PNC Bank 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

TATUS

O

F

Q

UALIFIED

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

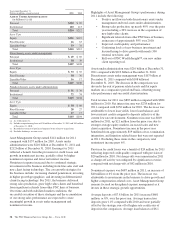

We have a noncontributory, qualified defined benefit pension

plan (plan or pension plan) covering eligible employees.

Benefits are determined using a cash balance formula where

earnings credits are a percentage of eligible compensation.

Pension contributions are based on an actuarially determined

amount necessary to fund total benefits payable to plan

participants. Consistent with our investment strategy, plan

assets are primarily invested in equity investments and fixed

income instruments. Plan fiduciaries determine and review the

plan’s investment policy, which is described more fully in

Note 14 Employee Benefit Plans in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

We calculate the expense associated with the pension plan and

the assumptions and methods that we use include a policy of

reflecting trust assets at their fair market value. On an annual

basis, we review the actuarial assumptions related to the

pension plan. The primary assumptions used to measure

pension obligations and costs are the discount rate,

compensation increase and expected long-term return on

assets. Among these, the compensation increase assumption

does not significantly affect pension expense.

The discount rate used to measure pension obligations is

determined by comparing the expected future benefits that

will be paid under the plan with yields available on high

quality corporate bonds of similar duration. In lower interest

rate environments, the sensitivity of pension expense to the

assumed discount rate increases. The impact on pension

expense of a 0.5% decrease in discount rate in the current

environment is $23 million per year. In contrast, the

sensitivity to the same change in discount rate in a higher

interest rate environment is less significant.

The expected long-term return on assets assumption also has a

significant effect on pension expense. The expected return on

plan assets is a long-term assumption established by

considering historical and anticipated returns of the asset

classes invested in by the pension plan and the asset allocation

policy currently in place. For purposes of setting and

reviewing this assumption, “long term” refers to the period

over which the plan’s projected benefit obligations will be

disbursed. We review this assumption at each measurement

date and adjust it if warranted. Our selection process

references certain historical data and the current environment,

but primarily utilizes qualitative judgment regarding future

return expectations. Accordingly, we generally do not change

the assumption unless we modify our investment strategy or

identify events that would alter our expectations of future

returns.

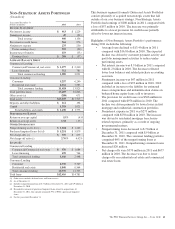

To evaluate the continued reasonableness of our assumption,

we examine a variety of viewpoints and data. Various studies

have shown that portfolios comprised primarily of US equity

securities have historically returned approximately 10%

annually over long periods of time, while US debt securities

have returned approximately 6% annually over long periods.

Application of these historical returns to the plan’s allocation

ranges for equities and bonds produces a result between 7.25%

and 8.75% and is one point of reference, among many other

factors, that is taken into consideration. We also examine the

plan’s actual historical returns over various periods. Recent

experience is considered in our evaluation with appropriate

consideration that, especially for short time periods, recent

returns are not reliable indicators of future returns. While

annual returns can vary significantly (rates of return for 2011,

2010, and 2009 were +.11%, +14.87%, and +20.61%,

respectively), the selected assumption represents our estimated

long-term average prospective returns.

Acknowledging the potentially wide range for this

assumption, we also annually examine the assumption used by

other companies with similar pension investment strategies, so

that we can ascertain whether our determinations markedly

differ from others. In all cases, however, this data simply

informs our process, which places the greatest emphasis on

our qualitative judgment of future investment returns, given

the conditions existing at each annual measurement date.

Taking into consideration all of these factors, the expected

long-term return on plan assets for determining net periodic

pension cost for 2011 was 7.75%, down from 8.00% for 2010.

This reduction was made after considering the views of both

internal and external capital market advisors, particularly with

regard to the effects of the recent economic environment on

long-term prospective fixed income returns. We are

maintaining our expected long-term return on assets at 7.75%

for determining pension cost for 2012.

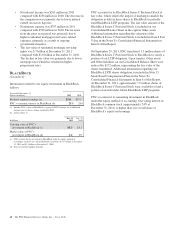

Under current accounting rules, the difference between

expected long-term returns and actual returns is accumulated

and amortized to pension expense over future periods. Each

one percentage point difference in actual return compared

with our expected return causes expense in subsequent years

to increase or decrease by up to $8 million as the impact is

amortized into results of operations.

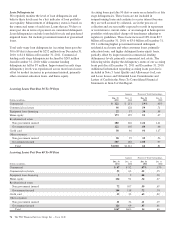

We currently estimate a pretax pension expense of $93 million

in 2012 compared with pretax expense of $3 million in 2011.

This year-over-year expected increase is primarily due to the

amortization impact of the unfavorable 2011 investment

returns as compared with the expected long-term return

assumption and the increase in obligations due to the drop in

the discount rate. In addition, the estimate for 2012 includes

approximately $2 million for employees expected to join the

plan after the RBC Bank (USA) acquisition.

68 The PNC Financial Services Group, Inc. – Form 10-K