PNC Bank 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

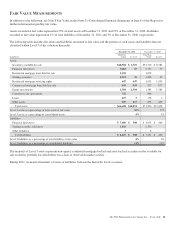

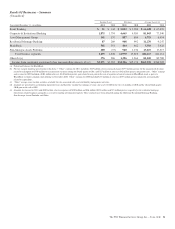

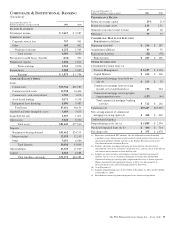

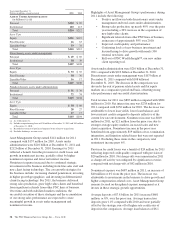

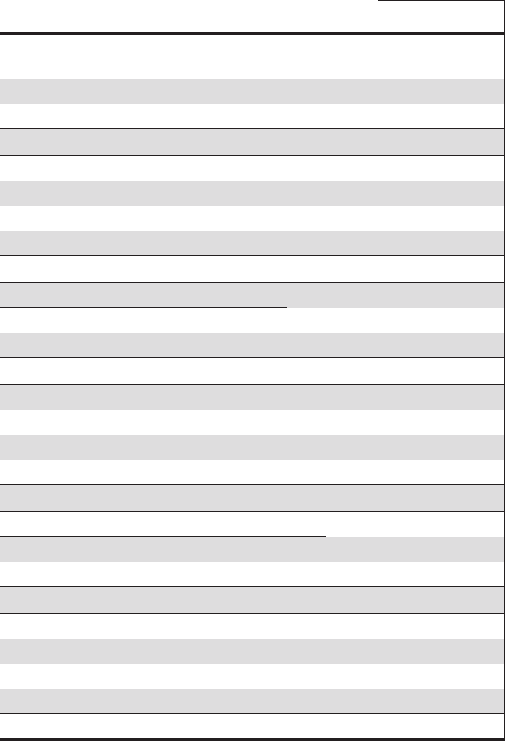

Year ended December 31

Dollars in millions, except as noted 2011 2010

A

SSETS

U

NDER

A

DMINISTRATION

(in billions) (a) (d)

Personal $100 $99

Institutional 110 113

Total $210 $212

Asset Type

Equity $111 $115

Fixed Income 66 63

Liquidity/Other 33 34

Total $210 $212

Discretionary assets under management

Personal $69 $69

Institutional 38 39

Total $107 $108

Asset Type

Equity $53 $55

Fixed Income 38 36

Liquidity/Other 16 17

Total $107 $108

Nondiscretionary assets under administration

Personal $31 $30

Institutional 72 74

Total $103 $104

Asset Type

Equity $58 $60

Fixed Income 28 27

Liquidity/Other 17 17

Total $103 $104

(a) As of December 31.

(b) Includes nonperforming loans of $56 million at December 31, 2011 and $82 million

at December 31, 2010.

(c) Recorded investment of purchased impaired loans related to acquisitions.

(d) Excludes brokerage account assets.

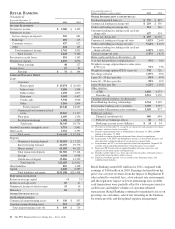

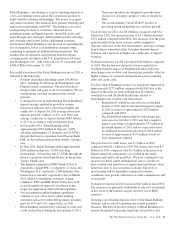

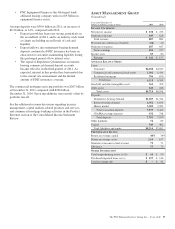

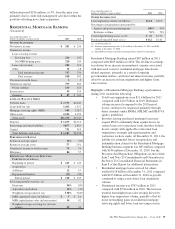

Asset Management Group earned $141 million for 2011

compared with $137 million for 2010. Assets under

administration were $210 billion at December 31, 2011 and

$212 billion at December 31, 2010. Earnings for 2011

reflected a benefit from the provision for credit losses and

growth in noninterest income, partially offset by higher

noninterest expense and lower net interest income.

Noninterest expense increased due to continued strategic

investments in the business including front-line sales staff and

new client facing technology. The core growth strategies for

the business include: increasing channel penetration; investing

in higher growth geographies; and investing in differentiated

client-facing technology. For 2011, the business delivered

strong sales production, grew high value clients and benefited

from significant referrals from other PNC lines of business.

Over time and with stabilized market conditions, the

successful execution of these strategies and the accumulation

of our strong sales performance are expected to create

meaningful growth in assets under management and

noninterest income.

Highlights of Asset Management Group’s performance during

2011 include the following:

•Positive net flows in both discretionary assets under

management and total assets under administration;

• Strong sales production, up nearly 40% over the prior

year including a 26% increase in the acquisition of

new high value clients;

•Significant referrals from other PNC lines of business,

an increase of approximately 50% over 2010;

• Improved credit quality and performance;

• Continuing levels of new business investment and

focused hiring to drive growth with nearly 300

external new hires; and

• Roll-out of PNC Wealth InsightSM, our new online

client reporting tool.

Assets under administration were $210 billion at December 31,

2011 compared with $212 billion at December 31, 2010.

Discretionary assets under management were $107 billion at

December 31, 2011 compared with $108 billion at

December 31, 2010. The decrease in the comparisons was

driven by the exit of pension related assets and flat equity

markets on a comparative period end basis, offsetting strong

sales performance and successful client retention.

Total revenue for 2011 was $887 million compared with $884

million for 2010. Net interest income was $238 million for

2011 compared with $256 million for 2010. The decrease was

attributable to lower loan yields, lower loan balances and

lower interest credits assigned to deposits reflective of the

current low rate environment. Noninterest income was $649

million for 2011, up $21 million from the prior year due to

stronger average equity markets, increased sales and new

client acquisition. Noninterest income in the prior year

benefitted from approximately $19 million of tax, termination,

integration, and litigation related items that were not repeated

in 2011. Excluding these items in the comparison, total

noninterest income grew 6%.

Provision for credit losses was a benefit of $24 million for 2011

reflecting improved credit quality compared with provision of

$20 million for 2010. Net charge-offs were immaterial in 2011

as charge-off activity was mitigated by significant recoveries

compared with net charge-offs of $42 million in 2010.

Noninterest expense was $687 million in 2011, an increase of

$40 million or 6% from the prior year. The increase was

attributable to investments in the business to drive growth and

higher compensation-related costs. Asset Management Group

remains focused on disciplined expense management as it

invests in these strategic growth opportunities.

Average deposits of $7.8 billion for 2011 increased $601

million, or 8%, over the prior year. Average transaction

deposits grew 11% compared with 2010 and were partially

offset by the strategic run-off of higher rate certificates of

deposit in the comparison. Average loan balances of $6.1

58 The PNC Financial Services Group, Inc. – Form 10-K