PNC Bank 2011 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

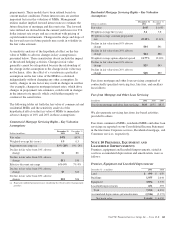

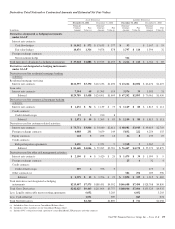

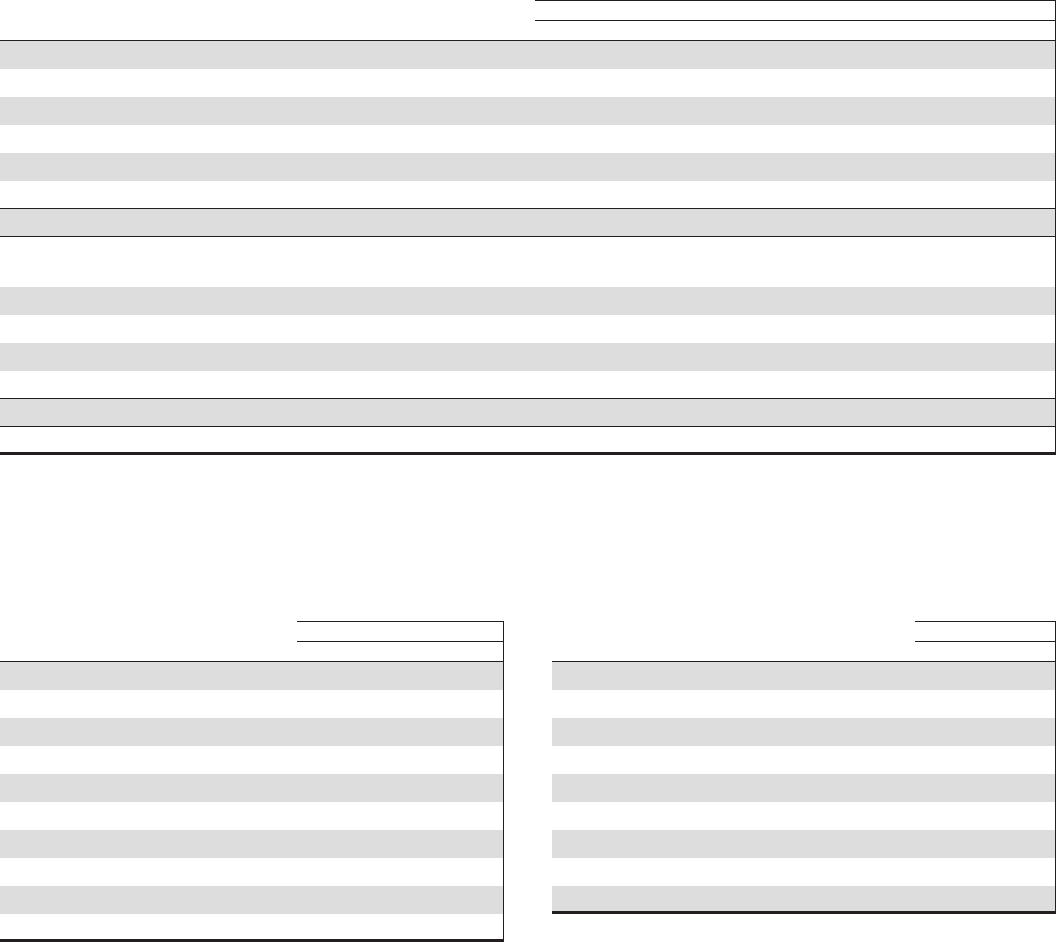

The components of net periodic benefit cost/(income) and other amounts recognized in other comprehensive income were as

follows.

