PNC Bank 2011 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

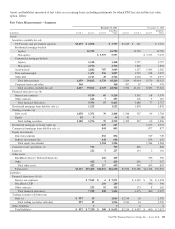

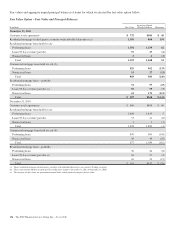

A

DDITIONAL

F

AIR

V

ALUE

I

NFORMATION

R

ELATED TO

F

INANCIAL

I

NSTRUMENTS

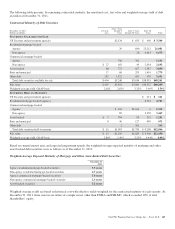

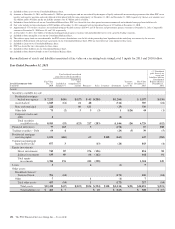

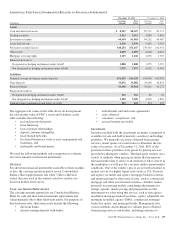

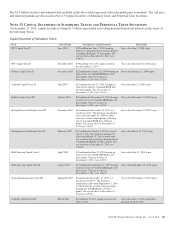

December 31, 2011 December 31, 2010

In millions

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Assets

Cash and short-term assets $ 8,567 $8,567 $9,711 $9,711

Trading securities 2,513 2,513 1,826 1,826

Investment securities 60,634 61,018 64,262 64,487

Loans held for sale 2,936 2,939 3,492 3,492

Net loans (excludes leases) 148,254 151,167 139,316 141,431

Other assets 4,019 4,019 4,664 4,664

Mortgage servicing rights 1,115 1,118 1,698 1,707

Financial derivatives

Designated as hedging instruments under GAAP 1,888 1,888 1,255 1,255

Not designated as hedging instruments under GAAP 7,575 7,575 4,502 4,502

Liabilities

Demand, savings and money market deposits 156,335 156,335 141,990 141,990

Time deposits 31,632 31,882 41,400 41,825

Borrowed funds 36,966 39,064 39,821 41,273

Financial derivatives

Designated as hedging instruments under GAAP 116 116 85 85

Not designated as hedging instruments under GAAP 7,490 7,490 4,850 4,850

Unfunded loan commitments and letters of credit 223 223 173 173

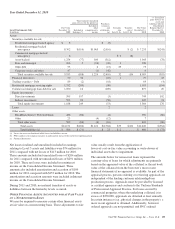

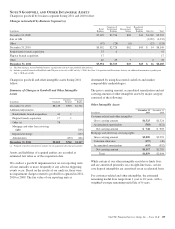

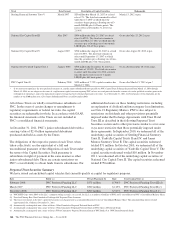

The aggregate fair values in the table above do not represent

the total market value of PNC’s assets and liabilities as the

table excludes the following:

• real and personal property,

• lease financing,

• loan customer relationships,

• deposit customer intangibles,

• retail branch networks,

• fee-based businesses, such as asset management and

brokerage, and

• trademarks and brand names.

We used the following methods and assumptions to estimate

fair value amounts for financial instruments.

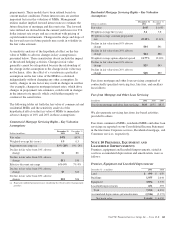

G

ENERAL

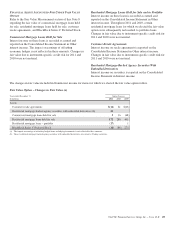

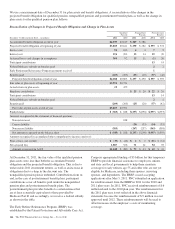

For short-term financial instruments realizable in three months

or less, the carrying amount reported on our Consolidated

Balance Sheet approximates fair value. Unless otherwise

stated, the rates used in discounted cash flow analyses are

based on market yield curves.

C

ASH AND

S

HORT

-T

ERM

A

SSETS

The carrying amounts reported on our Consolidated Balance

Sheet for cash and short-term investments approximate fair

values primarily due to their short-term nature. For purposes of

this disclosure only, short-term assets include the following:

• due from banks,

• interest-earning deposits with banks,

• federal funds sold and resale agreements,

• cash collateral,

• customers’ acceptances, and

• accrued interest receivable.

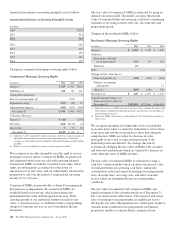

S

ECURITIES

Securities include both the investment securities (comprised of

available for sale and held to maturity securities) and trading

portfolios. We primarily use prices obtained from pricing

services, dealer quotes or recent trades to determine the fair

value of securities. As of December 31, 2011, 88% of the

positions in these portfolios were priced by pricing services

provided by third-party vendors. The third-party vendors use a

variety of methods when pricing securities that incorporate

relevant market data to arrive at an estimate of what a buyer in

the marketplace would pay for a security under current market

conditions. One of the vendor’s prices are set with reference to

market activity for highly liquid assets such as U.S. Treasury

and agency securities and agency mortgage-backed securities,

and matrix pricing for other asset classes, such as commercial

mortgage and other asset-backed securities. Another vendor

primarily uses pricing models considering adjustments for

ratings, spreads, matrix pricing and prepayments for the

instruments we value using this service, such as non-agency

residential mortgage-backed securities, agency adjustable rate

mortgage securities, agency CMOs, commercial mortgage-

backed securities, and municipal bonds. Management uses

various methods and techniques to validate prices obtained

from pricing services and dealers, including reference to

The PNC Financial Services Group, Inc. – Form 10-K 157