PNC Bank 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

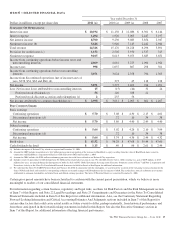

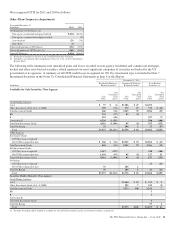

Corporate & Institutional Banking

Corporate & Institutional Banking earned $1.9 billion in 2011

and $1.8 billion in 2010. The increase in earnings was

primarily due to an improvement in the provision for credit

losses, which was a benefit in 2011, partially offset by a

reduction in the value of commercial mortgage servicing

rights and lower net interest income. We continued to focus on

adding new clients, increasing cross sales, and remaining

committed to strong expense discipline.

Asset Management Group

Asset Management Group earned $141 million for 2011

compared with $137 million for 2010. Assets under

administration were $210 billion at December 31, 2011 and

$212 billion at December 31, 2010. Earnings for 2011

reflected a benefit from the provision for credit losses and

growth in noninterest income, partially offset by higher

noninterest expense and lower net interest income. For 2011,

the business delivered strong sales production, grew high

value clients and benefitted from significant referrals from

other PNC lines of business. Over time and with stabilized

market conditions, the successful execution of these strategies

and the accumulation of our strong sales performance are

expected to create meaningful growth in assets under

management and noninterest income.

Residential Mortgage Banking

Residential Mortgage Banking earned $87 million in 2011

compared with $269 million in 2010. The decline in earnings

was driven by an increase in noninterest expense associated

with increased costs for residential mortgage foreclosure-

related expenses, primarily as a result of ongoing

governmental matters, and lower net interest income, partially

offset by an increase in loan originations and higher loans

sales revenue.

BlackRock

Our BlackRock business segment earned $361 million in 2011

and $351 million in 2010. The higher business segment

earnings from BlackRock for 2011 compared with 2010 were

primarily due to an increase in revenue.

Non-Strategic Assets Portfolio

This business segment (formerly Distressed Assets Portfolio)

consists primarily of acquired non-strategic assets that fall

outside of our core business strategy. Non-Strategic Assets

Portfolio had earnings of $200 million in 2011 compared with

a loss of $57 million in 2010. The increase was primarily

attributable to a lower provision for credit losses partially

offset by lower net interest income.

Other

“Other” reported earnings of $376 million for 2011 compared

with earnings of $386 million for 2010. The decrease in

earnings primarily reflected the noncash charge related to the

redemption of trust preferred securities in the fourth quarter of

2011 and the gain related to the sale of a portion of PNC’s

BlackRock shares in 2010 partially offset by lower integration

costs in 2011.

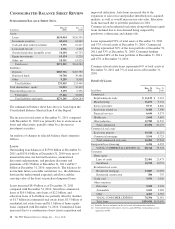

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Our Consolidated Income Statement is presented in Item 8 of

this Report.

Net income for 2011 was $3.1 billion compared with $3.4

billion for 2010. Results for 2011 include the impact of $324

million of residential mortgage foreclosure-related expenses

primarily as a result of ongoing governmental matters, a $198

million noncash charge related to redemption of trust

preferred securities and $42 million for integration costs.

Results for 2010 included the $328 million after-tax gain on

our sale of GIS, $387 million for integration costs, and $71

million of residential mortgage foreclosure-related expenses.

For 2010, net income attributable to common shareholders

was also impacted by a noncash reduction of $250 million in

connection with the redemption of TARP preferred stock.

PNC’s results for 2011 were driven by good performance in a

challenging environment of low interest rates, slow economic

growth and new regulations.

N

ET

I

NTEREST

I

NCOME AND

N

ET

I

NTEREST

M

ARGIN

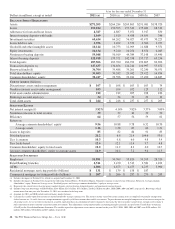

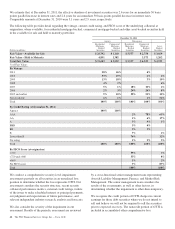

Year ended December 31

Dollars in millions 2011 2010

Net interest income $8,700 $9,230

Net interest margin 3.92% 4.14%

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources of funding. See the

Statistical Information (Unaudited) – Analysis Of

Year-To-Year Changes In Net Interest Income and Average

Consolidated Balance Sheet And Net Interest Analysis in

Item 8 and the discussion of purchase accounting accretion in

the Consolidated Balance Sheet Review in Item 7 of this

Report for additional information.

The decreases in net interest income and net interest margin

for 2011 compared with 2010 were primarily attributable to a

decrease in purchase accounting accretion on purchased

impaired loans primarily due to lower excess cash recoveries.

A decline in average loan balances and the low interest rate

environment, partially offset by lower funding costs, also

contributed to the decrease.

The PNC Financial Services Group, Inc. – Form 10-K 35