PNC Bank 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.M

ARKET

S

TREET

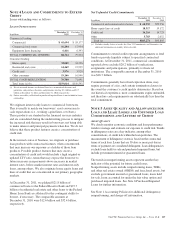

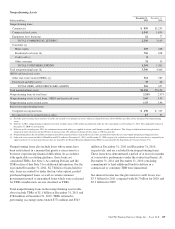

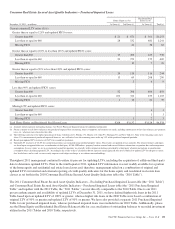

Market Street Funding LLC (Market Street) is a multi-seller

asset-backed commercial paper conduit that is owned by an

independent third-party. Market Street’s activities primarily

involve purchasing assets or making loans secured by interests

in pools of receivables from US corporations that desire

access to the commercial paper market. Market Street funds

the purchases of assets or loans by issuing commercial paper

and is supported by pool-specific credit enhancements,

liquidity facilities and program-level credit enhancement.

Generally, Market Street mitigates its potential interest rate

risk by entering into agreements with its borrowers that reflect

interest rates based upon its weighted-average commercial

paper cost of funds. During 2011 and 2010, Market Street met

all of its funding needs through the issuance of commercial

paper.

PNC Bank, N.A. provides certain administrative services, the

program-level credit enhancement and all of the liquidity

facilities to Market Street in exchange for fees negotiated

based on market rates. Through these arrangements, PNC

Bank, N.A. has the power to direct the activities of the SPE

that most significantly affect its economic performance and

these arrangements expose PNC Bank, N.A. to expected

losses or residual returns that are significant to Market Street.

The commercial paper obligations at December 31, 2011 and

December 31, 2010 were supported by Market Street’s assets.

While PNC Bank, N.A. may be obligated to fund under the

$8.3 billion of liquidity facilities for events such as

commercial paper market disruptions, borrower bankruptcies,

collateral deficiencies or covenant violations, our credit risk

under the liquidity facilities is secondary to the risk of first

loss provided by the borrower such as by the over-

collateralization of the assets or by another third-party in the

form of deal-specific credit enhancement. Deal-specific credit

enhancement that supports the commercial paper issued by

Market Street is generally structured to cover a multiple of

expected losses for the pool of assets and is sized to generally

meet rating agency standards for comparably structured

transactions. In addition, PNC Bank, N.A. would be required

to fund $1.5 billion of the liquidity facilities regardless of

whether the underlying assets are in default. Market Street

creditors have no direct recourse to PNC Bank, N.A.

PNC Bank, N.A. provides program-level credit enhancement

to cover net losses in the amount of 10% of commitments,

excluding explicitly rated AAA/Aaa facilities. PNC Bank,

N.A. provides 100% of the enhancement in the form of a cash

collateral account funded by a loan facility. This facility

expires in June 2016. At December 31, 2011, $857 million

was outstanding on this facility. This amount is eliminated in

PNC’s Consolidated Balance Sheet as we consolidate Market

Street. We are not required to nor have we provided additional

financial support to the SPE.

C

REDIT

C

ARD

S

ECURITIZATION

T

RUST

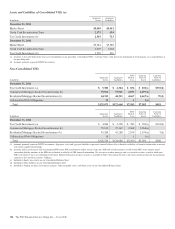

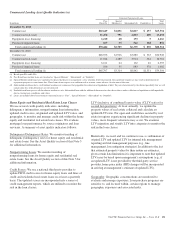

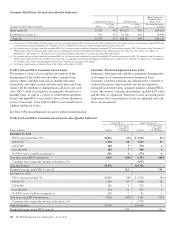

We are the sponsor of several credit card securitizations

facilitated through a trust. This bankruptcy-remote SPE or

VIE was established to purchase credit card receivables from

the sponsor and to issue and sell asset-backed securities

created by it to independent third-parties. The SPE was

financed primarily through the sale of these asset-backed

securities. These transactions were originally structured as a

form of liquidity and to afford favorable capital treatment. At

December 31, 2011, only Series 2007-1 issued by the SPE was

outstanding. Series 2006-1 and 2008-3 were paid off during

the first and second quarters of 2011, respectively.

Our continuing involvement in these securitization

transactions consists primarily of holding certain retained

interests and acting as the primary servicer. For the remaining

securitization series, our retained interests held are in the form

of a pro-rata undivided interest, or sellers’ interest, in the

transferred receivables, subordinated tranches of asset-backed

securities, interest-only strips, discount receivables, and

subordinated interests in accrued interest and fees in

securitized receivables. We have consolidated the SPE as we

are deemed the primary beneficiary of the entity based upon

our level of continuing involvement. Our role as primary

servicer gives us the power to direct the activities of the SPE

that most significantly affect its economic performance and

our holding of retained interests gives us the obligation to

absorb or receive expected losses or residual returns that are

significant to the SPE. Accordingly, all retained interests held

in the credit card SPE are eliminated in consolidation. The

underlying assets of the consolidated SPE are restricted only

for payment of the beneficial interest issued by the SPE. We

are not required to nor have we provided additional financial

support to the SPE. Additionally, creditors of the SPE have no

direct recourse to PNC.

T

AX

C

REDIT

I

NVESTMENTS

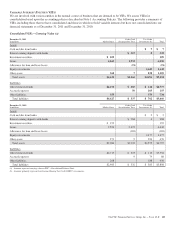

We make certain equity investments in various limited

partnerships or limited liability companies (LLCs) that

sponsor affordable housing projects utilizing the LIHTC

pursuant to Sections 42 and 47 of the Internal Revenue Code.

The purpose of these investments is to achieve a satisfactory

return on capital, to facilitate the sale of additional affordable

housing product offerings and to assist us in achieving goals

associated with the Community Reinvestment Act. The

primary activities of the investments include the identification,

development and operation of multi-family housing that is

leased to qualifying residential tenants. Generally, these types

of investments are funded through a combination of debt and

equity. We typically invest in these partnerships as a limited

partner or non-managing member. We make similar

investments in other types of tax credit investments.

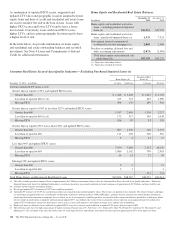

Also, we are a national syndicator of affordable housing

equity (together with the investments described above, the

LIHTC investments). In these syndication transactions, we

create funds in which our subsidiaries are the general partner

The PNC Financial Services Group, Inc. – Form 10-K 125