PNC Bank 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

I

NVESTMENT

S

ECURITIES

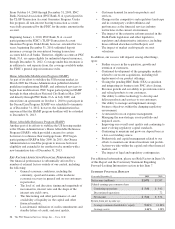

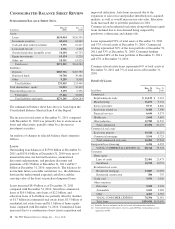

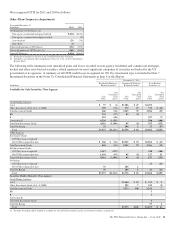

Details of Investment Securities

In millions

Amortized

Cost

Fair

Value

December 31, 2011

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

US Treasury and government agencies $ 3,369 $ 3,717

Residential mortgage-backed

Agency 26,081 26,792

Non-agency 6,673 5,557

Commercial mortgage-backed

Agency 1,101 1,140

Non-agency 2,693 2,756

Asset-backed 3,854 3,669

State and municipal 1,779 1,807

Other debt 2,691 2,762

Corporate stocks and other 368 368

Total securities available for sale $48,609 $48,568

S

ECURITIES

H

ELD TO

M

ATURITY

Debt securities

US Treasury and government agencies $ 221 $ 261

Residential mortgage-backed (agency) 4,761 4,891

Commercial mortgage-backed

Agency 1,332 1,382

Non-agency 3,467 3,573

Asset-backed 1,251 1,262

State and municipal 671 702

Other debt 363 379

Total securities held to maturity $12,066 $12,450

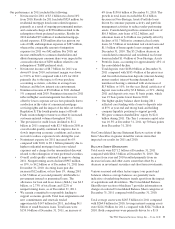

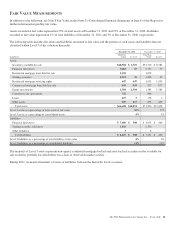

December 31, 2010

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

US Treasury and government agencies $ 5,575 $ 5,710

Residential mortgage-backed

Agency 31,697 31,720

Non-agency 8,193 7,233

Commercial mortgage-backed

Agency 1,763 1,797

Non-agency 1,794 1,856

Asset-backed 2,780 2,582

State and municipal 1,999 1,957

Other debt 3,992 4,077

Corporate stocks and other 378 378

Total securities available for sale $58,171 $57,310

S

ECURITIES

H

ELD TO

M

ATURITY

Debt securities

Commercial mortgage-backed (non-

agency) $ 4,316 $ 4,490

Asset-backed 2,626 2,676

Other debt 10 11

Total securities held to maturity $ 6,952 $ 7,177

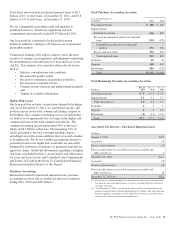

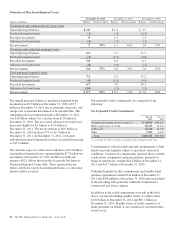

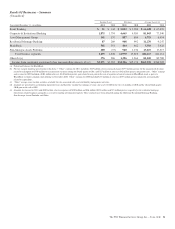

The carrying amount of investment securities totaled $60.6

billion at December 31, 2011, a decrease of $3.6 billion, or

6%, from $64.3 billion at December 31, 2010. The decline

resulted from principal payments and net sales activity related

to US Treasury and government agency and non-agency

residential mortgage-backed securities. Investment securities

represented 22% of total assets at December 31, 2011 and

24% of total assets at December 31, 2010.

We evaluate our portfolio of investment securities in light of

changing market conditions and other factors and, where

appropriate, take steps intended to improve our overall

positioning. We consider the portfolio to be well-diversified

and of high quality. US Treasury and government agencies,

agency residential mortgage-backed securities and agency

commercial mortgage-backed securities collectively

represented 63% of the investment securities portfolio at

December 31, 2011.

During 2011, we transferred securities with a fair value of

$6.3 billion from available for sale to held to maturity. The

securities were reclassified at fair value at the time of transfer.

Accumulated other comprehensive income included net pretax

unrealized gains of $183 million on the securities at transfer,

which are being accreted over the remaining life of the related

securities as an adjustment of yield in a manner consistent

with the amortization of the net premium on the same

transferred securities, resulting in no impact on net income.

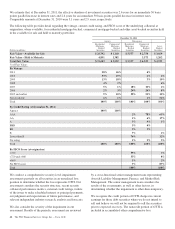

At December 31, 2011, the securities available for sale

portfolio included a net unrealized loss of $41 million, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2010 was a net

unrealized loss of $861 million. The fair value of investment

securities is impacted by interest rates, credit spreads, market

volatility and liquidity conditions. The fair value of

investment securities generally decreases when interest rates

increase and vice versa. In addition, the fair value generally

decreases when credit spreads widen and vice versa.

The improvement in the net unrealized pretax loss compared

with December 31, 2010 was primarily due to the effect of

lower market interest rates. Net unrealized gains and losses in

the securities available for sale portfolio are included in

shareholders’ equity as accumulated other comprehensive

income or loss from continuing operations, net of tax.

Unrealized gains and losses on available for sale securities do

not impact liquidity or risk-based capital. However, reductions

in the credit ratings of these securities could have an impact

on the liquidity of the securities or the determination of risk-

weighted assets which could reduce our regulatory capital

ratios. In addition, the amount representing the credit-related

portion of OTTI on available for sale securities would reduce

our earnings and regulatory capital ratios.

The expected weighted-average life of investment securities

(excluding corporate stocks and other) was 3.7 years at

December 31, 2011 and 4.7 years at December 31, 2010.

The PNC Financial Services Group, Inc. – Form 10-K 41