PNC Bank 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

9G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

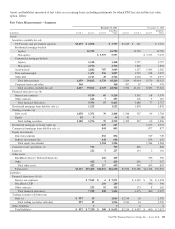

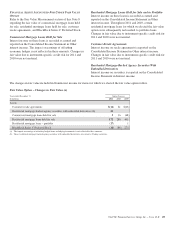

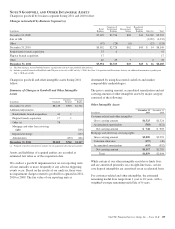

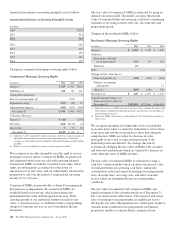

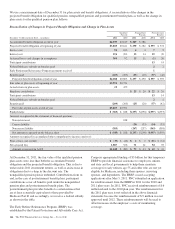

Changes in goodwill by business segment during 2011 and 2010 follow:

Changes in Goodwill by Business Segment (a)

In millions

Retail

Banking

Corporate &

Institutional

Banking

Asset

Management

Group

Residential

Mortgage

Banking Other (b) Total

December 31, 2009 $5,369 $2,756 $68 $43 $1,269 $9,505

Sale of GIS (1,232) (1,232)

Other (67) (28) (6) (23) (124)

December 31, 2010 $5,302 $2,728 $62 $43 $ 14 $8,149

BankAtlantic branch acquisition 35 6 41

Flagstar branch acquisition 17 17

Other 40 29 7 2 78

December 31, 2011 $5,394 $2,763 $69 $43 $ 16 $8,285

(a) The Non-Strategic Assets Portfolio business segment does not have any goodwill allocated to it.

(b) Includes goodwill related to BlackRock and GIS prior to the sale of GIS on July 1, 2010. See Note 2 Acquisition and Divestiture Activity for additional information regarding our

July 1, 2010 sale of GIS.

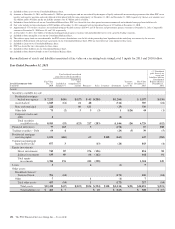

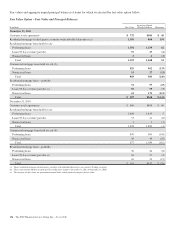

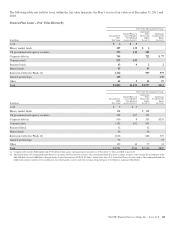

Changes in goodwill and other intangible assets during 2011

follow:

Summary of Changes in Goodwill and Other Intangible

Assets

In millions Goodwill

Customer-

Related

Servicing

Rights

December 31, 2010 $8,149 $903 $1,701

Additions/adjustments:

BankAtlantic branch acquisition 41 1

Flagstar branch acquisition 17 1

Other (a) 78

Mortgage and other loan servicing

rights (266)

Impairment charge (157)

Amortization (163) (161)

December 31, 2011 $8,285 $742 $1,117

(a) Primarily related to correction of amounts for an acquisition affecting prior periods.

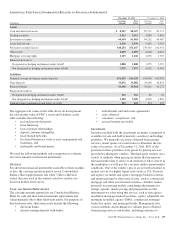

Assets and liabilities of acquired entities are recorded at

estimated fair value as of the acquisition date.

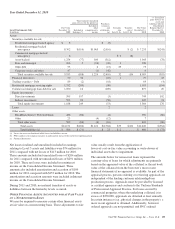

We conduct a goodwill impairment test on our reporting units

at least annually or more frequently if any adverse triggering

events occur. Based on the results of our analysis, there were

no impairment charges related to goodwill recognized in 2011,

2010 or 2009. The fair value of our reporting units is

determined by using discounted cash flow and market

comparability methodologies.

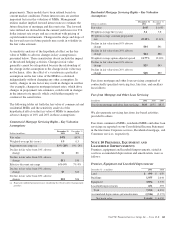

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

Other Intangible Assets

In millions

December 31

2011

December 31

2010

Customer-related and other intangibles

Gross carrying amount $1,525 $1,524

Accumulated amortization (783) (621)

Net carrying amount $ 742 $ 903

Mortgage and other loan servicing rights

Gross carrying amount $2,009 $2,293

Valuation allowance (197) (40)

Accumulated amortization (695) (552)

Net carrying amount $1,117 $1,701

Total $1,859 $2,604

While certain of our other intangible assets have finite lives

and are amortized primarily on a straight-line basis, certain

core deposit intangibles are amortized on an accelerated basis.

For customer-related and other intangibles, the estimated

remaining useful lives range from 1 year to 10 years, with a

weighted-average remaining useful life of 8 years.

The PNC Financial Services Group, Inc. – Form 10-K 159