PNC Bank 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

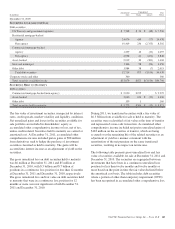

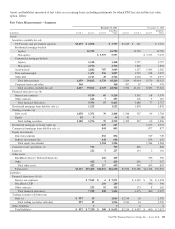

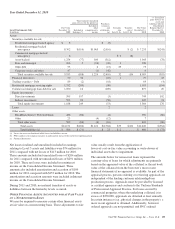

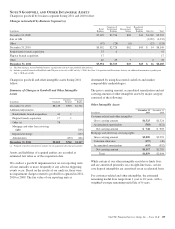

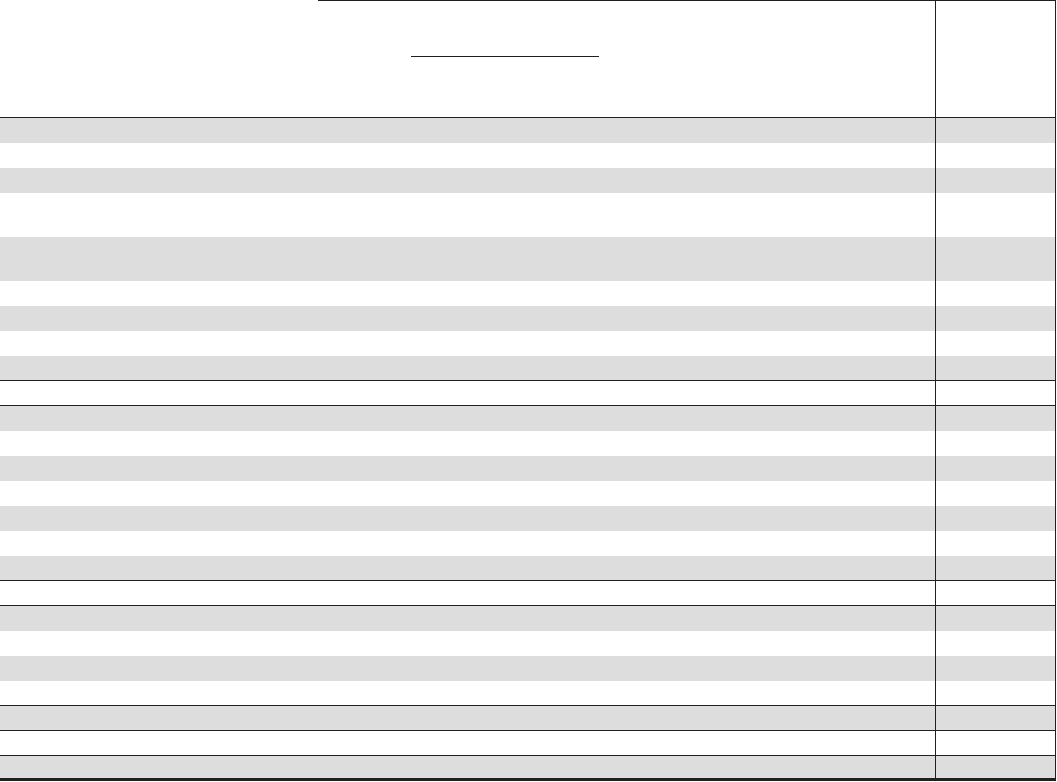

Year Ended December 31, 2010

Level 3 Instruments Only

In millions

Fair Value

December 31,

2009

Total realized / unrealized

gains (losses) for the period (a) Purchases,

issuances,

and

settlements,

net

Transfers

into

Level 3 (b)

Transfers

out of

Level 3 (b)

Fair Value

December 31,

2010

(*) Unrealized

gains (losses) on

assets and

liabilities held on

Consolidated

Balance Sheet at

December 31,

2010

Included in

Earnings (*)

Included in

other

comprehensive

income

Assets

Securities available for sale

Residential mortgage-backed agency $ 5 $ (5)

Residential mortgage-backed

non-agency 8,302 $(116) $1,065 (2,016) $ (2) $ 7,233 $(241)

