PNC Bank 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

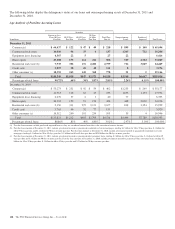

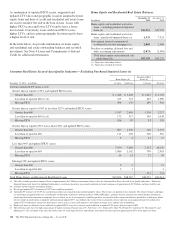

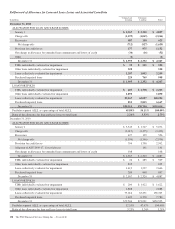

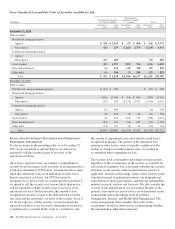

(a) At December 31, 2011, we had $49 million of credit card loans that are higher risk (i.e., loans with both updated FICO scores less than 660 and in late stage (90+ days) delinquency

status). The majority of the December 31, 2011 balance related to higher risk credit card loans is geographically distributed throughout the following areas: Ohio 20%, Michigan 14%,

Pennsylvania 13%, Illinois 7%, Indiana 7%, Florida 6%, and Kentucky 5%. All other states, none of which comprise more than 4%, make up the remainder of the balance. At

December 31, 2010, we had $70 million of credit card loans that are higher risk. The majority of the December 31, 2010 balance related to higher risk credit card loans is

geographically distributed throughout the following areas: Ohio 20%, Michigan 14%, Pennsylvania 14%, Illinois 8%, and Indiana 7%. All other states, none of which comprise more

than 5%, make up the remainder of the balance.

(b) Other consumer loans for which updated FICO scores are used as an asset quality indicator include non-government guaranteed or insured education loans, automobile loans and other

secured and unsecured lines and loans. Other consumer loans for which other internal credit metrics are used as an asset quality indicator include primarily government guaranteed or

insured education loans, as well as consumer loans to high net worth individuals. Other internal credit metrics may include delinquency status, geography or other factors.

(c) Credit card loans and other consumer loans with no FICO score available or required refers to new accounts issued to borrowers with limited credit history, accounts for which we

cannot obtain an updated FICO (e.g., recent profile changes), cards issued with a business name, and/or cards secured by collateral. Management proactively assesses the risk and size

of this loan portfolio and, when necessary, takes actions to mitigate the credit risk.

(d) Weighted-average updated FICO score excludes accounts with no FICO score available or required.

T

ROUBLED

D

EBT

R

ESTRUCTURINGS

(TDR

S

)

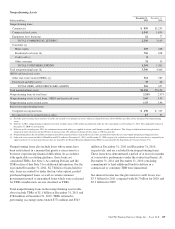

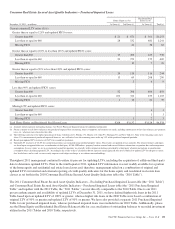

A TDR is a loan whose terms have been restructured in a

manner that grants a concession to a borrower experiencing

financial difficulties. TDRs typically result from our loss

mitigation activities and include rate reductions, principal

forgiveness, postponement/reduction of scheduled

amortization, and extensions, which are intended to minimize

economic loss and to avoid foreclosure or repossession of

collateral. In those situations where principal is forgiven, the

amount of such principal forgiveness is immediately charged

off.

Some TDRs may not ultimately result in the full collection of

principal and interest, as restructured, and result in potential

incremental losses. These potential incremental losses have

been factored into our overall ALLL estimate. The level of

any subsequent defaults will likely be affected by future

economic conditions. Once a loan becomes a TDR, it will

continue to be reported as a TDR until it is ultimately repaid

in full, the collateral is foreclosed upon, or it is fully charged

off. We held specific reserves in the ALLL of $580 million at

December 31, 2011 and $509 million at December 31, 2010

for the total TDR portfolio.

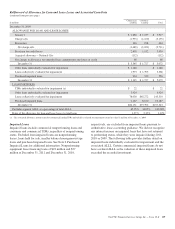

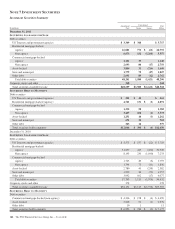

Summary of Troubled Debt Restructurings

In millions

Dec. 31

2011

Dec. 31

2010

Total consumer lending $1,798 $1,422

Total commercial lending 405 236

Total TDRs $2,203 $1,658

Nonperforming $1,141 $ 784

Accruing (a) 771 543

Credit card (b) 291 331

Total TDRs $2,203 $1,658

(a) Accruing loans have demonstrated a period of at least six months of performance

under the restructured terms and are excluded from nonperforming loans.

(b) Includes credit cards and certain small business and consumer credit agreements

whose terms have been restructured and are TDRs. However, since our policy is to

exempt these loans from being placed on nonaccrual status as permitted by

regulatory guidance as generally these loans are directly charged off in the period

that they become 180 days past due, these loans are excluded from nonperforming

loans.

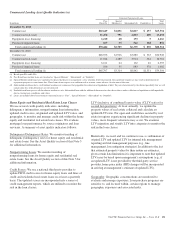

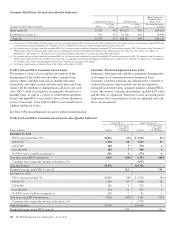

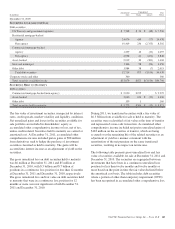

The table below quantifies the number of loans that were

classified as TDRs during the year ended December 31, 2011.

The change in the recorded investments as a result of the TDR

is also provided below.

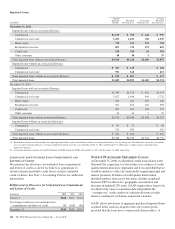

Financial Impact of TDRs (a)

During the year ended

December 31, 2011

Dollars in millions

Number

of Loans

Pre-TDR

Recorded

Investment (b)

Post-TDR

Recorded

Investment (c)

Commercial lending

Commercial 599 $ 129 $ 112

Commercial real estate 78 286 260

Equipment lease financing (d) 21

TOTAL COMMERCIAL

LENDING 679 416 372

Consumer lending

Home equity 4,013 321 320

Residential real estate 1,590 376 351

Credit card 12,564 92 92

Other consumer 472 13 13

TOTAL CONSUMER

LENDING 18,639 802 776

Total TDRs 19,318 $1,218 $1,148

(a) Impact of partial charge offs at TDR date are included in this table.

(b) Represents the recorded investment of the loans as of the quarter end prior to the

TDR designation, and excludes immaterial amounts of accrued interest receivable.

(c) Represents the recorded investment of the TDRs as of the quarter end the TDR

occurs, and excludes immaterial amounts of accrued interest receivable.

(d) Post-TDR Recorded Investment amount totaled less than $1 million.

TDRs may result in charge-offs and interest income not being

recognized. At or around the time of modification, there was

approximately $26 million in recorded investment of

commercial TDRs and approximately $15 million in recorded

investment of commercial real estate TDRs charged off during

the year ended December 31, 2011. For residential real estate,

approximately $29 million in recorded investment was

charged off during the year ended December 31, 2011 related

to modifications in which principal was partially deferred and

deemed uncollectible. Charge offs around the time of

modification related to home equity, credit card, and other

consumer TDR portfolios were immaterial for the period.

A financial effect of rate reduction TDRs is interest income not

recognized. Interest income not recognized that otherwise

would have been earned in the year ended December 31, 2011

related to both commercial TDRs and consumer TDRs is not

material.

The PNC Financial Services Group, Inc. – Form 10-K 135