PNC Bank 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

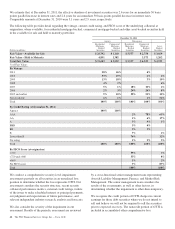

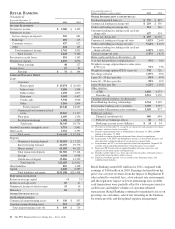

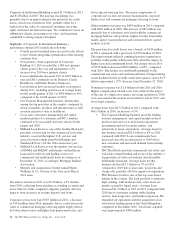

R

ETAIL

B

ANKING

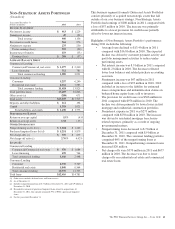

(Unaudited)

Year ended December 31

Dollars in millions, except as noted 2011 2010

I

NCOME

S

TATEMENT

Net interest income $ 3,280 $ 3,435

Noninterest income

Service charges on deposits 510 681

Brokerage 201 213

Consumer services 927 912

Other 124 145

Total noninterest income 1,762 1,951

Total revenue 5,042 5,386

Provision for credit losses 891 1,103

Noninterest expense 4,103 4,056

Pretax earnings 48 227

Income taxes 17 83

Earnings $31$ 144

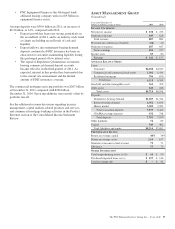

A

VERAGE

B

ALANCE

S

HEET

Loans

Consumer

Home equity $ 25,874 $ 26,450

Indirect auto 3,089 2,098

Indirect other 1,478 1,875

Education 9,103 8,497

Credit cards 3,738 3,938

Other 1,866 1,804

Total consumer 45,148 44,662

Commercial and commercial real

estate 10,567 11,177

Floor plan 1,450 1,336

Residential mortgage 1,180 1,599

Total loans 58,345 58,774

Goodwill and other intangible assets 5,751 5,861

Other assets 2,352 2,793

Total assets $ 66,448 $ 67,428

Deposits

Noninterest-bearing demand $ 18,183 $ 17,223

Interest-bearing demand 22,196 19,776

Money market 41,002 40,125

Total transaction deposits 81,381 77,124

Savings 8,098 6,938

Certificates of deposit 33,006 41,539

Total deposits 122,485 125,601

Other liabilities 855 1,458

Capital 8,168 8,439

Total liabilities and equity $131,508 $135,498

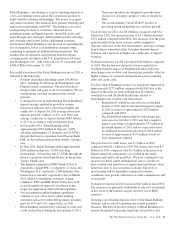

P

ERFORMANCE

R

ATIOS

Return on average capital –% 2%

Return on average assets .05 .21

Noninterest income to total revenue 35 36

Efficiency 81 75

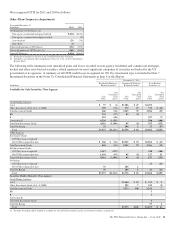

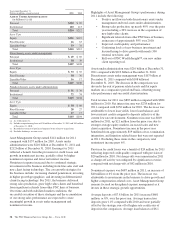

O

THER

I

NFORMATION

(a)

Credit-related statistics:

Commercial nonperforming assets $ 336 $ 297

Consumer nonperforming assets 513 422

Total nonperforming assets (b) $ 849 $ 719

Year ended December 31

Dollars in millions, except as noted 2011 2010

O

THER

I

NFORMATION

(

CONTINUED

) (a)

Purchased impaired loans (c) $ 757 $ 895

Commercial lending net charge-offs $ 219 $ 330

Credit card lending net charge-offs 211 316

Consumer lending (excluding credit card) net

charge-offs 427 424

Total net charge-offs $ 857 $1,070

Commercial lending net charge-off ratio 1.82% 2.64%

Credit card lending net charge-off ratio 5.64% 8.02%

Consumer lending (excluding credit card) net

charge-off ratio 1.00% 1.00%

Total net charge-off ratio 1.47% 1.82%

Home equity portfolio credit statistics: (d)

% of first lien positions at origination (e) 39% 36%

Weighted-average original loan-to-value ratios

(LTVs) (e) 72% 73%

Weighted-average updated FICO scores (f) 743 726

Net charge-off ratio 1.09% .90%

Loans 30 – 59 days past due .58% .49%

Loans 60 – 89 days past due .38% .30%

Loans 90 days past due 1.22% 1.02%

Other statistics:

ATMs 6,806 6,673

Branches (g) 2,511 2,470

Customer-related statistics: (in thousands)

Retail Banking checking relationships 5,761 5,465

Retail online banking active customers 3,519 3,057

Retail online bill payment active customers 1,105 977

Brokerage statistics:

Financial consultants (h) 686 694

Full service brokerage offices 38 34

Brokerage account assets (billions) $34$34

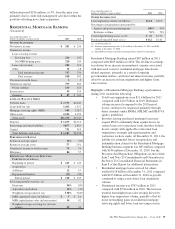

(a) Presented as of December 31, except for net charge-offs and annualized net charge-

off ratios, which are for the year ended.

(b) Includes nonperforming loans of $810 million at December 31, 2011 and $694

million at December 31, 2010.

(c) Recorded investment of purchased impaired loans related to acquisitions.

(d) Lien position, LTV, FICO and delinquency statistics are based upon balances and

other data that exclude the impact of accounting for acquired loans.

(e) Lien positions and LTV are based upon data from loan origination. Original LTV

excludes certain acquired portfolio loans where this data is not available.

(f) Represents FICO scores that are updated monthly for home equity lines and

quarterly for the home equity installment loans.

(g) Excludes satellite offices (e.g., drive-ups, electronic branches, retirement centers)

that provide limited products and/or services.

(h) Financial consultants provide services in full service brokerage offices and

traditional bank branches.

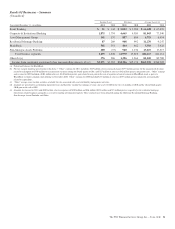

Retail Banking earned $31 million for 2011 compared with

earnings of $144 million in 2010. Earnings declined from the

prior year as lower revenues from the impact of Regulation E

rules related to overdraft fees, a low interest rate environment,

and the regulatory impact of lower interchange fees on debit

card transactions were partially offset by a lower provision for

credit losses and higher volumes of customer-initiated

transactions. Retail Banking continued to maintain its focus on

growing core customers, selectively investing in the business

for future growth, and disciplined expense management.

52 The PNC Financial Services Group, Inc. – Form 10-K