PNC Bank 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.aggregation measure is supplemented with secondary

measures of risk to arrive at an estimate of corporate-wide

risk. The economic capital framework is a measure of

potential losses above and beyond expected losses. Our capital

management practices incorporate risks associated with

potential credit losses (Credit Risk); fluctuations of the

estimated market value of financial instruments (Market

Risk); failure of people, processes or systems (Operational

Risk); calculations, assumptions, and validation of internal

measurements (Model Risk); and losses associated with

declining margins and/or fees, and the fixed cost structure of

the business. We estimate credit and market risks at pool and

exposure levels while we estimate the remaining risk types at

an institution or business segment level.

Risk Management Strategies

Risk management is not about eliminating risks, but about

identifying and accepting risks and then working to effectively

manage them so as to optimize all aspects of shareholder

value.

We centrally manage policy development, exception approval,

and oversight through our corporate-level risk management

structure. Some of these policies express our risk appetite

through limits to the acceptable level of risk. If we are in

excess of certain limits, we implement strategies designed to

progressively manage our risks to be within acceptable

tolerances. We also review and revise certain policies to better

reflect specific business requirements of our changing

organization. This risk management structure also affords us

opportunities to take action in either preventing or mitigating

unapproved exceptions to policies. PNC’s Internal Audit

function also performs its own assessment of our internal

control environment. Internal Audit plays a critical role in risk

management, testing the operation of the internal control

system and reporting findings to management and to the Audit

Committee of the Board.

Risk Monitoring and Reporting

Monitoring and evaluation of controls help to provide

assurance that controls are effective, and can also result in the

identification of opportunities to improve risk controls. Our

risk reporting provides an overall risk aggregation and

transparent communication of these aggregated risks. Risk

reports are produced at the line of business level, the

functional level (credit, market, operational), and at the

corporate level. Our enterprise risk profile is a point-in-time

assessment of corporate-wide risk. The risk profile represents

PNC’s overall risk position in relation to the desired corporate

risk appetite. The determination of the risk profile’s position is

based on comprehensive and subjective analysis of reported

risk limits, metrics, operating guidelines, and qualitative

assessments.

C

REDIT

R

ISK

M

ANAGEMENT

Credit risk represents the possibility that a customer,

counterparty or issuer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities, and entering into financial

derivative transactions and certain guarantee contracts. Credit

risk is one of our most significant risks. Our processes for

managing credit risk are embedded in PNC’s risk culture and

in our decision-making processes using a systematic approach

whereby credit risks and related exposures are: identified and

assessed; managed through specific policies and processes;

measured and evaluated against our risk tolerance limits; and

reported, along with specific mitigation activities, to

management and the board through our governance structure.

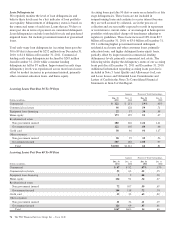

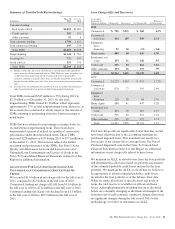

Asset Quality Overview

Overall asset quality trends for 2011 were positive and

included the following:

• Overall loan delinquencies, excluding government

insured or guaranteed loans, have declined from

year-end 2010 levels helped by the slowly improving

economy.

• Aided by a continued, albeit slowly, improving

economy, nonperforming loans declined $906

million, or 20%, to $3.6 billion as of December 31,

2011 compared with December 31, 2010. Similarly,

nonperforming assets decreased $967 million, or

19%, to $4.2 billion as of December 31, 2011,

compared with December 31, 2010.

• Commercial credit quality trends improved

noticeably with levels of criticized commercial loan

outstandings declining by approximately $3.8 billion,

or 28% compared with December 31, 2010, to $9.9

billion at December 31, 2011. See Note 5 Asset

Quality and Allowances for Loan and Lease Losses

and Unfunded Loan Commitments and Letters of

Credit in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional

information.

• Net charge-offs declined significantly to $1.6 billion,

down 44% from 2010 net charge-offs of $2.9 billion.

• Reflecting improvements in asset quality, the

provision for credit losses declined to $1.2 billion for

2011 compared with $2.5 billion for 2010.

• The level of ALLL has decreased to $4.3 billion at

December 31, 2011 from $4.9 billion at

December 31, 2010.

These positive trends were partially offset by our ongoing loan

modification efforts to assist homeowners and other

borrowers. These efforts continued to increase our overall

level of troubled debt restructurings (TDRs). In particular,

TDRs included in nonperforming loans increased to 32% of

total nonperforming loans. However, as the economy has

slowly improved, the amount of TDRs returning to performing

status has increased.

The PNC Financial Services Group, Inc. – Form 10-K 73