PNC Bank 2011 Annual Report Download - page 200

Download and view the complete annual report

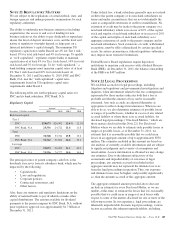

Please find page 200 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.turn was merged into PNC Bank, N.A.). The cases have been

consolidated for pretrial proceedings in the United States

District Court for the Eastern District of New York under the

caption In re Payment Card Interchange Fee and Merchant-

Discount Antitrust Litigation (Master File

No. 1:05-md-1720-JG-JO). Those cases naming National City

were brought as class actions on behalf of all persons or

business entities who have accepted Visa®or MasterCard®.

The plaintiffs, merchants operating commercial businesses

throughout the US and trade associations, allege, among other

things, that the defendants conspired to fix the prices for

general purpose card network services and otherwise imposed

unreasonable restraints on trade, resulting in the payment of

inflated interchange fees, in violation of the antitrust laws. In

January 2009, the plaintiffs filed amended and supplemental

complaints adding, among other things, allegations that the

restructuring of Visa and MasterCard, each of which included

an initial public offering, violated the antitrust laws. In their

complaints, the plaintiffs seek, among other things, injunctive

relief, unspecified damages (trebled under the antitrust laws)

and attorneys’ fees. In January 2008, the district court

dismissed the plaintiffs’ claims for damages incurred prior to

January 1, 2004. In April 2009, the defendants filed a motion

to dismiss the amended and supplemental complaints. In May

2009, class plaintiffs filed a motion for class certification.

Both of these motions were argued in November 2009. In

February 2011, the defendants filed a motion for summary

judgment, which was argued in November 2011. The court

has not yet ruled on any of these motions.

National City and National City Bank entered into judgment

and loss sharing agreements with Visa and certain other banks

with respect to all of the above referenced litigation. All of the

litigation against Visa is also subject to the indemnification

obligations described in Note 23 Commitments and

Guarantees. PNC Bank, N.A. is not named a defendant in any

of the Visa or MasterCard related antitrust litigation nor was it

initially a party to the judgment or loss sharing agreements,

but it has been subject to these indemnification obligations

and became responsible for National City Bank’s position in

the litigation and responsibilities under the agreements upon

completion of the merger of National City Bank into PNC

Bank, N.A. In March 2011, we entered into a MasterCard

Settlement and Judgment Sharing Agreement with

MasterCard and other financial institution defendants and an

Omnibus Agreement Regarding Interchange Litigation

Sharing and Settlement Sharing with Visa, MasterCard and

other financial institution defendants. If there is a resolution of

all claims against all defendants, the Omnibus Agreement, in

substance, apportions that resolution into a Visa portion and a

MasterCard portion, with the Visa portion being two-thirds

and the MasterCard portion being one-third. This

apportionment only applies in the case of either a global

settlement involving all defendants or an adverse judgment

against the defendants, to the extent that damages either are

related to the merchants’ inter-network conspiracy claims or

are otherwise not attributed to specific MasterCard or Visa

conduct or damages. The MasterCard portion (or any

MasterCard-related liability not subject to the Omnibus

Agreement) will then be apportioned under the MasterCard

Settlement and Judgment Sharing Agreement among

MasterCard and PNC and the other financial institution

defendants that are parties to this agreement. The

responsibility for the Visa portion (or any Visa-related

liability not subject to the Omnibus Agreement) will be

apportioned under the pre-existing indemnification

responsibilities and judgment and loss sharing agreements.

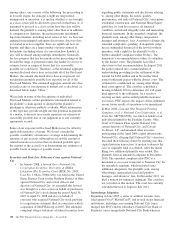

CBNV Mortgage Litigation

Between 2001 and 2003, on behalf of either individual

plaintiffs or proposed classes of plaintiffs, several separate

lawsuits were filed in state and federal courts against

Community Bank of Northern Virginia (CBNV) and other

defendants asserting claims arising from second mortgage

loans made to the plaintiffs. CBNV was merged into one of

Mercantile Bankshares Corporation’s banks before PNC

acquired Mercantile in 2007. The state lawsuits were removed

to federal court and, with the lawsuits that had been filed in

federal court, were consolidated for pre-trial proceedings in a

multidistrict litigation (MDL) proceeding in the United States

District Court for the Western District of Pennsylvania,

currently under the caption In re: Community Bank of

Northern Virginia Lending Practices Litigation (No. 03-0425

(W.D. Pa.), MDL No. 1674). In January 2008, the

Pennsylvania district court issued an order sending back to the

General Court of Justice, Superior Court Division, for Wake

County, North Carolina the claims of two proposed class

members. These claims are asserted in a case originally filed

in 2001 and captioned Bumpers, et al. v. Community Bank of

Northern Virginia (01-CVS-011342).

MDL Proceedings in Pennsylvania. In August 2006, a proposed

settlement agreement covering some of the class members was

submitted to the district court handling the MDL proceedings

for its approval, which it granted in August 2008. The class

covered by this settlement is referred to as the Kessler class.

Some objecting members of the Kessler class appealed the

final approval order to the United States Court of Appeals for

the Third Circuit. In their appeal, the objecting Kessler class

members had asserted that CBNV’s annual percentage rate

disclosures violated the Truth in Lending Act (TILA) and the

Home Ownership and Equity Protection Act (HOEPA), that

those claims are very valuable, and that the settling plaintiffs

should have asserted those claims. The settling plaintiffs

advanced a number of reasons why they had not asserted

TILA/HOEPA claims. In September 2010, the court of

appeals vacated the district court’s class certification decision

and approval of the class settlement and remanded the case to

the district court for further proceedings. As a result of the

settling plaintiffs’ decision not to continue to pursue the

settlement and instead participate in the joint amended

consolidated class action complaint described below,

however, there will be no proceedings in the district court on

the remand relating to the settlement.

The PNC Financial Services Group, Inc. – Form 10-K 191