PNC Bank 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.this Item 7 includes the consolidated revenue to PNC for these

services. A discussion of the consolidated revenue from these

services follows.

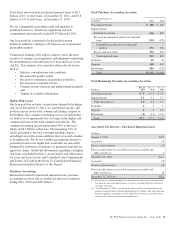

Treasury management revenue, which includes fees as well as

net interest income from customer deposit balances, totaled

$1.2 billion for both 2011 and 2010. Declining deposit spreads

were offset by increases in core processing products, such as

lockbox and information reporting, and in growth products

such as commercial card and healthcare related services.

Revenue from capital markets-related products and services

totaled $622 million in 2011 compared with $606 million in

2010. The comparison reflects higher derivatives and foreign

exchange sales and the reduced impact of counterparty credit

risk on valuations of derivative positions. These increases

were partially offset by lower underwriting activity.

Commercial mortgage banking activities resulted in revenue

of $112 million in 2011 compared with $262 million in 2010.

This decline was primarily due to a reduction in the value of

commercial mortgage servicing rights largely driven by lower

interest rates and higher loan prepayment rates. 2010 included

a higher level of ancillary commercial mortgage servicing fees

and revenue from a duplicative agency servicing operation

that was sold in that year.

P

ROVISION

F

OR

C

REDIT

L

OSSES

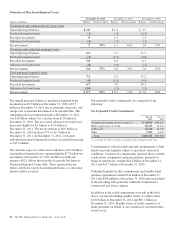

The provision for credit losses declined to $1.2 billion in 2011

compared with $2.5 billion in 2010 as overall credit quality

continued to improve due to improved economic conditions

and actions we took to reduce exposure levels during the year.

We expect our provision for credit losses in 2012 to remain

stable relative to 2011 assuming the economic outlook for

2012 will be a continuation of the 2011 environment. This

includes consideration of the impact of the pending RBC

Bank (USA) acquisition.

The Credit Risk Management portion of the Risk Management

section of this Item 7 includes additional information

regarding factors impacting the provision for credit losses. See

also Item 1A Risk Factors and the Cautionary Statement

Regarding Forward-Looking Information section of Item 7 of

this Report.

N

ONINTEREST

E

XPENSE

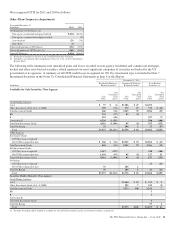

Noninterest expense was $9.1 billion for 2011 and $8.6 billion

for 2010. Noninterest expense for 2011 included $324 million

of residential mortgage foreclosure-related expenses primarily

as a result of ongoing governmental matters, a noncash charge

of $198 million for the unamortized discount related to

redemption of trust preferred securities, and $42 million for

integration costs. The comparable amounts for 2010 were $71

million, $0 and $387 million, respectively.

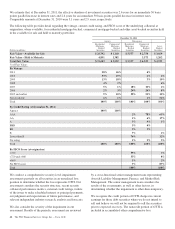

Apart from the possible impact of legal and regulatory

contingencies, charges on further trust preferred redemptions,

and RBC Bank (USA) integration expenses in 2012, and

excluding the fourth quarter charge for residential mortgage

foreclosure-related expenses of $240 million and the noncash

charge of $198 million related to the trust preferred securities

redemption in 2011, we expect that total noninterest expense

for 2012 will increase in percentage terms by mid single-digits

compared to 2011. This expectation reflects flat-to-down

expense for PNC stand alone and 10 months of RBC Bank

(USA) operating expenses of approximately $600 million.

In connection with the pending acquisition of RBC Bank

(USA) in March 2012, we expect to incur total merger and

integration costs of approximately $170 million in the first

quarter of 2012.

E

FFECTIVE

I

NCOME

T

AX

R

ATE

The effective income tax rate was 24.5% in 2011 compared

with 25.5% in 2010. The decrease in the effective tax rate was

primarily attributable to the impact of higher tax-exempt

income and tax credits.

The PNC Financial Services Group, Inc. – Form 10-K 37