PNC Bank 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

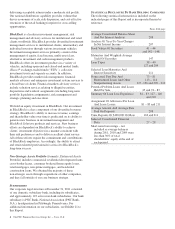

Tier 1 Common Capital Ratio

At Year End

Banking in a New Environment As I look at the business world today, there’s

no doubt that we are experiencing unprecedented change. Less than a decade ago Twitter didn’t

exist. Neither did Facebook or Skype. Blockbuster was the number one entertainment company in

the United States, and Apple was rumored to be on the verge of bankruptcy.

In the banking industry, we are experiencing sweeping changes in customer preferences and almost

daily advances in technology. We are operating at a time of historically low interest rates, important

new regulations and a challenging political environment.

At PNC, we have always taken the long view. While some banks regard the current environment as

a time for contraction, we see it as an opportunity. And we believe we are

better positioned today than we have ever been in the 160-year history of

the company.

Our capital and liquidity positions are strong. We have a highly competitive

set of products and services to meet our customers’ needs. Our existing markets are profitable and

we are entering new ones that provide the potential for significant growth. And we have outstanding

employees who are led by a management team that is committed to delivering for our customers,

shareholders and communities.

PNC’s performance over time is reflected in our share price. For the last five-year period, we have

ranked first in cumulative total shareholder return among our peer banks.* Although our share

price declined 5 percent in 2011, the S&P 500 Banks index declined by 12 percent.

While these are good results on a relative basis, no one ever made money on a relative basis.

At PNC we manage our business with the goal of creating opportunities for increased shareholder

value over the long term.

Meeting Our Highest Capital Priorities In the

current regulatory environment, great attention is being paid to capital

adequacy and for good reason. Banks need sufficient capital to weather

changes in the global economy.

Today, most U.S. banks have stronger capital and liquidity than at the height of

the 2008 downturn. In fact U.S. bank capital ratios are at their highest levels in

six decades.

2011

10.3%

While some banks regard the current

environment as a time for contraction, we see

it as an opportunity. And we believe we are

better positioned today than we have ever

been in the 160-year history of the company.

2010

9.8%

* PNC’s 2011 peer group consists of BB&T Corporation, Bank of America Corporation, Capital One Financial Corporation, Comerica Incorporated,

Fifth Third Bancorp, JPMorgan Chase & Co., KeyCorp, M&T Bank Corporation, The PNC Financial Services Group, Inc., Regions Financial

Corporation, SunTrust Banks, Inc., U.S. Bancorp, and Wells Fargo & Company.

6.0%

2009