemed totaled $10 million. In November

2011, we redeemed all of the underlying capital securities of

National City Capital Trust II. The capital securities redeemed

totaled $750 million.

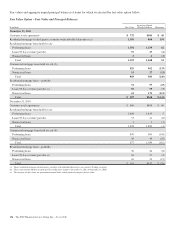

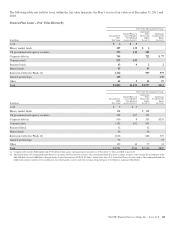

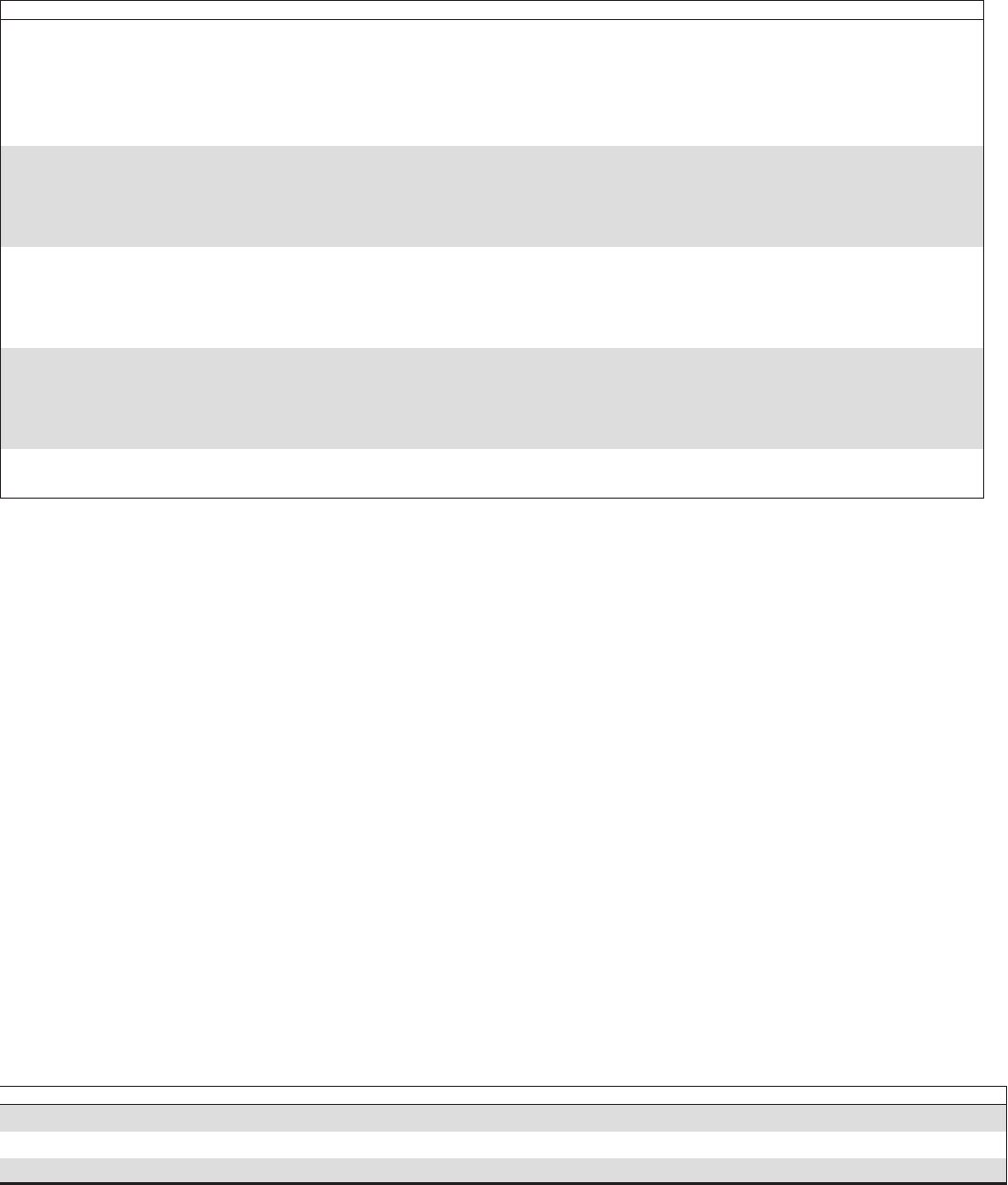

Perpetual Trust Securities Summary

We have issued certain hybrid capital vehicles that currently qualify as capital for regulatory purposes.

Date Entity (a) Private Placement (b) Rate Trust Issuing Notes (c)

February 2008 PNC Preferred Funding LLC $375 million 8.700% PNC Preferred Funding Trust III (d)

March 2007 PNC Preferred Funding LLC $500 million 6.113% PNC Preferred Funding Trust II (e)

December 2006 PNC Preferred Funding LLC $500 million 6.517% PNC Preferred Funding Trust I (f)

(a) PNC REIT Corp. owns 100% of the LLC’s common voting securities. As a result, the LLC is an indirect subsidiary of PNC and is consolidated on PNC’s Consolidated Balance Sheet.

(b) Fixed-to-Floating Rate Non-Cumulative Exchangeable Perpetual Trust Securities.

(c) The trusts investments in the LLC’s preferred securities are characterized as a noncontrolling interest on our Consolidated Balance Sheet. This noncontrolling interest totaled

approximately $1.3 billion at December 31, 2011.

(d) Automatically exchangeable into a share of Series J Non-Cumulative Perpetual Preferred Stock of PNC.

(e) Automatically exchangeable into a share of Series I Non-Cumulative Perpetual Preferred Stock of PNC (Series I Preferred Stock).

(f) Automatically exchangeable into a share of Series F Non-Cumulative Perpetual Preferred Stock of PNC Bank, N.A. (PNC Bank Preferred Stock).

164 The PNC Financial Services Group, Inc. – Form 10-K