Commercial mortgage-backed

non-agency 6 $ 2 (8)

Asset-backed 1,254 (77) 180 (312) 1,045 (78)

State and municipal 266 5 (24) (20) 1 228

Other debt 53 6 (15) 29 73

Corporate stocks and other 47 (1) (42) 4

Total securities available for sale 9,933 (188) 1,226 (2,410) 32 (10) 8,583 (319)

Financial derivatives 50 36 (10) 1 77 43

Trading securities – Debt 89 (2) (18) 69 (4)

Residential mortgage servicing rights 1,332 (209) (90) 1,033 (194)

Commercial mortgage loans held for sale 1,050 16 (189) 877 20

Equity investments

Direct investments 595 157 (3) 749 102

Indirect investments 593 92 (50) 635 74

Total equity investments 1,188 249 (53) 1,384 176

Loans 22

Other assets

BlackRock Series C Preferred Stock 486 (86) (4) 396 (86)

Other 23 (4) (12) 7

Total other assets 509 (86) (4) (16) 403 (86)

Total assets $14,151 $(184) $1,222 $(2,784) $33 $(10) $12,428 $(364)

Total liabilities (c) $ 506 $ (71) $ 23 $ 2 $ 460 $ (73)

(a) Losses for assets are bracketed while losses for liabilities are not.

(b) PNC’s policy is to recognize transfers in and transfers out as of the end of the reporting period.

(c) Financial derivatives.

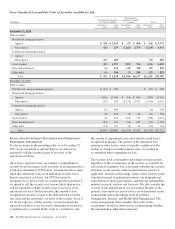

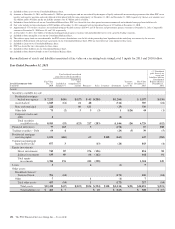

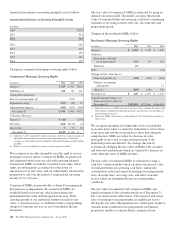

Net losses (realized and unrealized) included in earnings

relating to Level 3 assets and liabilities were $74 million for

2011 compared with net losses of $113 million for 2010.

These amounts included net unrealized losses of $204 million

for 2011 compared with net unrealized losses of $291 million

for 2010. These net losses were included in noninterest

income on the Consolidated Income Statement. These

amounts also included amortization and accretion of $109

million for 2011 compared with $153 million for 2010. The

amortization and accretion amounts were included in Interest

income on the Consolidated Income Statement.

During 2011 and 2010, no material transfers of assets or

liabilities between the hierarchy levels occurred.

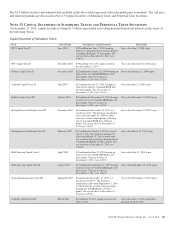

O

THER

F

INANCIAL

A

SSETS

A

CCOUNTED FOR AT

F

AIR

V

ALUE

ON A

N

ONRECURRING

B

ASIS

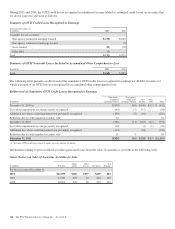

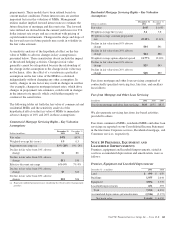

We may be required to measure certain other financial assets

at fair value on a nonrecurring basis. These adjustments to fair

value usually result from the application of

lower-of-cost-or-fair value accounting or write-downs of

individual assets due to impairment.

The amounts below for nonaccrual loans represent the

carrying value of loans for which adjustments are primarily

based on the appraised value of the collateral or the net book

value of the collateral from the borrower’s most recent

financial statements if no appraisal is available. As part of the

appraisal process, persons ordering or reviewing appraisals are

independent of the lending customer relationship/loan

production process. Appraisals must be provided by licensed

or certified appraisers and conform to the Uniform Standards

of Professional Appraisal Practice. For loans secured by

commercial properties where the underlying collateral is in

excess of $250,000, appraisals are obtained at least annually.

In certain instances (e.g., physical changes in the property), a

more recent appraisal is obtained. Additionally, borrower

ordered appraisals are not permitted, and PNC ordered

The PNC Financial Services Group, Inc. – Form 10-K 153