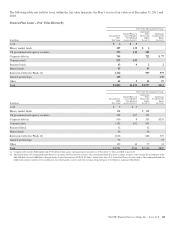

Components of Net Periodic Benefit Cost

Qualified Pension Plan Nonqualified Pension Plan Postretirement Benefits

Year ended December 31 – in millions 2011 2010 2009 2011 2010 2009 2011 2010 2009

Net periodic cost consists of:

Service cost $94 $ 102 $ 90 $4 $3 $2 $7 $5 $4

Interest cost 196 203 206 13 14 15 19 20 21

Expected return on plan assets (298) (285) (260)

Amortization of prior service cost (8) (8) (2) (3) (3) (5)

Amortization of actuarial losses 19 34 83 531

Net periodic cost 346 117 22 20 18 23 22 20

Other changes in plan assets and benefit obligations recognized in other

comprehensive income:

Current year prior service cost/(credit) (43) 2

Amortization of prior service credit 882 335

Current year actuarial loss/(gain) 579 (99) (263) 15 11 24 (1) 21 21

Amortization of actuarial (loss) (19) (34) (83) (5) (3) (1) (1)

Total recognized in OCI 568 (125) (387) 10 825 124 26

Total recognized in net periodic cost and OCI $ 571 $ (79) $(270) $32 $28 $43 $24 $46 $46

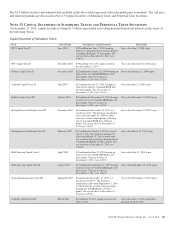

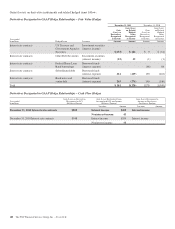

The weighted-average assumptions used (as of the beginning

of each year) to determine net periodic costs shown above

were as follows:

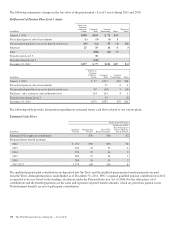

Net Periodic Costs – Assumptions

Net Periodic Cost Determination

Year ended December 31 2011 2010 2009

Discount rate

Qualified pension 5.20% 5.75% 6.05%

Nonqualified pension 4.80 5.15 5.90

Postretirement benefits 5.00 5.40 5.95

Rate of compensation increase (average) 4.00 4.00 4.00

Assumed health care cost trend rate

Initial trend 8.00 8.50 9.00

Ultimate trend 5.00 5.00 5.00

Year ultimate reached 2019 2014 2014

Expected long-term return on plan assets 7.75 8.00 8.25

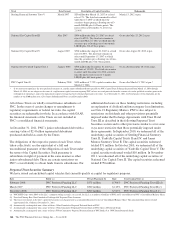

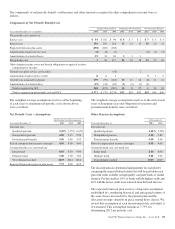

The weighted-average assumptions used (as of the end of each

year) to determine year-end obligations for pension and

postretirement benefits were as follows:

Other Pension Assumptions

At December 31

Year ended December 31 2011 2010

Discount rate

Qualified pension 4.60% 5.20%

Nonqualified pension 4.20 4.80

Postretirement benefits 4.40 5.00

Rate of compensation increase (average) 4.00 4.00

Assumed health care cost trend rate

Initial trend 8.00 8.00

Ultimate trend 5.00 5.00

Year ultimate reached 2019 2019

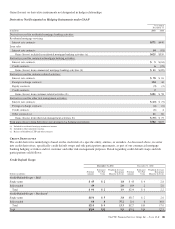

The discount rates are determined independently for each plan by

comparing the expected future benefits that will be paid under each

plan with yields available on high quality corporate bonds of similar

duration. For this analysis, 10% of bonds with the highest yields and

40% with the lowest yields were removed from the bond universe.

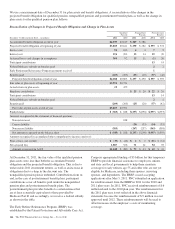

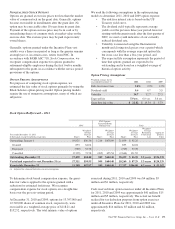

The expected return on plan assets is a long-term assumption

established by considering historical and anticipated returns of

the asset classes invested in by the pension plan and the

allocation strategy currently in place among those classes. We

review this assumption at each measurement date and adjust it

if warranted. This assumption remains at 7.75% for

determining 2012 net periodic cost.

The PNC Financial Services Group, Inc. – Form 10-K 171